Stanbic is the first commercial bank in Uganda to be granted a license by the Bank of Uganda (BOU) to provide ‘Bancassurance’ as a product on the local market.

The award of the licence to Stanbic follows the passing of the Financial Institutions Amendment (FIA) bill 2016 which included a provision for Bancassurance and the subsequent approval of the regulatory guidelines by the BOU.

The Financial Institutions Act 2016 specifies that the Insurance Regulatory Authority of Uganda (IRAU) is responsible for receiving applications from financial institutions for licensing to conduct Bancassurance business, subject however to prior written authorisation from the Central Bank.

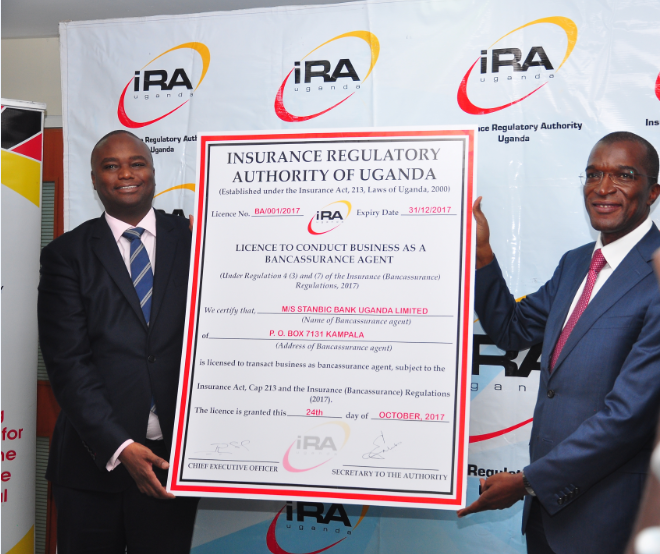

Handing over the license at ceremony held at the IRAU headquarters in Kampala yesterday, Alhaj Ibrahim Kaddunabbi Lubega, the IRAU CEO said: “As an industry we are extremely pleased that Bancassurance in Uganda has finally become a reality.”

Mr. Lubega noted that the 0.8% insurance penetration in Uganda was still unacceptably low. “Selling insurance through alternative channels such as banks will undoubtedly make a huge difference,” he noted.

Receiving the license, Patrick Mweheire, the Chief Executive of Stanbic Bank, said: “We are extremely proud to be the first commercial bank in Uganda to offer Bancassurance.”

Mr. Mweheire said Stanbic had invested significantly in training staff, signing partnerships and putting in place the technology and infrastructure needed to roll out the product smoothly.

He said the success of the project also would involve raising public knowledge and awareness about the various benefits and types of insurance products available through banks. “To that end, we look forward to working with the regulator and other industry players to run effective communications and stakeholder initiatives that will ensure this happens,” he said.

Talking about the benefits of selling Bancassurance Lydia Kayonde, the Head of Bancassurance at Stanbic Bank said the product will provide customers with a one-stop-shop solution which offers greater convenience, savings and choice.

“In addition, the premium prices will be better negotiated and product turnaround times will inevitably improve. Bancassurance is an efficient distribution channel with higher productivity and lower costs to serve than traditional sales channels,” Ms. Kayonde said.