The ongoing legal dispute between the Bank of Uganda and city tycoon Sudhir Ruparelia over the closure of Crane Bank ( in receivership) might just easily turn out to be the most expensive litigation in Ugandan courts since Independence in 1962, spent by the central bank on legal and ‘management’ costs.

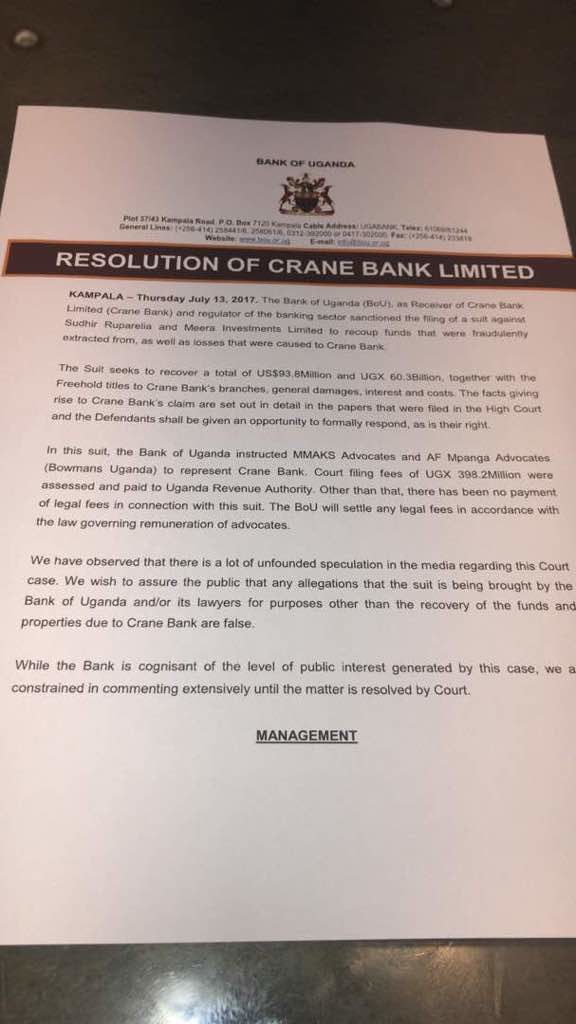

Despite the BoU publicly stating that it has spent only Shs300 million as court filing fees in the ongoing legal dispute, which is now the subject of mediation, information emerging indicates that the central bank has instead spent over four billion shillings, paid to a local law firm Messrs. MMAKS Advocates and two international audit and accounting firms, PriceWaterHouse Coopers (PwC) and Klynveld Peat Marwick Goerdeler (KPMG) in legal and ‘management’ costs, respectively.

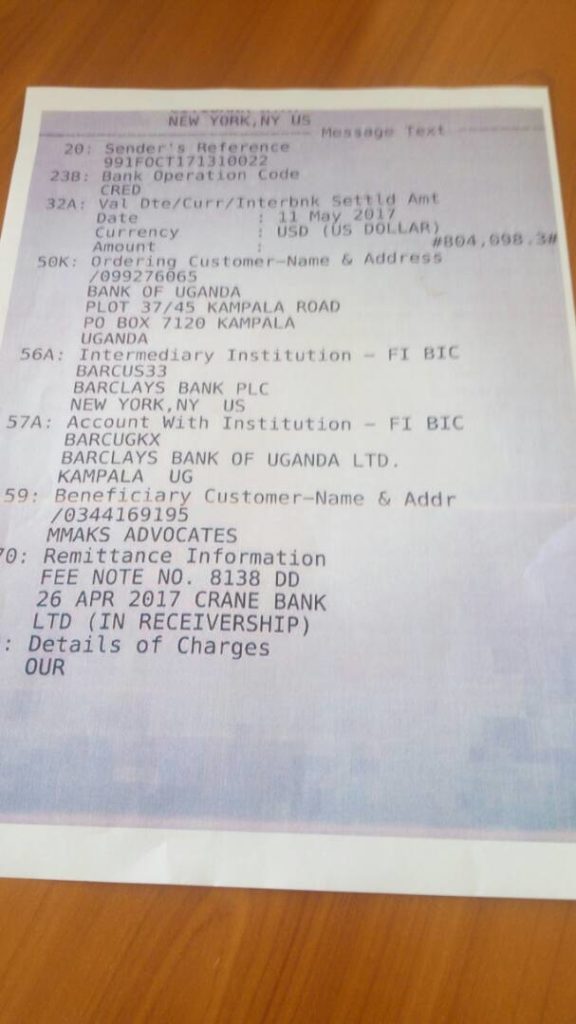

According to documents seen by this news website, the BoU paid out a total of US$804.094 to law firm Messrs. MMAKS Advocates in December 2016 and May 2017 in respect to Crane Bank, in transactions initiated by Citi Bank in New York, with Barclays Bank PLC in New York as the ‘intermediary institution’ and the BoU as the ‘ordering customer’ referenced as number 099276065. The money was paid in two installments, with the first disbursement of US$166, 796 paid out as ‘professional fees’ on December 14, 2016 under sender’s (Citi Bank) Ref. No. 991FOCT163490002, and the second installment of US$804, 098 disbursed on May 11, 2017 under sender’s (Citi Bank) Ref. No. 991FOCT171310022.

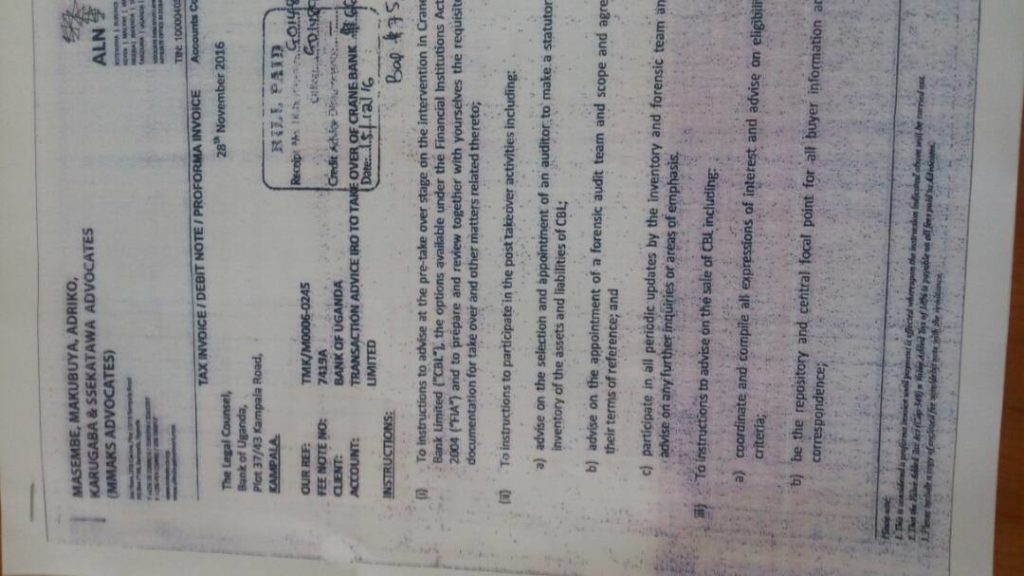

And, according to a ‘Tax Invoice/Debit Note/ Pro forma Invoice’ by MMAKS Advocates dated November 28, 2016 and titled ‘Transaction Advice IRO to take over of Crane Bank Limited’, the law firm sought US$230.000 as ‘professional fees’ at the ‘pre take over stage on the intervention in Crane bank Limited’ (“CBL”), and of the said money the first disbursement of US$166.796 is made reference to, leaving an outstanding balance of US$75, 313.

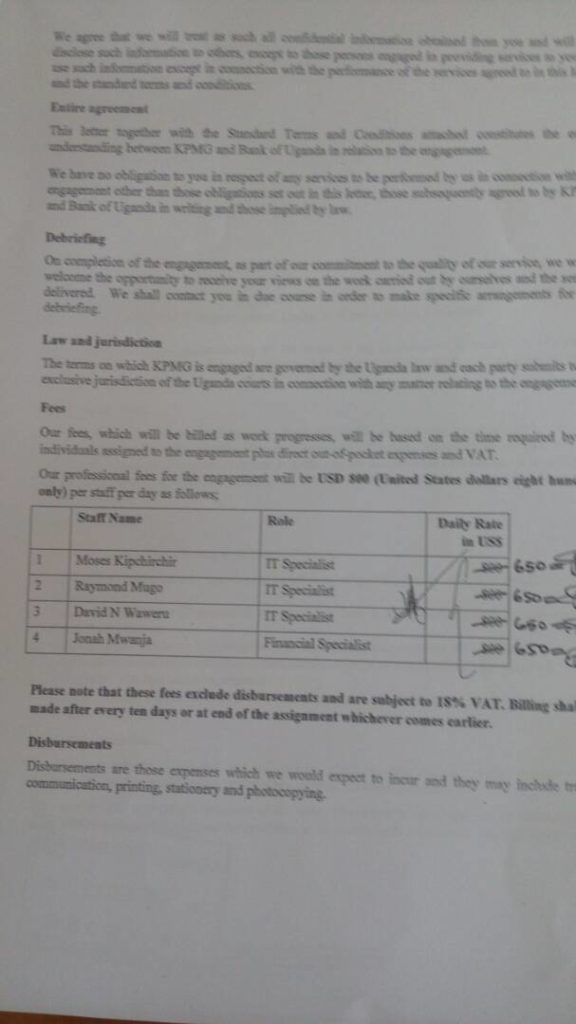

As for KPMG, in an October 24, 2016 letter to Benedict Sekabira, the BoU Director Commercial Banking, the accounting firm detailed the payments to be made to its four staff members who were to offer ‘technical support’ to the BoU team in respect to the management of Crane Bank after take over.

BoU also came out to deny that they hadn’t paid any money to MMAKS advocates in a press statement, BoU only acknowledged the filing fees.

In the letter titled ‘Letter confirming terms of engagement for provision of technical support to Bank of Uganda team at Crane Bank Limited’, KPMG demanded that it’s three IT Specialists: Moses Kipchirchir, Raymond Mugo and David N Waweru, and one Financial Specialist, Jonah Mwanja, be paid US$800 per day for an unspecified period of time. The figure was later revised downwards to US$650 a day, and according to the specimen signature on the letter referenced B004/bmn/mk and received by Sekabira on October 26, 2016, only one person signed to receive the money on behalf of the four KPMG specialists. In the letter, it is not clear how long the duration of the technical support was. However, in a letter to the Executive Director Supervision dated March 24 KPMG with Kaindi Kalyesula Wilson as the reference person, and through Tax Invoice No. 631F07143 demanded from BoU US$83, 611.33, ‘being Professional fees for the months of November, December and January for support and monitoring at Crane Bank Uganda Limited’.

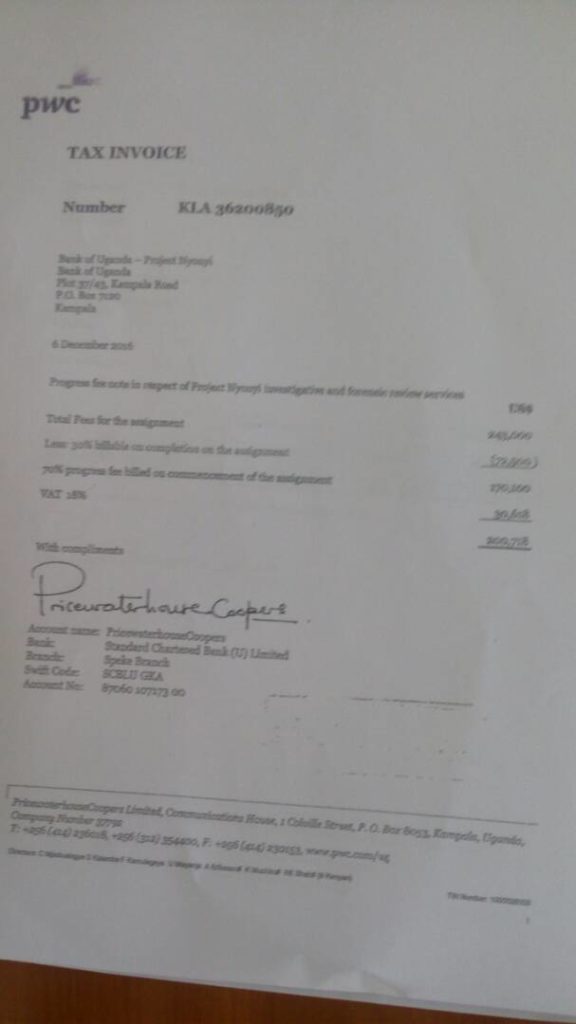

As for PriceWaterhouse Coopers, on December 6, 2016, the audit firm ‘Tax Invoiced’ BoU US$243.000 under invoice number KLA 36200850, in respect to ‘investigative and forensic review services of ‘Project Nyonyi’, the name adopted by BoU and PwC in respect to the Crane Bank post-closure management. The Invoice was issued against Credit Notes KLA 36200849 and KLA 36200820.

On the same day, PwC issued Tax Invoice no. KLA 36200851, making reference to UgShs286, 650, 000 charges for ‘Progressive fee note of the compilation and agreed upon procedures engagement of Crane Bank Limited as at 20 October, 2016’. Part payment of UgShs200, 655, 000 and the disbursement was made against Credit Notes KLA 36200841 and KLA 36200813.

Further, on December 16, 2016, PwC through Tax Invoice 36200873, made the final fee note demand of UgShs91 million and VAT of 16, 522, 610, bringing the total to UgShs 108, 314, 888.

And early this week, it emerged that the BoU had engaged the services of another law firm, Messrs. Sebalu and Lule Company Advocates, to represent its interest in the imminent mediation, a development that is likely to make the bill shoot up.

The poor governance practices is the main cause of the problems.Then one would wonder why Crane Bank was closed due to governance and management weaknesses yet the same is practiced by the Banking Regulator. True Crane Bank was closed,let also BOU leadership and senior management resign for the mess. ooh Uganda shame upon you people.

Im grateful for the article post.Really looking forward to read more. Really Great.