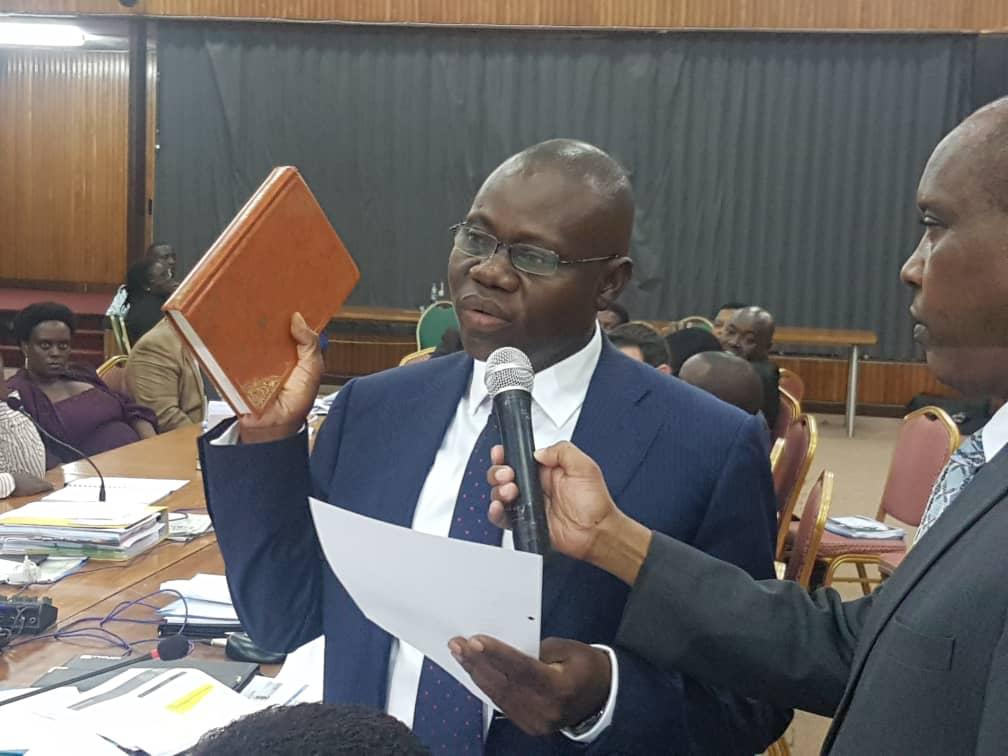

Two top executives of Dfcu bank were on Thursday put on oath by parliament’s Committee on Commissions, Statutory Authorities and State Enterprises (COSASE) after they made contradictory statements as regards to the transfer of Crane Bank Limited assets to Dfcu .

William Sekabembe, the Chief Executive of Business Development at Dfcu bank said CBL statutory manager Edward Katimbo Mugwanya handed CBL assets to Dfcu bank, but Mugwanya while appearing before the committee last year alongside Bank of Uganda (BoU) officials, said he didn’t have chance to hand over CBL to Dfcu.

Katuntu played to Dfcu Bank managers an audio recording of Mugwanya denying he ever handed over CBL to them (Dfcu bank).

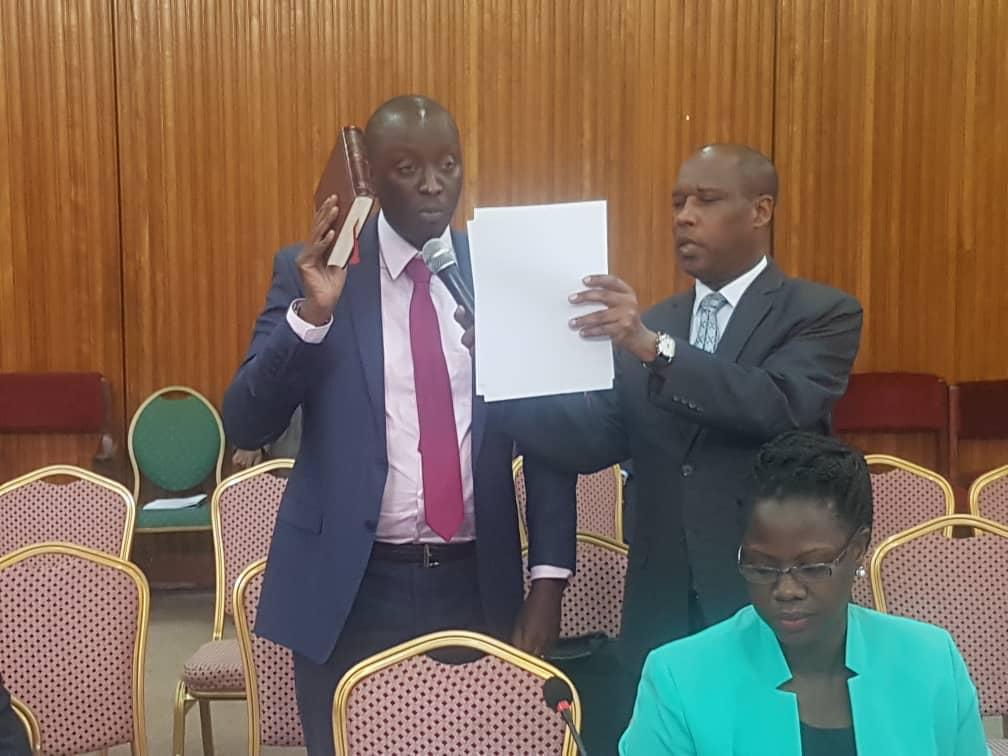

Former Managing Director of Dfcu bank Juma Kisaame also was put on oath as MPs were tired of his contradictory statements on the acquisition of Shs570 billion bad book (written off loans). But Dfcu bank officials failed to convince MPs on the Shs570 billion written of loans taken from CBL, yet it was not in the Purchase and Assumption of liabilities agreement.

such as Sekabembe said Mugwanya handed over CBL assets to DFCU Bank, he could not present any copy of the handover report. The MPs also established that DFCU Bank does not have the Chief government valuer’s report on CBL assets.

The MPs also established that the monetary values attached to each of CBL’s properties by independent valuer and government valuer differ sharply. For instance the independent valuer tagged one of the buildings in Kampala at Shs500 million while the government chief valuer put it at Shs2 billion. Another building valued at Shs400 billion by an independent valuer was valued at Shs1.6 billion by the chief government valuer.

The MPs believe some CBL assets were undervalued by Dfcu bank to make profit.

BoU sold CBL assets based on due diligence of Dfcu bank without the central bank making its own evaluation of the assets. Dfcu bank signed confidentiality agreement on November 13,2016 before the commercial bank bid for the assets of CBL on December 20, 2017. Dfcu bank said it relied on a partial inventory report by PwC before entering into P & A with BoU on January 25, 2017.

Kisaame could not give the MPs satisfactory explanations about the process that led to transfer of CBL assets to its rival. Dfcu bank officials also struggled to satisfy the MPs with explanations concerning the status of 46 branches of CBL whose landlord was Meera Investments that wants Dfcu bank pay rent arrears.

The Dfcu team was led by new Managing Director Mathis Katamba, the legal team and representatives of the shareholders.

The former owner of CBL, Sudhir Ruparelia and his lawyers were also in the house listening to Dfcu bank officials present their case.