Having released their financial reports for the year ended December 2016, member banks of the Uganda Bankers Association (UBA) will hold a conference to take stock of their business activities that saw most banks make impressive profits and accumulate assets despite a bad economy characterised by low production.

Organisers say bankers and other participants at the conference will gain insights from global, regional and country specific issues, trends and drivers in the banking and financial services sector.

They will also discuss the dynamics that are increasingly shaping sustainability strategies in banking and finance. The Conference is scheduled for 19th July 2017 in under the theme, “The Future of Banking”

The event is expected to attract banking and non-bank financial sector executives, international development partners and multi-lateral agencies, investment advisors, regulators, research associates and academia, among others.

However, as bankers plan to hold their meeting, there is concern within the Ugandan society that commercial banks reduce their prime lending rates to encourage private sector borrowing. “Hope they will agree to reduce their rates,” an economist says.

Mid June, Bank of Uganda (BOU) cut its central bank rate (CBR) to 11%, expecting commercial banks to follow by cutting their prime lending rates. Currently it is only Stanbic Bank that has reduced its prime lending rate to 19%.

On average, Ugandan commerical banks lend at 20.5 percent, but this only happened this year, as of February 2016, the average lending rate was 25.2%.

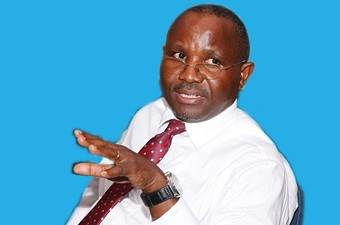

BOU Governnor, Prof. Emmanuel Tumusiime-Mutebile has always urged commercial banks to peg their lending rates to the CBR, but this is far from happening, much as Prof. Mutebile says the reduction would attract the private sector players to borrow and boost production.

The conference also comes at a time when government is determined to introduce the Islamic mode of banking which gives interest-free loans, but borrowers instead share profits and losses with the banks.

Experts say Islamic banking, if launched in the country would help those without collateral to borrow to do business. Collateral as a form of security in terms of titiled fixed assets such as land, buildings, has evaded most would-borrowers.

Prince Kassim Nakkibinge, the MD Cairo Bank, says collateral is a big challenge for the local banking sector and that it needs to be addressed. “The issue of collateral is a big challenge,” he says.

The commercial banks have been accused of mainly targetting salaried workers at the expense of the majority of the population who dont have a steady flow of income. “They should come up with ways of reaching people in the informal sector,” says Milton Seguya, a welder in Kisenyi, a Kampla suburb.

Other people have called on government to cap the lending rates like Kenya did recently.

But the bankers’ association says capping interest rates could be counterproductive for the Uganda economy an interest control regime could instead stifle free market forces, expose lenders to possible collapse, discourage credit growth.

In a statement released months ago, Wilbrod Humpreys Owor, the executive director of the Uganda Bankers Association argued that capping interest rates “does not necessarily translate into lower cost of credit and discourages banking players investing further.”