A civil society group, the Uganda Debt Network (UDN) has urged the government to be cautious about external borrowing, saying that there is now limited possibility that the country could be forgiven of her debt.

“Given new debt architecture such as new creditors like China and Korea, there is only up to limited possibility of future debt forgiveness today, unlike in 1990s and shortly after,” UDN, which tracks government public debt, urges in its latest weekly update.

The NGO wants the government to engage in discussion for more prudent and accountable management of all public resources, including debt resources with view to slowing down the rate of borrowing.

Statistics show that Uganda’s public debt has reached US$ 9.8 billion in 2017/18 compared to US$ 8.4 billion in 2016/17. The increase in public debt is as a result of increase in borrowings to finance the ambitious infrastructural developments.

UDN also argues that government must track performance outcomes and ensure efficient use of available domestic resources before it can borrow from domestic or external sources.

Further, UDN says there is a need for a gradual reduction in stock of public debt, before it reaches critical proportions and debt distress for Ugandans.

It argues that Uganda’s future debt service obligations are increasing at a rate that is faster than Economic growth of 3.9 percent in 2016/17 though economists say it will grow at 5 to 5.5 percent in 2017/18.

‘We ought to be candid in highlighting the implications of current trends on Uganda’s Economic Development. Then we can together seek feasible strategies for sustainable Debt and Accountable Governance in Uganda’, it says.

The NGO says that government needs to ensure that matters of debt acquisition, structure, usage and sustainability come to the fore in light of the financial crisis of 2008 and debt that triggered an economic crisis and global recession that has persisted longer than predicted.

It further says that the potential risks associated with exchange rate depreciation and volatility, lower global growth trends, persistent decline in global commodity prices, corruption and mismanagement, somewhat cast doubt on Uganda’s economic development trajectory.

Government public finance experts say that although the public debt has increased at a higher rate compared to past trends, it is sustainable in relation to the size of the economy.

They argue that current debt to GDP ratio of 39% is below the Public Debt Management Framework threshold and the East African Community Monetary Union convergence criteria requirement of 50 percent.

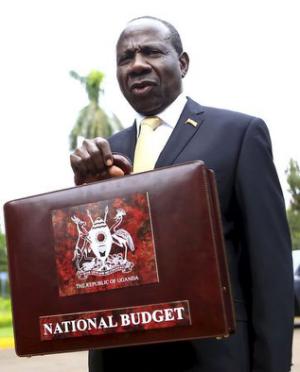

Uganda’s total budget of Shs29 trillion for the financial 2017/18, had Shs4,999 billion go to refinancing of maturing debt; Shs949 billion was to meet external debt repayments, Shs2,675 billion was for interest payments while Shs300.86 billion was for settlement of domestic debts.