The Civil Society Budget Advocacy Group (CSBAG) has urged the government to consider taxing bodabodas (commercial cyclists) to raise more revenue that can be used to fund the priority sectors earmarked to deliver the country into the middle income status by 2020 as envisaged in Vision 2040.

Speaking on behalf of CSBAG in Kampala yesterday during the national budget conference for financial year 2018/19, Richard Sewakiryanga, the NGO Forum Executive Director, said that bodabodas in the country are potential sources of revenue that have not been tapped into due to political reasons.

“As the resource needs of the country grow and are expected to increase further in 2018/19, some potential revenue sources like bodobodas which have previously been politically sensitive should be explored,” Sewakiryanga, who formery worked in the Ministry of Finance, said.

He said Kampala alone, which has about 300,000 bodaboda riders, could annually contribute Shs36 billion in revenue at a monthly tax rate of Shs10,000 per operator.

“The bodadabodas already have associations which would make it easier to collect revenue from their membership,” he said.

Giving his views on Vision 2020 target of transforming the country into middle income status, doubted it could be achieved. “It remains unlikely that this tatget will be met…the economy has over the last three financial years failed to meet the set growth rates.

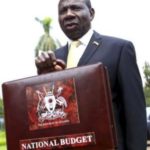

Presenting the Budget Strategy for financial year 2018/19 in Kampala yesterday, Minister of State for Finance, David Bahati, said that the country would in the medium term of the financial year 2017/18 grow at 7 percent, but grow achieve 5 percent growth for the whole period. Last financial year it grew by 3.9 percent from the 4.5 percent realised in the previous year.

Bahati said the country was on course to achieve the middle income status by financial year 2019/20, adding that government only needs to swiftly tackle the current challenges facing the country.

He said the economy needs to grow from the current USD 25.7 billion to USD 41.7 billion by financial year 2019/20 to achieve middle income status. He said: “To achieve the growth rate consistent with our aspirations for middle income status, we need to swiftly deal with the challenges we face today.”

Minister Bahati however said that the current revenue base can still raise more revenue “if base erosion and profit shifting are eliminated;one stop border posts are completed and tax audits improved, among others.”

Uganda’s tax to GDP ratio has been growing at 0.2 percent against a target of 0.5 percent per year, and currently stands at 14 percent of GDP which is lower than the second National Development Plan target of 16 percent and the EAC convergence target of 20 percent.

Local tax analysts say that low domestic revenue has pushed government to resort to borrowing both domestically and externally, resulting into increased debt obligations. Almost half of the Shs 29 trillion 2017/18 national budget went to debt servicing, leaving less resources for social services delivery.

The Chairman of the Private Sector Foundation (PSF) Uganda, Patrick Bitature, believes that for government to continue managing the economy sustainably, among other things it can do is to increase and expand revenue bases. Bitature has urged government to continue priotising tax effciency and administration.

Amos Lugoloobi, the Chairman of Budget Committee of Parliament of Uganda has meanwhile urged government to address issues such as resource misallocation, non-utilisation of funds and weak expenditure controls, which he says have given rise to acumulation of domestic arrears. MP Lugolooba says government institutions that abuse funds allocated to them must be punished as stated in the Public Finance Management Act, 2015.

Jennie Barugh, Chair Local Development Partners Group says that much as the government continues to borrow externally to finance projects, it is important that it boosts domestic resource mobilisation so as to pay debts in future.

“Development partners remain willing to continue to support you to improve both public investment management and increase domestic resource mobilisation,” Barugh says.

According to Prime Minister, Ruhakana Rugunda 2018/19 national budget will continue with implementing priority areas such as roads, energy, railways, as well as boosting the private sector growth.