Uganda’s chances of benefiting from various debt restructuring and relief initiatives are limited and the country is unlikely to be bailed out this time, a local non-government organization, the Uganda Debt Network (UDN), has warned in its latest update on the country’s debt trends.

Uganda has formally benefited from various debt restructuring and relief initiatives; both bilateral and multilateral such as The 1989 Toronto Terms; 1992 Enhanced Toronto Terms; 1995 Naples Terms and 1998 Lyon Terms, which were all on bilateral basis.

The Multilateral initiatives that the country benefited from include; Heavily Indebted Poor Countries (HIPCs) (1997, 2000, 2002); 2002 Monterrey Summit and 2006 Multilateral Debt Relief Initiative (MDRI). “Even so, Uganda’s debt accumulation path still concerns us and could be a lesson for African economies,” warns UDN, a national NGO that analyses the country’s national debt processes.

According to the update issued by Julius Kapwepwe, the UDN Director of Programmes, there is need for government to expend and improve domestic revenue by widening, and deepening tax base as well as concentrating on a few but strategic exports like minerals.

It adds that public infrastructural investment should be linked to rapid growth areas such as Agro-industrial linkages but also address tax dodging especially illicit financial flows (IFFs) “UK AID has worked closely with Uganda Revenue Authority towards plugging holes in aspects of IFFs,” the release indicates but adds more remains to be done.

UDN also wants government to address the real causes of debt accumulation: “Go to the roots not leaves in dealing with underlying causes for debt accumulation beyond mere debt restructuring,” it says, adding that government should continue to advocate against global and regional unfair international trade regimes.

More so, UDN says government should ensure feasible use and utilization of the borrowed funds as way of containing low absorption rates that have been regularly reported on public debt.

The NGO also wants government to and revise the Debt Sustainability Analysis (DSA) framework: “The IMF and World Bank should revise the current DSA frame to corporate in variables… that pro-vide the real picture of the economy especially reflecting on is-sues like domestic arrears which are currently ignored in the present frame work,” it says adding that the CSOs already raised this with IMF, UN, Donor Economic Group and others.

It says there is also need to check creditors who by-pass the country’s legal, institutional and policy regimes or any other tenets for good lending and borrowing. This, UDN says leads to illegitimate debts that should not be paid.

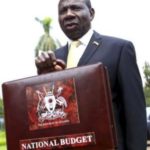

In June this year, finance minister Matia Kasaija reported that Uganda’s external and domestic debt had hit $8.7 billion (sh28 trillion).

According to Kasaija, the debt burden, which is almost equivalent to this year’s national budget, accounts for 33.8% of the country’s Gross Domestic Product (GDP).

Government debt as a percent of GDP is used by investors to measure a country’s ability to make future payments, and a negative perception can affect the country’s borrowing costs and government bond yields.