Three firms shortlisted for the impending Bank of Uganda (BOU) investigations over the sale of Crane Bank may have to pull out the process if the investigations are to be considered credible.

The five firms shortlisted are KPMG, Pricewaterhouse Coopers (PwC), Deloitte and Touch. However, it should be noted that KPMG and Pricewaterhouse Coopers worked with defunct Crane Bank as its auditors.

Pricewaterhouse Coopers did a forensic audit upon which BOU relied on as a basis to file a case in a commercial court division, claiming one of the major shareholders Sudhir Ruparelia and Meera Investments has duped the bank of about Shs400 billion. The case is pending in court awaiting hearing.

On the other hand KPMG and Deloitte and Touch are said to have worked for defunct Crane Bank, which also, for purposes of transparency puts the two firms out of the process. They have also worked for BoU and Auditor General on several other inquiries.

Elsewhere, PwC was banned in India whereas KPMG was banned in South Africa for double dealing, which is against the code of ethics of the accounting profession.

India’s securities regulator has banned the global accountancy firm PwC from auditing listed companies in the country for two years, after it failed to spot a $1.7bn fraud at the defunct Satyam Computer Services. In a damning 108-page report, the Securities and Exchange Board of India wrote that PwC had neglected to check “glaring anomalies” in the financial details reported by Satyam, whose downfall was one of India’s worst financial scandals in recent years.

Business Leadership South Africa (BLSA) has decided to suspend KPMG’s membership pending the outcome of an independent investigation.

The BLSA board says it recognises the considerable steps announced by KPMG to change its leadership and start a process of “cultural change”. However the organisation cannot ignore the gravity of the firm’s conduct.

The auditing firm has lost several clients after the firm released the findings of its internal investigation which revealed serious failings in the work it did for Gupta-linked companies and Sars.

BLSA’s CEO Bonang Mohale says the organisation took this bold step because what KPMG has done goes against its values.

The controversial sale of Crane Bank of its competitor dfcu Bank early last year by Bank of Uganda (BOU) caused outcry within the banking industry as well as the general public, something government has followed and now BOU is to face an investigation which is expected to dig out the rot in the central bank’s regulatory operations.

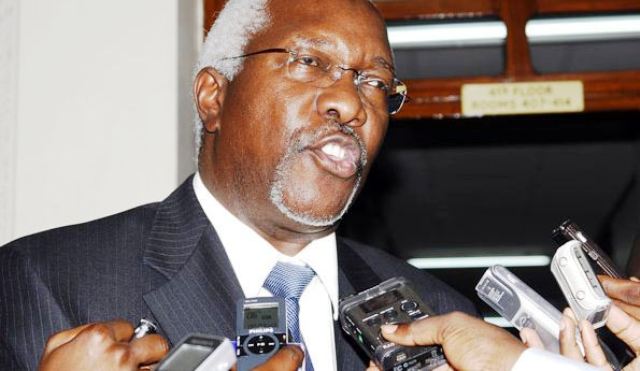

The Auditor General (AG) John Muwanga has for purposes of transparency listed five audit firms from which he will pick to carry out the investigations that should pin BOU Governor Emmanuel Tumusiime-Mutebile and sacked director for supervision Justine Bagyenda. Whether it gives them advantage or disadvantage will be known when the best bidder is selected to do the job that is likely to change regulatory operations at the central bank but also bring to surface the overlooked issues as BOU sold Crane Bank to dfcu at Shs200 billion against held assets worth Shs1.3b, leave alone the loans Crane Bank was in the process of recovering.

Meanwhile, Abdu Katuntu (Bugweri Constituency), the Chairperson of Parliament’s Committee on Commissions Statutory Authorities and State Enterprises (COSASE) has welcomed the move to shortlist the firms but also expressed that any auditor must do a professional job in case they win the bid. According to MP Katuntu, parliament wants the AG to audit the management and sale of defunct commercial banks in the country. Parliament also wants an investigation into disputed agreements BOU signed with dfcu Bank and issues such as supervision, guidelines and policies.

Reports say President Yoweri Museveni is keen on knowing what exactly happened as BOU sold Crane Bank. He is also not happy with the operations at the central bank, sources say. Days ago he held a meeting with Mutebile and Irene Mulyagonja, the Inspector General of Government (IGG). It followed a dispute on staff changes at BOU.

The IGG had received complaints from the affected staff. Former owners of Crane Bank accuse BOU management of selling their bank without their approval. They argue they were kept out of negotiations, which they say contravenes provisions of the Financial Institutions Act which governs the local banking industry. Having acquired Crane Bank, dfcu has been earning profits as reported for the two halves of 2017. The first half saw dfcu make profit of Shs114 billion; this was far higher than the profit it made in second as reported late last month.

PwC, KPMG, Deloitte &Touch have conflict of interest in BOU-Crane Bank investigations-sources

- Advertisement -