Growth in Sub Saharan Africa is projected to pick up to 3.1 percent in 2018, and to firm to 3.5 percent in 2019 and 3.7 percent in 2020, according to the according to the new Africa’s Pulse, a bi-annual analysis of the state of African economies conducted by the World Bank.

According to the analysis, the forecasts are predicated on the expectations that oil and metals prices will remain stable, expansion in global trade will stay robust, and external financial market conditions will continue to be supportive.

However, the report says structural constraints will prevent a faster pick-up in GDP growth in the region without renewed progress in structural reform. Among the region’s largest economies, the forecasts for Nigeria were revised downward. Growth forecasts for 2018 and 2019–20 are is 0.4 and 0.5 percentage points lower, respectively, than in October, reflecting a slower than previously anticipated recovery in the oil sector due to emerging capacity constraints and continued challenges to growth in the non-oil industry and services sectors.

The growth forecasts for Angola and South Africa have been revised slightly upward. In Angola, growth is projected to reach 1.7 percent in 2018 and 2.4 percent by 2020, helped by a more efficient foreign exchange allocation system, increased availability of foreign exchange due to higher oil prices, rising natural gas production, and improved business sentiment.

In South Africa, the economy is expected to grow at 1.4 percent in 2018, and expand by 1.8 percent in 2019 and 1.9 percent in 2020, on the expectation that slowing inflation and improving sentiment would help sustain the ongoing recovery in domestic demand, especially in investment.

However, although political transitions have opened opportunities for reforms in Angola and South Africa, they each face challenges in translating expectations of reforms into stronger investment and growth. An uneven recovery is expected in other oil and metals exporters.

Rising oil and mining output as new projects come online, combined with stable commodity prices, are expected to boost growth in some countries, including the Democratic Republic of Congo and Mauritania. But growth will be moderate in others, reflecting a more gradual recovery in the mining sector.

The recovery will be slower than anticipated in some oil exporters in the Central Africa region, reflecting the need for fiscal consolidation as they continue to adjust to high debt levels and low external buffers. Among non-resource intensive countries, activity in 2018 and 2019–20 is expected to remain robust.

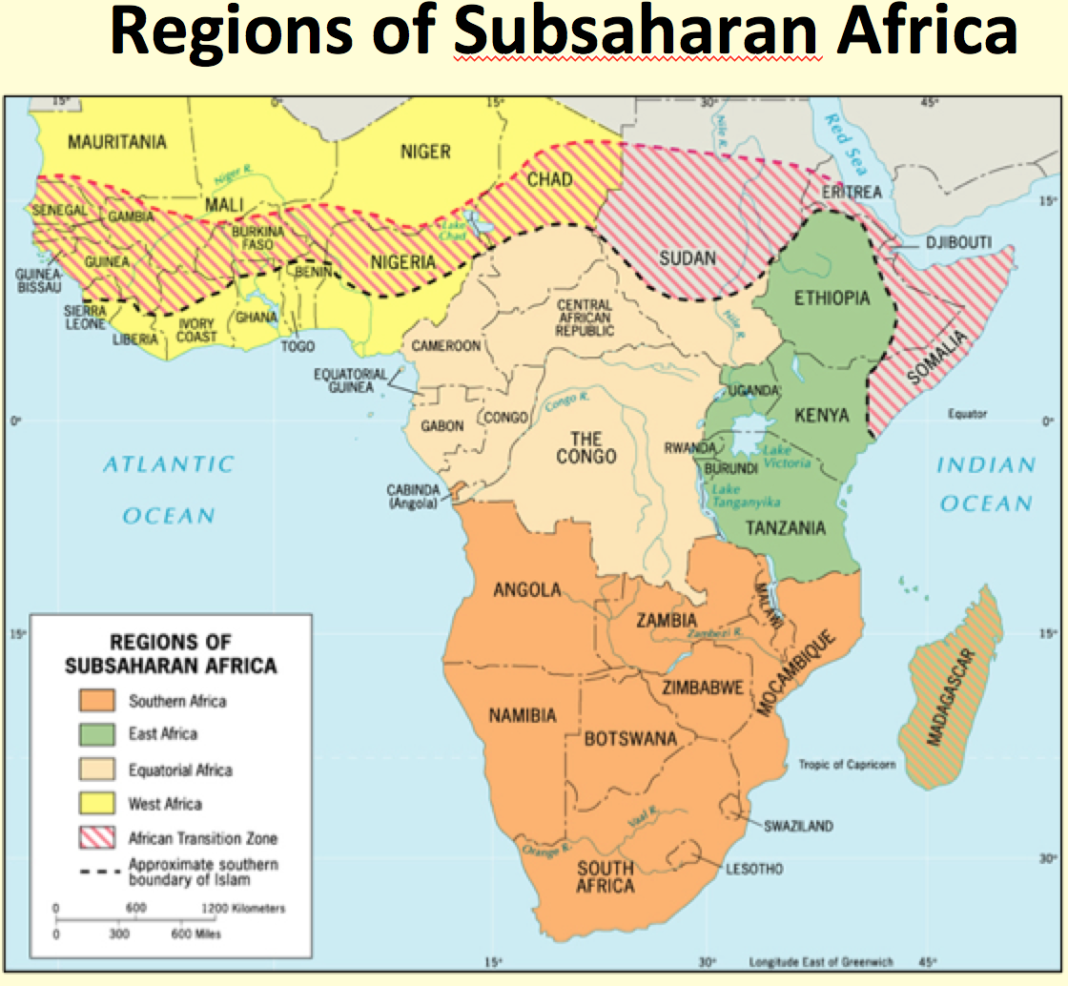

Solid growth, supported by infrastructure investment, will continue in West Africa, led by Côte d’Ivoire and Senegal. Following a dip in 2017, growth prospects have improved in most of East Africa, including Kenya, Rwanda, and Uganda, owing to improving agriculture sector growth following droughts and a rebound in private sector credit growth.

Elsewhere, although growth in Ethiopia is expected to soften, as policies are tightened to contain inflation, it will remain high, as government-led infrastructure investment continues. In some smaller economies like The Gambia and the Comoros, improved political stability and rising remittance flows will allow for a modest pick-up in activity. However, in Malawi, the spread of the fall armyworm, a pervasive agricultural pest, will weigh heavily on activity.

Although per capita GDP growth in the region will turn positive, it will remain well below its long-term average and inadequate to reduce significantly the region’s high poverty levels. The total poverty headcount in the region, at the international poverty line, is projected to decline only slightly, even as more than one-fifth of African countries have poverty rates well over 50 percent.

Faster poverty reduction in the region will require acceleration in GDP per capita growth. Structural reforms that increase productivity and support export diversification, including by improving the quantity and quality of electric power, telecommunications, transport, and water and sanitation infrastructure, will be critical to achieving desired development goals.