The Bank of Uganda (BOU) liquidated Crane Bank in 2016 and controversially sold it in January 2017 to DFCU Bank but the controversial transaction continues to haunt both of the top managers at BOU and DFCU Bank.

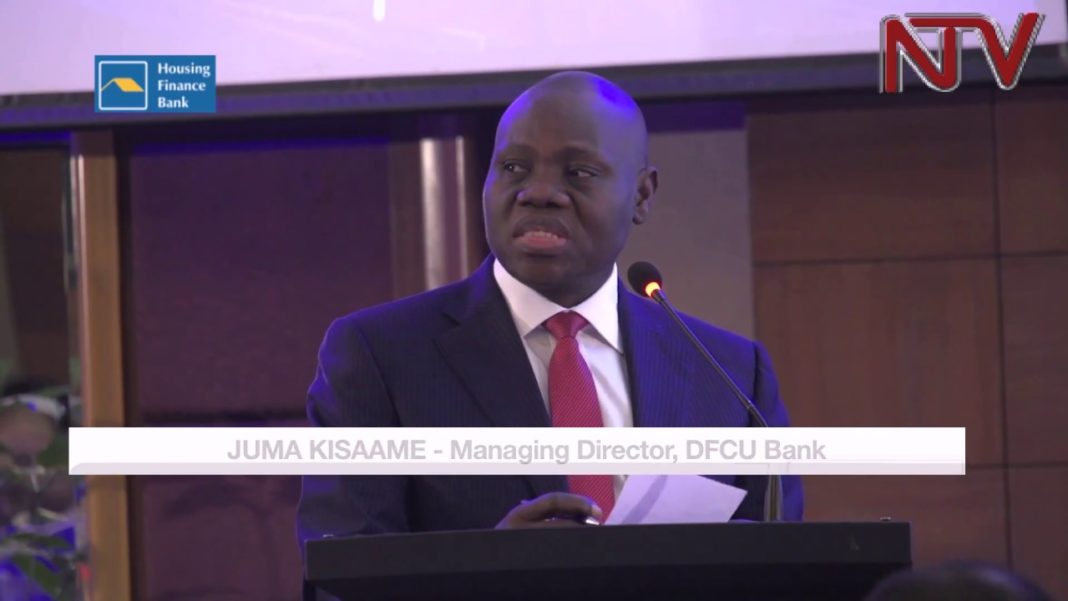

Eagle Online understands that the Managing Director of DFCU Bank Juma Kisaame, intends to hand in his letter of resignation soon, following a series of events that have happened after DFCU Bank took over Crane Bank.

Firstly, the sale of Crane caused public alarm to the extent that parliament ordered for an investigation into BOU regarding to the sale of defunct banks in the country such as National Bank of Commerce, Crane Bank, Greenland Bank, Gold Trust Bank among others.

Parliament accused BOU of not producing any report, despite spearheading the closure and selling off about five banks. The Office of the Auditor General (AG) is investigating BOU. Reports have emerged that top officials there are coy to give vital information to the AG’s investigators. But that is not likely to save them as parliament is alert waiting for the report that would help inform the future transactions.

After BOU sold Crane Bank to DFCU, Governor Emmanuel Tumusiime-Mutebile would later sack his director of supervision, Ms Justine Bagyenda under unclear circumstances. Bagyenda would later drag Mutebile to the Office of the Inspector General of Government (IGG) for wrongful dismissal, causing a public spat between Irene Mulyagonja and Mutebile. President Museveni had to come in to settle the matter.

Insiders however say Mutebile sacked Bagyenda because she failed to do her job of supervising commercial banks. She is said to have ill-advised Mutebile during the transactions to sell off Crane Bank to DFCU Bank at Sh200 billion. Before the sale, BOU had spent Shs200 billion of taxpayers to recapitalise Crane Bank. At the time Crane Bank was sold off, it had an asset base of just over Shs1 trillion.

The former PAC vice chairperson Paul Mwiru (Jinja East) said before the release Shs200 billion to Crane Bank Parliament had already capitalised BoU with Shs400b. all these monies remain unaccounted for and MP Mwiru months ago said that all the money must be accounted for by BOU top managers.

In September last year, parliament asked the AG to look into the cost of Crane Bank liquidation, assets management, hiring of external lawyers, liabilities and the status of all the banks closed by the central bank. However, in the expanded audit, the AG’s investigators will look into the financial operations and accountability of funds, among other issues.

Later on, leaked documents would expose Ms Bagyenda’s different banks accounts transacting about Shs20 billion. More details would emerge that she owns over 10 prime properties in Kampala. Investigations are ongoing to establish Ms Bagyenda’s source of wealth. The IGG recently said she would share the report with relevant authorities.

The former head of Parliament’s Public Accounts committee Nathan Nandala Mafabi (Budadiri West) wants Ms Bagyenda investigated for money laundering. He recently said: “Bagyenda has been the head of Anti-Money Laundering committee and the law we passed, stated that whoever participates in money laundering has to be imprisoned for 20 years.”

Bagyenda’s fate as regards her wealth, is awaiting the IGG’s release of the report. Investigations at BOU are also expected to touch on her work. She is a woman now wondering what befell her.

DFCU woes

Upon acquiring Crane Bank in January 2017, DFCU Bank would later announce half year net profits of Shs114 billion from Shs23 billion in 2016. It would at the end of 2017 announce net profits of Shs127.6 billion from Shs46.2 billion in 2016. To the shareholders, that was good business as they would earn higher dividends.

However, the celebrations were short-lived as major holders started to fight over the huge profits, leading to some seeking exit from the company.

Britain’s Commonwealth Development Corporation (CDC) is leading the way for those that want to leave as announced in the recent letter. CDC is said to have been against buying of Crane Bank.

Day ago, Deepak Malik resigned from the DFCU board as a non executive member even if the bank said it was a normal resignation especially that he had been appointed CEO of Arise B.V. the biggest shareholder of DFCU Bank with over 50 per cent.

Reports also say William Sekabembe, who has been the Chief Business & Executive Director since 2016 resigned. Sources say Sekabembe tendered in his resignation letter some time back though he is waiting for the three month notice to expire before can officially move on. This was agreed as he signed his contract with employers.

Juma Kisaame, the current troubled Managing Director of DFCU Bank also intends to resign, according to inside sources. Sekabembe is said to have disagreed with DFCU’s purchase of Crane Bank, something that did not go well with other top managers who were in favour of the transaction that has ended in courts of law, following a suit filed by former shareholders of Crane Bank.

Meera Investments went to court in February seeking to reclaim leasehold titles and developments for 48 banking halls taken over by DFCU Bank. The company contends that it is the rightful owner of the land titles and that their transfer to dfcu Bank should have been effected after its consent.