The sale of insurance products through banks (Bancassurance) contributed Shs9.3 billion to the local insurance sector, according to the latest report.

The collection was from nine banks licensed since end of 2017. The performance as at end of June 2018 shows that a total of Shs442 billion in gross written premium income was underwritten in the first half of this year compared to Shs358 billion which was underwritten in the same period of 2017.

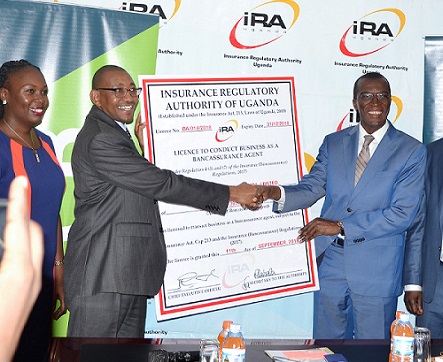

The performance was revealed by the Ag. Director Planning, Market Research and Development, Sande Protazio, at the handover ceremony of the 13th and 14th Bancassurance Agents licenses to KCB Bank and Opportunity Bank respectively, at the IRA offices.

Mr. Sande said that: “Out of Shs9.3 billion underwritten premiums generated through bancassurance, life business accounted for Sh7.5 billion and non-life business was Shs1.8 billion.”

The Chief Executive Officer of the Insurance Regulatory Authority (IRA), Alhaj Kaddunabbi Ibrahim Lubega, said bancassurance would give the much needed support to boost insurance penetration. “We believe that the commercial banks’ wide network, product innovation, technological advancement and platforms running in different banks, will provide an ideal niche or focused market for the insurance sector,” he said.

Meanwhile, IRA recognizes that one way of fast tracking access to insurance is by creating awareness and deeper understanding of its benefits.

The Authority has therefore taken deliberate effort to focus its work towards public and consumer education drives aimed at reducing the vulnerability of Ugandans to risks and increasing their socio-economic empowerment.

IRA recently participated in the Uganda Revenue Authority (URA) Tax Payers Appreciation Week to sensitise business communities in business risk management