The Bank of Uganda (BoU) is badly in need of Shs484 billion which it also wants to use to repay Shs320 billion the Auditor General John Muwanga said could not be accounted for despite claims by BoU top officials that they spent it on liquidity support for Crane Bank Limited (CBL) while under receivership between October 20, 2016 and January 25, 2017 when Dfcu Bank controversially took over CBL’s assets.

Mr Muwanga established that Shs320 billion couldn’t be accounted for by BoU top officials after MPs who were on parliament’s Committee of Commissions, Statutory Authorities and State Enterprises (COSASE) led by the then Chairperson Abdul Katuntu ordered him in December last year to audit Shs478 billion BoU officials claimed was spent on CBL as liquidity support and other intervention costs.

The MPs were then probing BoU over its controversial closure of seven banks such as Teefe Trust Bank, Greenland Bank, International Credit Bank, Cooperative Bank, National Bank of Commerce, Global Trust Bank and CBL.

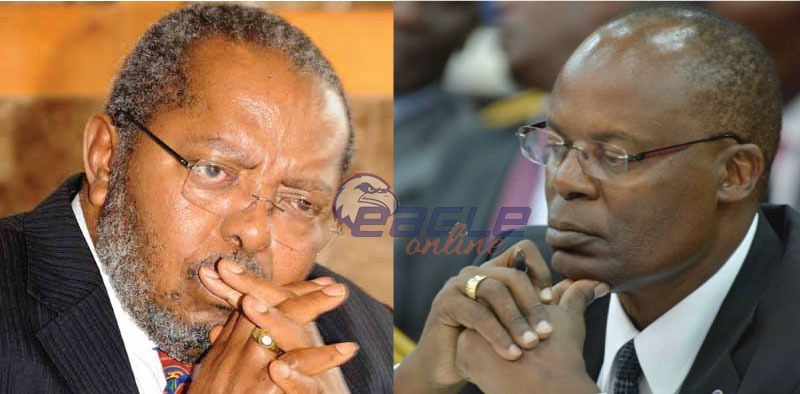

The Shs320 billion which was meant to support CBL so that it keeps afloat was diverted by some of the top officials of BoU for their own selfish interests. COSASE in its report has recommended that officials responsible for the loss must be held accountable. They include former BoU Executive Director of Bank Supervision Justine Bagyenda and Ben Sekabira, the BoU Director Financial Markets Development Coordination.

Days ago Eagle Online reported that BoU through the Ministry of Finance was requesting for Shs484 billion for capitalisation, which is not clear. Sources say BoU officials want to use that money to repay Shs320 billion missing. The other plan is to hoodwink MPs that Shs484b they want is just for securities (assets) not cash, which is not true,” a source who preferred to remain anonymous said. “They desperately need the money…They are meeting individual MPs on Finance Committee,” the source said.

Like Eagle Online reported days ago, the latest need for money to capitalise BoU confirms the idiom, “throwing good money after bad”, which refers to spending more money on something problematic that one has already spent money on, in the presumably futile hopes of fixing it or recouping one’s original investment.

Analysts say that whereas recapitalising BoU is a strategic and urgent business for parliament, it should also be equally urgent and strategic to quickly implement the recommendations of COSASE which among others call for the restructuring both the board and management and regulatory regime at the central bank.

“The people who are behind the mistakes that led to the need for recapitalisation, cannot be the same people to manage the recapitalised central bank. That would be the equivalent of throwing good money at bad money,” an analyst said.

“Insanity is doing the same thing over and over again and expecting different results. BoU potentially faces up to Shs1 trillion in lawsuits as a result of the findings and recommendations of COSASE. Parliament should not put the proverbial cart before the horse; BoU needs overhauling first before anything else. You can’t just take a request to parliament to give you Shs484.2 billion before you account for Shs478 billion stolen in the name of Crane Bank Limited’s capitalisation,” another one adds.

Government wants to pressure MPs to approve a total of Shs620.7 billion for the planned recapitalisation of BoU and other five banks like; Uganda Development Bank (Shs103 billion ), Housing Finance Bank (Shs30 billion ), Post Bank (Shs4.7 billion ), Trade and Development Bank (Shs2.5 billion ) and African Development Bank (Shs1 billion )

Without shame in their faces, Ministry of Finance officials told MPs on Finance Committee yesterday that Shs484.2b was urgently needed to cover for deficits and losses accumulated since 2013.

Lawrence Ssemakula, the Accountant General in the Finance Ministry said while presenting a ministerial policy statement for the financial year 2018/19 to legislators.

Mr Ssemakula told the committee that the Central Bank had indicated to the Ministry that it had suffered deficits since June 2013 and that the money was needed to avert an impending crisis.

“They have indicated that they have been impaired from June 2013. So as per the BoU Act, we have no option but to allocate the money in our budget since their operations are in deficits,” he said.

When MPs asked whether the ministry had done due diligence on the request by the Central Bank managers, Mr Ssemakula said the deficits are captured in the Auditor General’s reports.

Shs484.2b capitalisation fund for BoU is expected to increase the budgetary allocation towards payment of domestic debt from Shs2.3 trillion in 2018/19 financial year to Shs3.2 trillion in financial year 2019/20.

The Shs3.2 trillion domestic debt budget includes Shs62b for Contingency Fund, Shs140b for court awards arrears, Shs510 billion for treasury bills interest, Shs2.04 trillion for treasury bonds costs, Shs1.2 billion for listing fees and Shs750 million for bank charges.

The latest BoU request for capitalisation first came to the attention of Parliament in May last year with a request for Shs474 billion.

PS Keith Muhakanizi had previously written to the Clerk of Parliament, explaining that BoU had registered a deficit of Shs17b and talked of operating losses of Shs457 billion on account of “monetary policy” and “currency costs”.

“This projected deficit in the core capital position, together with the required core capital position of Shs30b, puts the additional recapitalisation securities to the tune of Shs504 billion,” read Muhakanizi’s letter in part.

However, MPs rejected the request because it had come at the tail end of the budgeting process and members needed time to scrutinise the request.

The MPs last year accused the Finance ministry of undermining as legislators insisted that the losses at BoU were not fully explained, and that the request recapitalisation came at the end of the budgeting process.

Some committee members, however, called for an investigation into the cause of losses and deficits at BoU before injecting the taxpayer’s money in the bank.