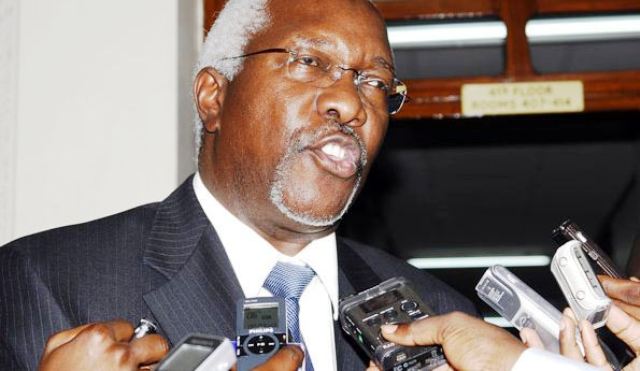

The Auditor General John Muwanga in his latest report to parliament for the financial year ended June 30, 2018 reveals some gaps in government planning and budgeting which it says affect the timeliness, accuracy and usefulness of plans by government.

According to the report, the shortcomings include; sector delays to submit plans, lack of service delivery standards in all ministries, departments and agencies (MDAs) and local governments (LGs), delay in issuing of circular for the National Development Plan III (NDP III) by the National Planning Authority (NPA), failure by NPA to undertake mid-term review assessment of the NPD II, failure by 40 entities to submit strategic plans and failure by 54 percent of MDAs in attaining satisfactory score on Certificate of Compliance (CoC).

The report says: “As a result most sector plans and annual budgets are not aligned with the NDP and assessing service delivery and level of implementation of the NDP is difficult without service delivery standards and regular reviews.”

On revenue mobilisation, the report says out of Shs28.2 trillion government had set out to receive in form of domestic, development partner funding, treasury Instruments and Appropriation in Aid (AIA) only Shs26.6 trillion (94.3 per cent) was received leading to a shortfall of Shs1.6 trillion. “During the year, government budgeted to spend a total of Shs30.8 trillion, through MDAs, LGs, Referral Hospitals, Missions and embassies. Only Shs26.1 trillion was released representing a performance of 85 per cent. This affects implementation of planned activities,” it says.

Pension and Gratuity

By close of the financial year, MDAs and LGs had not paid out Shs65.6 billion in pension and gratuity arrears despite the fact that these funds had been released.

Funds were thus returned to the UCF. The implication is that either the pensioners are non-existent or MDAs/LGs are denying/delaying beneficiaries their benefits.

Management of Public Debt

The report notes that Uganda’s debt has increased by 22 per cent from Shs33.99 trillion as at June 30, 2017 to Shs41.51 trillion as June 30 2018. Although Uganda’s debt to GDP ratio of 41 per cent is still below the IMF risky threshold of 50 per cent and compares well with other East African countries, the report says.

However, the report says it is unfavourable when debt payment is compared to national revenue collected which is the highest in the region at 54 per cent. According to the report, 50 per cent of the loans sampled totalling Shs3.98 trillion will expire in 2020. “If government is to service the loans as projected in the next financial years (2018/2019 and 2019/2020), it would require more than 65 per cent of the total revenue collections which is over and above the historical sustainability levels of 40,” the report says.

Interest payments

According to the report, interest payments on both domestic and external loans during the year amounted to Shs2.34 trillion, which is 17 per cent of total revenue collections, above the limit set in Public Debt management Framework 2013 of 15 per cent. “This has been on the rise for the last four years,” it says.

The auditor General in the report adds that although the absorption of external debt has improved compared to last financial year, there were cases of low absorption. “I noted some loans with absorption levels as low as 10 below and below. An example is the USMID project with over Shs95 billion (95 per cent) still on the various accounts of Municipal Councils by close of year, despite various incomplete and abandoned works due to non-payment to Contractors. Another project, Mbarara-Nkenda and

Tororo-Lira transmission line has delayed for almost eight years resulting into cancellation of the loan by the funder with an undisbursed loan amount of US$ 6.5 million,” he said.

He notes that significant value loans have stringent conditions which could have adverse effects on Uganda’s ability to sustain its debt. These conditions, he says, include; waiver of sovereign immunity by government over all its properties and itself from enforcement of any form of judgement, adoption of foreign laws in any proceedings to enforce agreements, requiring government to pay all legal fees and insurance premiums on behalf of the creditor.

Youth Livelihood Program

The report notes that whereas Ministry of Gender, Labour and Social Development had budgeted for a total amount of Shs231.2 billion for the F/Y 2013/2014 to F/Y 2017/2018, only Shs161.1 billion (69.7 per cent) was released to the program resulting in a shortfall of Shs70.1 billion (30.3 per cent). As a result only 15,979 (67 per cent) of the proposed 23,850 projects were funded. This affected the number of youths who had been targeted by the program as it only benefited 195,644 out of 286,200 youths, (68 per cent) by June 30, 2018.

Low recovery of disbursed funds

According to the report, from a total amount of Shs38.8 billion that was disbursed to 5,505 youth groups in the financial years 2013/2014 and 2014/2015, on average, only 26.7 per cent was recovered from the youth countrywide. “There is high probability that the balance of almost Shs28.4 billion may never be recovered as almost 64 per cent of the sampled projects, consisting of 71 per cent value of loans, were non-existent. Another 25 per cent had reportedly embezzled or diverted the funds, the report says.

However, the report says that in the financial years 2015/16 to 2017/18, out of a total amount of Shs83.3 billion disbursed to 10,444 Youth Groups, there was a noted improvement of recoveries ranging from 24 per cent in 2015/16 to 60 per cent in 2017/18 which is still below satisfactory performance.

Out of the total amount of the Shs18.1 billion recovered from the youth groups at the time of audit, Shs16.1 billion (90 per cent) had been transferred to the Revolving Fund in Bank of Uganda, according to the guidelines. Besides, only Shs8 billion had been revolved to other Youth Groups. However, the reports says the delay in revolving funds to other eligible groups undermines the ultimate goal of the program.