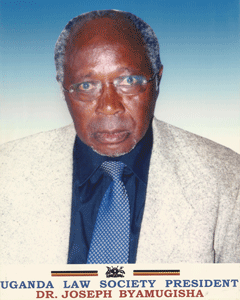

Bank of Uganda (BoU) last week threw out conflicted city lawyers of Lule and Sebalu advocates and instead appointed Joseph Byamugisha to represent them in the recent suit that was filed by city business mogul Sudhir Ruparelia.

In a notice dated May 17, 2019 to the High Court, BoU said Dr. Byamugisha had been appointed as their attorney. Last month, Commercial Court kicked out Sebalu & Lule Advocates, who were on April 29, declared conflicted and therefore unfit to represent BoU in a longstanding commercial dispute.

However, sources say Byamugisha who is also a close ally of Sebalu and Lule Advocates was seconded by Deputy Governor Louis Kasekende. In the twist of events, Eagle Online has reliably learnt Counsel Timothy K. Masembe of MMKAS Advocate who was a lawyer for Dr. Byamugisha during his tenure when was an external lawyer for National Social Security Fund had participated heavily in having Byamugisha replace Lule and Sebalu.

According to sources, Masembe who is a close confidant of the Dr. Kasekende played an inportant role to have Byamugisha appointed BoU lawyer in the current case involving city businessman Sudhir Ruparelia.

As a recap, in December 2017, the Commercial Court disqualified city lawyers Masembe and Mr David Mpanga from the Sh397 billion BoU case against Sudhir Ruparelia, also citing conflict of interest, thus acted in violation of the Advocates (Professional Conduct) regulations.

Eagle Online has also reliably learnt that Dr. Byamugisha was a legal counsel for Mr Masembe representing him on the transaction of the legal fees that were paid by BoU during the Crane bank takeover.

Byamugisha who also comes from Kabale district like BoU Governor Emmanuel Mutebile is also a member of well networked group of influential individuals who hail from same district. He is expected to battle lawyers from Kampala Associated Advocates that represents Sudhir.

The Central Bank in October 2016 closed Crane Bank Limited, previously one of the best performing banks before controversially transferring it Dfcu Bank in January 2017 for a paltry Shs200 billion. The central bank has since come under the spotlight after the closure of Crane Bank Ltd backfired with both Parliament and the Auditor General faulting the BoU officials in the middle of the transaction.

Deputy Registrar of the Commercial Court Festo Nsenga on Monday April 29, 2019 delivered a ruling in which city businessman Sudhir Ruparelia emerged the victor after seeking dismissal of Sebalu & Lule Advocates from a case involving Crane Management Services Limited (CMS) and Dfcu Bank Limited which had hired the law firm to defend it in a suit where CMS was seeking rent arrears of about Shs3 billion as well as recovering US $385,728.5 from the bank.

The Commercial court is yet to hear the pending applications in the case between Bank of Uganda (BoU) and Ruparelia over sale of Crane bank to Dfcu bank. The BoU sued Ruparelia and his Meera Investments Company for allegedly fleecing Crane bank of Shs397 billion in fraudulent transactions and transfers.

The third application was filed by Ruparelia, demanding dismissal of BoU pleadings. Crane bank was taken over by the central bank on October 20, 2016 and later sold to Dfcu bank in 2017. Ruparelia has denied the fraud accusations and instead counter-sued the central bank, seeking compensation of about Shs28 billion in damages for breach of contract between him and BoU.

However, April 29th’s ruling means that BoU and Dfcu bank cannot hire any lawyers that were in the past employed by any company of the Ruparelia Group on the grounds that such lawyers or law firms have a privilege to some information that they can use against Sudhir and his companies, thus creating a scenario of conflict of interest as agreed by Justice Paul Gadenya Wolimbwa who said there exists an Advocate-client relationship between Sebalu & Lule Advocates and Meera Investments, a member of the Ruparelia Group.

Further the ruling which is a precursor to the main ruling puts BoU in a weaker position as officials BoU were hoping to bank on the knowledge of Sebalu and Lule Advocates in regard to Ruparelia Group businesses. Now they will have to look elsewhere for lawyers who have never worked for Sudhir. It will be hard for new lawyers to present evidence pinning Sudhir.

The ruling also came after parliament’s Committee on Commissions, State Authorities and State Enterprises (COSASE) established that Shs478 billion BoU claimed it put in Crane Bank during receivership was not all used as Shs320 billion is not accounted for. Interestingly CBL needed only Shs150 billion to remain operating, yet BoU handed over CBL assets to Dfcu bank at Shs200 billion. BoU will have to prove how Sudhir fleeced CBL of Shs397 billion in alleged fraudulent transactions and transfers.