Bank of Uganda (BoU) closed seven commercial banks during the period 1993 to 2016, mainly on account of undercapitalization. But it was the closure of Crane Bank Limited (CBL) and its subsequent sale in January 2017 that would trigger an audit of BoU on closure of the same defunct banks whose owners now want financial compensation.

However, the controversial sale of CBL at only Shs200 billion to Dfcu bank was the highlight of the processes where BoU closed and sold off assets of the seven banks. CBL sale led to job losses, resignations, transfers and, reputation damage, to mention but just a few, in regards to BoU, Dfcu bank and law firms such as MMKAS Advocates, AF Mpanga, Advocates and Sebalu & Lule Advocates.

The closure of CBL particularly affected certain individuals in BoU, Dfcu bank and the law firms in many ways that have changed public perception about them:

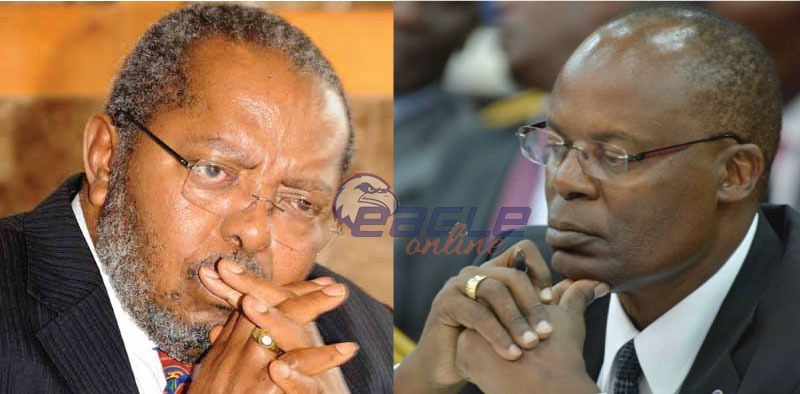

Emmanuel Tumusiime-Mutebile’s image tarnished, loses trust

Emmanuel Tumusiime-Mutebile was first appointed BoU Governor on January 1, 2001. In his tenures he has had issues with Members of Parliament where at one point, the MPs thought he had undermined their legislative role of oversight when he said he only fears God and President Museveni.

But the closure of CBL on October 20, 2016 will always remain the day to remember for Tumusiime-Mutebile as long as he lives. First he assured the public and the media that no employee of former CBL would lose their jobs as he transferred it to Dfcu bank. That assurance never came to pass as a Dfcu bank started laying off the employees a few months after the taking over its former rival. Former employees would later drag BoU and Dfcu bank to court for compensation. And that meant portrayed Tumusiime-Mutebile as a person could not be trusted.

The sale of CBL to Dfcu bank exposed Tumusiime-Mutebile as a bad manager, especially when he and his team claimed to have spent Shs478 billions of taxpayers’ money on CBL in receivership liquidity support yet he could transfer its assets at Only Shs200 billion, sadly BoU failed to account for all the money injected in CBL while in receivership yet at the same time wanted to recover it from CBL shareholders, a calculation MPs on COSASE saw as fraud.

Dr. Louis Kasekende unlikely to be promoted

An established economist and BoU Deputy Governor, Kasekende was expected to replace his boss Tumusiime-Mutebile who has a few months to retire. Now analysts close to the appointing authority say the anticipated promotion is unlikely to happen. This is because Kasekende and Tumusiime-Mutebile are majorly blamed for the mess in the closure of CBL and other banks. The two are accused of failing to supervise their juniors during the processes to close CBL and other banks. The issue became prominent when they could present all required documents to COSASE during the BoU probe over closed banks. It should be remembered that Kasekende worked hard to fail Auditor General’s probe of BoU until he was overruled by Speaker of Parliament Rebecca Kadaga.

Insiders say it is unlikely Kasekende will even remain in that capacity as Deputy Governor following the recent report that revealed that he and Tumusiime-Mutebile were leading cliques of staff in the performance of official duties. A new face is likely to replace outside of BoU Tumusiime-Mutebile.

MS Justine Bagyenda sacked before her official retirement

Justine Bagyenda, now enjoying her retirement, was the BoU executive director, bank supervision who played a big role in the closure of CBL. But her boss Tumusiime-Mutebile would later fire her as scandals in the closure of CBL kept emerging. She would rush to the IGG for help but not much was done for her as Tumusiime-Mutebile and IGG Justice Irene Mulyagonja went public bashing each other over Bagyenda’s sacking. She was replaced by Dr. Tumubweinee Twinemanzi who Tumusiime-Mutebile picked from Uganda Communications Commission, even though a recent report said he didn’t have any banking experience prior to being appointed to that job.

Ben Sekabira fails to replace Bagyenda

At the time of the closure and sale of CBL, Ben Sekabira, the current BoU Director Financial Markets Development Coordination, was director commercial banking and played a huge role in the sale of CBL as he worked hand in hand with his boss Bagyenda. He had hoped to succeed Bagyenda but his hopes were dashed away after CBL sale scandals emerged. He would later reveal during COSASE that CBL only needed Shs150 billion to remain afloat much as BoU injected Shs478 billion in the bank during receivership. Interestingly, Dfcu bank would post Shs114 billion for the first half 2017, up from Shs23 billion in the same period of the year 2016. The sharp increase was largely attributed to acquisition of CBL assets.

On the Dfcu bank side, the controversial acquisition of CBL created instabilities in its operational processes as shareholders disagreed on how that business was acquired. That would lead to the resignation of former MD Juma Kisaame following a series of revelations that showed he didn’t handle CBL transactions in the best way. He was replaced by Mathias Katamba on January 2, 2019.

Further, Agnes Tibayeyita Isharaza who had been serving as Dfcu’s Chief Legal officer and company secretary resigned and joined the National Social Security Fund (NSSF). With Dfcu embroiled in several legal battles following the controversial take-over of Crane Bank in January 2017, Isharaza’s position had become a hot seat for her to endure. Insiders say she blamed for offering poor legal advice in that transaction, that could see the bank lose billions of shillings in court battles with the Ruparelia Group that used to own defunct CBL.

Enter Jimmy Mugerwa’s recall to Tullow Oil plc in London

Jimmy Mugerwa, the former Managing Director of Tullow Oil Uganda who was days ago recalled to Tullow Oil plc headquarters in London, was also the Chairman of Dfcu bank and as such participated in the controversial acquisition of CBL in 2017. However, negative media reports on that transaction threatened the image of Tullow Oil plc, given that Mugerwa’s name in the local press kept emerging as CBL sale scandals continued. The solution was to recall Mugerwa to London and was replaced by Mariam Nampeera Mbowa who now is expected to look after the company’s interests in Uganda’s oil & gas sector, as it negotiates a farm down of its discovered oil blocks with the government of Uganda.

Conflicted law firms of MMAKS Advocates MMKAS Advocates, AF Mpanga, Advocates and Sebalu & Lule Advocates exposed

The three Kampala law firms were exposed and ordered by court not to ever represent any side in cases involving the Ruparelia Group, the three firms having worked for the same company. It should be noted that MMKAS Advocates were also hired by BoU as transaction advisors in the sale of CBL whereas Sebalu & Lule Advocates are accused of misguiding Dfcu bank in the transfer of Meera Investment Limited.’s leasehold properties that CBL was using as banking halls. The exposure of the three firms has tarnished their image and eroded their credibility.

The affected names aside, watchers are wondering whether the controversial closure of CBL has become a curse that is now haunting key players in the transaction now expected to be battled in court between CBL shareholders and BoU which is demanding about Shs397 billion from CBL shareholders who also want BoU to compensate them about Shs28 billion.