|

Justice David Wangutusi on Monday morning dismissed a case which Bank of Uganda (BoU)/ Crane Bank in Receivership filed against city tycoon Sudhir Ruparelia, accusing him and his Meera Investments Limited of allegedly fleecing Shs397Bn from Crane Bank before it was closed and sold it to Dfcu Bank in January 2017. However, Sudhir dismissed BoU’s allegations and counter sued them, further stating that Crane Bank in Receivership had no obligation to sue him as it violates the law. Justice Wangutusi agreed with Sudhir and dismissed the case, ruling that (Crane Bank In Receivership) had no capacity to sue Sudhir and any other entity. Below is Justice Wangutusi’s ruling verbatim;

THE REPUBLIC OF UGANDA IN THE HIGH COURT OF UGANDA AT KAMPALA (COMMERCIAL DIVISION)

MISCELLANEOUS APPLICATION NO. 320 OF 2019 (ARISING FROM CIVIL SUIT NO. 0493 OF 2017)

SUDHIR RUPARELIA MEERA INVESTMENTS::::::::::::::::::::::::::::::::::::::::::::::::::APPLICANTS VERSUS CRANE BANK LIMITED [IN RECEIVERSHIP]::::::::::::::::RESPONDENTS

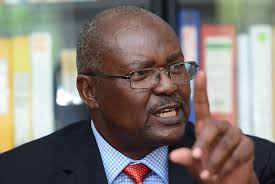

BEFORE: THE HON. JUSTICE DAVID WANGUTUSI R U L I N G: The Applicants Sudhir Ruparelia and Meera Investments filed this Application against Crane Bank Limited (In Receivership) seeking orders that; The Respondent has no locus standi to commence actions against the Applicants under Civil Suit No. 493 of 2017; The Plaint in Civil Suit No. 493 of 2017 does not disclose a cause of action against the Applicant; The orders sought against the 2nd Applicant in Civil Suit No. 493 of 2017 are barred in law; Civil Suit No. 493 of 2017 be dismissed with costs and; Costs of the Application be provided for. The background to these claims as discerned from the pleadings is that the 1st Applicant founded the Respondent in 1995 and was a Director and the Vice Chairman of the Board of Directors since its foundation. On 20th October 2016 the Bank of Uganda took over management of the Respondent in accordance with sections 87(3) and 88(1) (a) and (b) of the Financial Institutions Act 2004. On 20th January 2017 Bank of Uganda placed the Respondent under Receivership according to section 94 of the Financial Institutions Act. On 30th June 2017 the Respondent filed Civil Suit No. 493 of 2017 against the Applicants alleging that 1st Applicant participated in illegal shareholding in the Respondent bank. She contended that at the time of Bank of Uganda’s intervention, the 1st Applicant beneficially owned and controlled 100% of the Respondent’s issued shares which contravened sections 18 and until October 2016 contravened section 24 of the Financial Institutions Act. The Respondent also alleges that the 1st Applicant is the beneficial owner of and controls a further 47.33% of the Respondent’s issued shares (99,398,250 shares) registered in the name of White Sapphire Limited a company nominally owned by Rasikal Chhotalal Kantaria herein called “Kantaria.” Furthermore, that the 1st Applicant is the beneficial owner of a further 4% of the Plaintiff’s issued shares (8,400,000 shares) registered in the name of Jitendra Sanghai herein called “Sanghai.” It is the Respondent’s contention that the 1st Applicant also owns and controls a further 19.83% of the Respondent’s issued shares (41,648,294 shares) registered in the names of his immediate family namely; his wife and three adult children. That White Sapphire limited together with its nominal owner “Kantaria” and “Sanghani” as well as the 1st Applicant’s family members have at all times acted in the affairs of the Respondent as the 1st Applicant’s nominees. As a result, the 1st Applicant fraudulently concealed his beneficial ownership of the Respondent by using “Kantaria” and White Sapphire Limited. Furthermore, that Kantaria’s dividends and Sanghani’s dividends had actually been paid to the 1st Applicant. According to the Respondent the 1st Applicant wrongfully extracted a sum of USD 92,830,172.00 from the Respondent; internal accounts which were not mapped onto her profit and loss statement or balance sheet. That this system of management therefore enabled the extraction of US$ 80,000,000 from the Respondent purportedly for the payment of persons, companies and entities for the 1st Applicant’s benefit. The Respondent also alleges that a sum of US$ 9.27 million was extracted through Technology Associates who had not supplied any services or supplies nor executed a valid contract with the Respondent. The Respondent further contends that fraudulent cash transactions were made through Infinity Investments Limited a company owned and controlled by the 1st Applicant. That in March 2017 after the Respondent had been placed in Receivership, National Social Security Fund carried out a compliance audit for the period January 2007 to December 2016 and established that the Respondent owed UGX. 52,083,953,995.00/= being arrears of standard contributions, special contributions, interest and penalty accruing for the period audited. Because the 1st Applicant failed to comply with his fiduciary duty to the Respondent, the transactions of the Respondent was tainted with illegalities and fraud. She therefore filed the head suit against the Applicants seeking payment of US$ 80,000,000, US$ 9,270,172.00, US $ 3,560,000.00, US $ 990,000.00, UGX. 52,083,953,995.00 as compensation for breach of fiduciary duty. She also seeks orders for an account of the Respondent as constructive trustee of money received in knowledge of breach of trust, an account for the money extracted from the Respondent and all transactions in respect of those extractions. On the part of the 2nd Applicant, the Respondent alleges that being an associate of the 1st Applicant and part of a network of companies owned and controlled by the 1st Applicant known as “Ruparelia Group”, the 2nd Applicant dishonestly appropriated the Respondent’s valuable freehold and mailo land at no consideration. For this reason, the Respondent seeks a delivery up of the freehold certificates of title to 48 properties comprising the Respondent’s countrywide branch network as well as duly executed transfer deeds in respect of each of them. The Respondent also seeks payment of USD 990,000.00 from the 2nd Applicant, interest on the money claimed, general damages and costs of the suit from both Applicants. At the hearing of this Application, Counsel for the Applicants submitted that the suit should be struck out because the Respondent has no locus to bring this suit. He submitted that the Financial Institutions Act provides ways in which the Bank of Uganda may take over and resolve the financial institution that is in distress. He cited section 89 of the Financial Institutions Act, contending that from 20th October 2016 to 20th October 2017 the Respondent could institute a suit under sections 89(1),(2) (e) and (9) of the Act, however from the 20th of January 2017 when the Respondent was placed under Receivership, the power to sue was lost. According to the Applicants the Financial Institutions Act creates the right to sue under statutory management and liquidation. That receivership is only for a limited period, a limited mandate or extent of twelve months and the statute does not create any rights for a Receiver to sue. In reply Counsel for the Respondent submitted that the suit is commenced by Crane Bank in Liquidation. That liquidation does not take away its corporate personality. Furthermore, that it is a corporate body capable of suing and being sued. That because receivership is a management situation, there is no legal change as to capacity of a company to sue or be sued. He stated; “In this case, this suit is intended to fill up the coffers in receivership so that the creditors may be paid. They refer to the right to sue being vested in the Board of Directors. The right to sue is not vested in the Board of Directors; it is vested in the Company. It is only who may take action if a company in Receivership is going to sue that should be addressed. In this case, it is a Receiver who may do so because the board has been suspended. The right to sue again vested in the Statutory Manager or Liquidator are not the same as those vested in the company itself which are given under the Companies Act by its corporate status.” While the Respondent conceded that any matters concerning financial institutions are governed by the Financial Institutions Act in accordance with section 133 of the Act and that the it takes precedence over any enactment and in case of conflict, the same would prevail, he contended that the Financial Institutions Act did not exclude the corporate personality of the Respondent conferred by the Companies Act. The Respondent further contended that section 96 of the Financial Institutions Act bars proceedings, execution proceedings or other legal proceedings from being commenced against a financial institution placed under receivership but does not prohibit the Respondent from commencing legal action. That if the law was to prevent the Respondent from suing, it would have specifically stated so. Locus standi implies the legal capacity of a person which enables him or her to invoke the jurisdiction of the court in order to be granted a remedy; Fakrudin Vallibhai Kapasi, Fazlehusein Kapasi vs Kampala District Land Board and Alliance Holdings Ltd Civil Suit No. 570 of 2015. On 20th January 2017 Bank of Uganda must have concluded that Crane Bank Limited would not be able to meet the demands of its depositors or pay its obligations in the normal course of business, or that it had incurred or was likely to incur further losses that would deplete all or most of its capital. It also found that Crane Bank was undercapitalized. For those reasons, Bank of Uganda proceeded to place her under Receivership under section 94(1) and (2) of the Financial Institutions Act. What relationship did Bank of Uganda action bring forth? Section 94(3) of the Financial Institutions Act provides; “If a financial institution is placed under receivership, the Central Bank shall become the receiver of the closed financial institution.” The foregoing means that when Bank of Uganda placed Crane Bank under receivership, it became the receiver. It means that Bank of Uganda would, if it thought that a merger of Crane Bank with another financial institution would be the best option to marshal the greater amount of Crane Bank estates, or protect depositors’ interests, minimize losses and ensure stability of the financial sector, would proceed to arrange such merger. On the other hand, as a Receiver, it was now in a position to arrange for the purchase of assets and assumption of liabilities by other financial institutions. It could in the alternative arrange its sell or liquidate its assets. As provided under section 95 of the Financial Institutions Act, it had twelve months within which it could perform the functions I have referred to above. It is important to add, that on being placed under receivership, Crane Bank achieved insulation against legal proceedings. Section 96 of the Financial Institutions Act provides; “96. Where a financial institution is placed under receivership- no steps may be taken by any person to enforce any security over the property of the financial institution; no other proceedings and no execution or other legal process may be commenced or continued against the financial institution or its property.”

The foregoing clearly prohibited any person to sue the Respondent. This was conceded to by both parties. The Respondent’s advocate submitted that while the Respondent could not be sued, she had the right to sue under her corporate status since section 133 of the Financial Institutions Act did not exclude the corporate status of the Respondent. The section provides; “For the purposes of any matter concerning financial institutions, this Act shall take precedence over any enactment and in the case of conflict, this Act shall prevail.” The Act in this case provided for instances where Central Bank could go to court. It is therefore within the Financial Institutions Act that the solution to the question whether a Receiver of a financial institution can sue, is to be found. The Financial Institutions Act gives three instances when parties in management of a financial institution can go to court. The first instance is under section 89(2)(e) where the Central Bank can “ initiate, defend and conduct in its name any action or proceedings to which the financial institution may be a party. This right arises at the stage of statutory management. The second instance where court can be sought for redress is provided under section 91, where a person may with leave of Court or with the prior written consent of the Central bank commence to continue with any legal proceeding against a financial institution while it is under management of Central Bank. This power to go to Court against the Receiver stops on the appointment of the Receiver as provided for in section 96 of the Financial Institutions Act which bars proceedings against financial institution under receivership. The third instance is when the Financial Institution moves to liquidation stage. Section 100(1)(a) provides; “The liquidator may, with the approval of the Central Bank – bring or defend any action or other legal proceedings in the name and on behalf of the financial institution..” These three instances clearly indicate that the framers of this Act were alive to the need of litigation. They provided for litigation during the statutory management stage and during liquidation. They skipped litigation during receivership. The reasons for doing so are easy to find. One of them is the time span of receivership. The twelve months provided is too short to finish a case. A suit in Uganda begins with filing allowing 21-35 days to effect service of summons. Fourteen days may elapse before it is fixed for mediation. How long the parties are given before commencement of mediation varies from Mediator to Mediator. Suffice to say that a month may go by before the 1st mediation sitting takes place. The Judicature (Mediation) Rules 2013 provide in Rule 7 that mediation be concluded in sixty to seventy days. If the matter does not settle, a month may go by for exchanging the Joint Scheduling memoranda, compiling and filing the Trial bundles, followed by witness statements, Hearing date may then be fixed for two to three months ahead. By the time hearing starts, six to nine months will have gone by. Receivership which runs for only twelve months will close on the parties before completion of the case. Imagine the costs that would further deplete the financial institution which the Receiver is instead trying to strengthen financially. Secondly under Receivership, the role of the Receiver would be either to arrange a merger, with another financial institution, or arrange the purchase of assets and assumption of all or some of the liabilities by other financial institutions or arrange to sell the financial institution or liquidate the assets. The foregoing would not normally require court in any case, for the Receiver to do it properly diversions of Court should be avoided. These in my view were considerations that must have been taken into account by the framers of the Act. But having insulated the Respondent against suits they would not have enabled it to sue because suits expect responses and counterclaims. In my view where suits against the Respondent were not allowed, there would be no legal basis to allow her sue. The Financial Institutions Act provided situations where redress could be sought through Court. In Part IX and XI of the Act which deals with Corrective actions and Liquidation leaving out Part X dealing with Receivership on purpose. Then in section 133 they advise those involved in financial institutions to give precedence to the Financial Institutions Act. In my view if it had wanted the Receiver who had only 12 months on stage to sue, it would have expressly provided for it. It is not that the Act does not provide for instances of going to Court, having provided for others and left out the Receiver speak loud and clear of the intention of the legislature. It is not upon Court now to imagine and say “the legislature forgot this we should insert it for them.” It is then clear that when the Receiver filed this suit, it was not clothed with authority. It had no power to do so and Court cannot impute an intention foreign to the legislature. This situation is well described in Smart Protus Magara and 138 Others vs Financial Intelligence Authority HCMA No. 215 of 2018 in these words; “Court cannot legislate under the guise of interpretation against the will expressed in the enactment itself. It is not open to the Court to usurp the functions of the legislature. Nor is it open to the court to place unnatural interpretation on the language used by the legislature and impute to it an intention which cannot be inferred from the language used by it by basing itself on ideas derived from other laws.” The end result is that once Crane Bank was put under Statutory Management, its Board of Directors was suspended. If there was to be any suit, it would be brought by the Central Bank as the Statutory manager under section 89(2)(e) or by the Liquidator with approval of the Central Bank under section 100(1)(a) of the Financial Institutions Act. These two were empowered to initiate and defend court action by the Financial Institution Act which interestingly left out the Receiver. The Legislature did not want any court action against the Receiver. So Counsel’s submission that their right to sue was reserved by its company status cannot be sustained. It follows that the Respondent under Receivership lacked locus standi. Without locus standi its attempt at filing a suit was null abi nitio. In this I am buttressed by Gordon Sentiba & Others vs Inspectorate of Government SCCA No. 6 of 2008 in which the Supreme Court held that the authority to sue came from statute and where no provision to sue was provided for , the courts would not fill in the gaps by recognizing a nonexistent right. In Commissioner General Uganda Revenue Authority vs Meera Investments Limited SCCA No. 22 of 2007 Justice Kanyeihamba JSC had this to say; “In my view, he or she who is empowered to sue is also made liable by necessary implication to be sued.” In the same case Justice Tsekooko JSC wrote; “In these circumstances I cannot find any legal basis in support of the view that the Commissioner General who can sue and maintain a suit in his/her official name cannot be sued in the same name in any competent court.” By this the Learned Justices meant that where the Respondent was insulated against suits, he could not sue. That notwithstanding even if the Respondent could sue, by the 30th June 2017 when they filed the suit they were not in a position to do so. They had ceased to own property and their liabilities and assets had all been exhausted. That they were no more and had no locus standi to sue is discerned from a publication by the Governor Bank of Uganda which I find appropriate to reproduce here. Informing the people of Uganda and the world at large, the Governor wrote; “NOTICE TO THE PUBLIC DFCU BANK LIMITED TAKES OVER CRANE BANK LIMITED It would be recalled that on the 20th October 2016, Bank of Uganda took over the management of Crane Bank Limited (“Crane Bank”) and issued a Notice to the Public setting out the reasons for the takeover. Since then, Crane Bank has been conducting banking business but under the management and control of Bank of Uganda. Subsequent to the takeover, Bank of Uganda as required by law, appointed an independent external auditor to take an inventory of the assets and liabilities of Crane Bank which exercise confirmed that Crane Bank‘s liabilities, as at the 20th October 2016, being the date of takeover, grossly exceeded its assets and that it was insolvent, which insolvency has continued to date. Bank of Uganda, on the 24th January 2017, progressed Crane Bank from statutory management to Receivership with Bank of Uganda as Receiver. In exercise of its powers as Receiver, under section 95(1)(b) of the FIA, Bank of Uganda has now transferred the liabilities (including the deposits)of Crane Bank to DFCU Bank Limited (“DFCU Bank”) and in consideration of that transfer of liabilities has conveyed to DFCU Bank, Crane Bank assets. All customers and depositors of Crane Bank shall now have their accounts operated by DFCU Bank through its wide branch network, which will now include some of which were formerly branches of Crane Bank Ltd. Bank of Uganda congratulates DFCU Bank upon this significant milestone that will certainly make the bank’s footprint wider. Bank of Uganda reassures the public that it will continue to protect depositors’ interests and maintain the stability of the financial sector.” This public notice made it clear that the Receiver had done an evaluation of the Respondent and arranged for the purchase of its assets and assumption of its liabilities by another financial institution. In his notice he specifically stated that the liabilities of the Respondent had been transferred to DFCU Bank Ltd and that because DFCU Bank had taken over the liabilities, it would by way of consideration be paid by conveying to it the Respondent’s assets. In doing this the Central Bank had not only fulfilled section 95(1)(b) of the Financial Institutions Act but had in a way also sold the Respondent albeit that the payment was by in kind by way of exchange of liabilities for assets. Interestingly, the Central Bank sold and did away with the Respondent on the 24th 2017 four days after it had been placed under Receivership. In my view after conveying all these assets to DFCU Bank together with the liabilities including deposits the Respondent was left high and dry with no proprietary interest in any of the assets that had originally belonged to it. In my view, the Receivership was exhausted with that transfer and conveyance. The Respondent therefore had no locus standi to file any suit claiming any property because it had ceased to exist. Nonetheless, the Recivership would have in any case expired by now within 12 months from 24th January 2017. The sum total is that the Respondent at the time it filed this suit was not in existence its lifetime having been terminated when it was surrendered to DFCU Bank whose consideration was the DFCU assumption of the Respondent’s liabilities which assumption was paid by conveying her assets to DFCU Bank. As to whether there was a cause of action, the finding herein above resolves it. I say so because if it had no assets to claim, and more so if it was already nonexistent, having lost everything when the Receiver conveyed all her assets to DFCU, there was nothing to sue for. In that regard therefore, there was no cause of action. Having found so above, I would have left it at that but I find it necessary to make a finding on whether the orders sought against the 2nd Applicant in HCCS No. 493 of 2017 are barred by law. The relevant claim for consideration is found in paragraph 6.1 which reads as follows; “Delivery up of the Freehold Certificates of Title to 48 properties comprising the Plaintiff’s countrywide branch network, together with duly executed transfer deeds in respect of each of them in favour of the Plaintiff, or its nominee, which properties, were purchased and/or developed using the Plaintiff’s monies and were fraudulently transferred, under the 1st Defendant’s direction and/or with his knowledge and in breach of his fiduciary duty as a director of the Plaintiff, from the names of the 2nd Defendant and then purportedly leased back to the Plaintiff.” The prayer against the 2nd Applicant is for delivery up of freehold certificates of title to 48 properties comprising the Plaintiff’s country wide branch network together with duly executed transfer deeds in respect of each of them in favour of the Plaintiff or its nominee. The Applicants’ contend that it would be illegal to transfer freehold titles to the Respondent because she is a noncitizen. The relevant provisions regarding land ownership is clearly provided by Article 237 of the Constitution of the Republic of Uganda. It provides; “237. Land ownership (1)Land in Uganda belongs to the citizens of Uganda and shall vest in them in accordance with the land tenure systems provided in the Constitution.” Article 237(2) (c) provides for acquisition of land by noncitizens in these words; “(c) Noncitizens may acquire leases in land in accordance with the laws prescribed by Parliament, and the laws so prescribed shall define a noncitizen for the purposes of this paragraph.” Section 40(4) of the Land Act provides; “Subject to the other provisions of this section, a noncitizen shall not acquire or hold mailo or freehold land.” A noncitizen is defined under section 40 (7) of the Land Act Cap 227 in the following words; “(7) For the purposes of this section, “non citizen” means- (a)a person who is not a citizen of Uganda as defined by the Constitution and the Uganda Citizenship Act; (b)in the case of a corporate body, a corporate body in which the controlling interests lies with noncitizens; (c)in the case of bodies where shares are not applicable, where the body’s decision making lies with noncitizens; (d)a company in which the shares are held in trust for noncitizens; (e) a company incorporated in Uganda whose articles of association do not contain a provision restricting transfer or issue of shares to noncitizens.” The law on ownership of land by noncitizens is crystal clear. Noncitizens cannot own land under Freehold or Mailo. For a company to hold land under the tenure herein described it must prove its citizenship. It is clear from the evidence on record that the majority of the shares were owned by White Sapphire, a company incorporated in Mauritius. That it owned the majority shares was a matter well known by the Central Bank because 47.33% of the shareholding was transferred to White Sapphire with the approval of the Bank of Uganda. This approval dated 24th September 2013 written to the Chairman Board of Directors Crane Bank Limited reads; “We refer to your letter ref: CB: ADV: CO: SECY: 2013/, Dated March 01 on the above subject. We hereby convey Bank of Uganda’s no objection to Crane Bank Ltd. to transfer Mr. Rasik Kantarai’s entire shareholding of 47.33% in the bank to M/s White Sapphire Ltd.” That approval was given after Crane Bank had on the 1st of March 2013 communicated its intention in a letter that clearly laid out a list of shareholders of Crane Bank to Bank of Uganda. On that list was another Jitendra Sanghani who held 4% of the shares. The two therefore hold over 51% of shares. It is not in dispute that White Sapphire was incorporated in Mauritius and therefore a Mauritian company. It is also not in dispute that Sanghani is a British national. It follows therefore that the majority shares are held by noncitizens. This is a position that the Plaintiff/Respondent recognizes and has made very clear in the plaint. In paragraph 8.3 for instance of the plaint the Respondent states that 4% of the shares registered are in the names of Jitendra Sanghani. Paragraph 27.6 states that the Plaintiff was classified as a noncitizen under section 40 of the Land Act and was therefore prohibited from owning freehold land in Uganda. The majority shareholders being noncitizens renders the company likewise noncitizen. Having found that the Respondent is a noncitizen for purposes of the Land Act and the Constitution, an attempt to confer freehold title upon it would be an illegality. An illegality because the holding of shares by noncitizens prevented them from owning land under the tenure that the Respondent’s/Plaintiff’s prayer in the plaint seeks. In this I am fortified by the decision in Lakeside City Ltd vs Sam Engola & Others HCCS No. 251 of 2010 wherein the Learned Judge observed; “The 2nd Defendant is composed of majority shareholding of noncitizens. The 3rd and 5th Defendants, their Articles of Association do not contain a clause to restrict the transfer of shares to noncitizens; and to that extent they qualify to be noncitizens. Accordingly, therefore, the transfers by the 2nd Defendant to the 3rd Defendant and by the 3rd Defendant to the 5th Defendant and their registration on the suit certificates of titles which are freehold are prohibited under Article 237 of the Constitution of the Republic of Uganda and section 40 of the Land Act as amended. Wherefore I answer the preliminary objection in the affirmative.” Consequently any orders awarding delivery of Freehold title to the Plaintiff/ Respondent would be illegal and barred in law. The Respondent cannot hold freehold and any pleadings seeking court orders to that effect amount to no cause of action. As for costs, it is well established that unless sufficient reason is given to prevent the award of costs, the costs of any action/cause or other matter or issue shall follow the event unless Court shall for good reason order otherwise; Section 27 of the Civil Procedure Act Cap 71; Dauda vs Ahmed & Ors (1987) KLR 665. The issue of costs in this case raises a little difficultly. Having found herein above that the liability and assets of Crane Bank had passed over to DFCU Bank the question that arises is who is going to pay the costs. Under such circumstances the party to bear the costs must be the one who brought the matter to Court. At the time of filing the suit Bank of Uganda had taken over management. Counsel for the Plaintiff/ Respondent submitted that the proceedings were not commenced by the Bank of Uganda but by Crane Bank Limited in Liquidation. A perusal of the affidavit in reply to the Application throws light on who brought the suit to Court. The affidavit is deponed by Margaret K. Kasule who describes herself and occupation in paragraph 1 thus; “I am an adult female Uganda of sound mind and the Legal Counsel of Bank of Uganda which is the statutory receiver of Crane Bank Ltd in Receivership and I swear this affidavit in that capacity.” From the foregoing there is no doubt that the suit was filed by Bank of Uganda. Since section 96 of the Financial Institutions Act insulated Crane Bank under Receivership from court proceedings, execution or other legal processes the person that should pay costs should be the person who instituted the suit and that is Bank of Uganda. This is so because Crane Bank in Receivership had no capacity to foot the costs and much so the Bank of Uganda that instituted the suit was aware of this incapacity. In Kyaninga Royal Cottages Ltd vs Kyaninga Lodge Limited HCMA No. 551 of 2018 this court while considering a situation of a nonexistent company had this to say; “In my view it is the Managing Director of the nonexistent company who instructed the advocates to file the suit. He must have been the one who paid the court fees. He was in my view the person who was behind the Plaint. It is he therefore who should pay the costs.” In the instant case the deponent of the affidavit in reply has put it on oath that Bank of Uganda instructed the advocates. It must have been the one that paid the court fees and it was certainly the one behind the plaint. The Bank of Uganda should therefore be the one to pay the costs. In conclusion, the Plaintiff/ Respondent did not have jurisdiction to file HCCS No. 493 of 2017. It is also my finding that the property the Plaintiff/ Respondent was seeking when she filed the suit on 30th June 2017 had earlier been given away by the Receiver to DFCU Bank on the 24th of January 2017 four days into Receivership and five months before the filing of this suit thus leaving the Plaintiff/ Respondent with no property. Furthermore, its my finding that the orders sought against the 2nd Applicant are barred in law rendering the Plaintiff/ Respondent with no cause of action against the 2nd Applicant. For those reasons this application succeeds and the suit is dismissed. The Respondent shall bear the costs of the application and the suit. Dated at Kampala this 26th day of August 2019

HON. JUSTICE DAVID WANGUTUSI JUDGE |

Why Justice Wangutusi agreed with Sudhir in Shs397 case against Bank of Uganda: Details in full ruling

- Advertisement -