Absa Group in partnership with Official Monetary Financial Institutions Forum (OMFIF) will launch the Absa Africa Financial Markets Index 2019 on October 18, 2019 in Washington D.C, according to organisers.

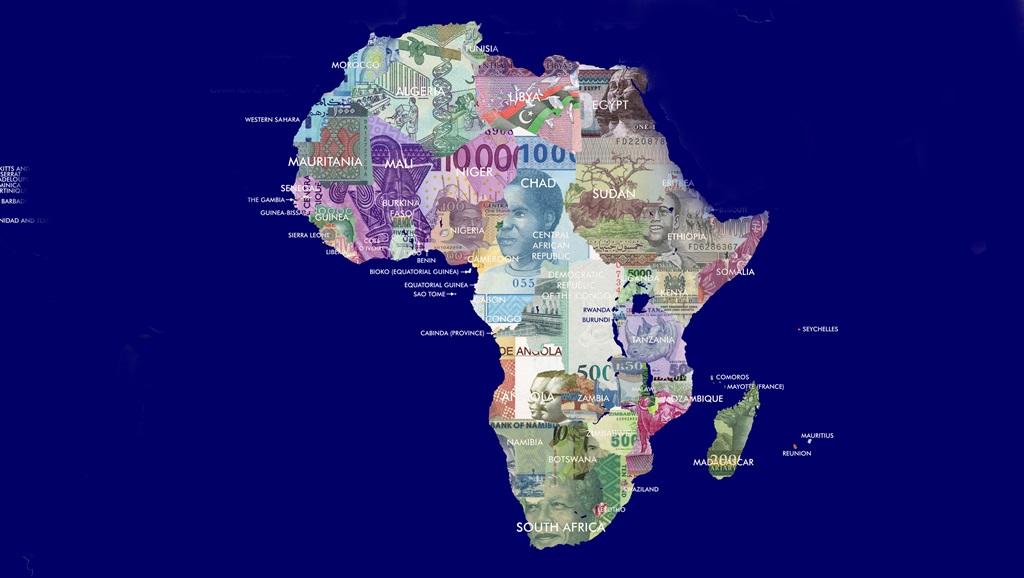

Now in its third year, the Absa Africa Financial Markets Index records the openness to foreign investment of countries across the continent. The index is a premier indicator of the attractiveness of Africa’s capital markets, for use by policy-makers, investors and asset managers around the world.

Over the past year, key mergers, new regulations and innovative financial products have contributed to the growth of financial markets across the region. The 2019 edition draws special focus on policy and market developments that have made an impact on the 20 countries covered by the index, and will boost financial market growth in the region for years to come.

The launch will take place alongside the International Monetary Fund-World Bank Group annual meetings. It will feature a presentation of the report and key findings, followed by a panel discussion and moderated Q&A session.

‘The development of well regulated, deep and liquid financial markets is a key priority that should be at the top of Africa’s development agenda. The index facilitates a meaningful debate about the maturity and accessibility of Africa’s financial markets. It is an important contribution that supports policy-makers, investors, regulators and other market participants to identify the areas and initiatives which will drive the most significant improvements,’ said Maria Ramos, chief executive officer of Absa Group at the launch of the 2018 edition of the index .

‘It is heartening to see the advances made by African countries, in many areas, to improve the efficiency of capital markets,’ said David Marsh, chairman of OMFIF. ‘However, more remains to be done regarding the robustness of market infrastructure and regulatory frameworks across Africa and we look forward to tracking progress annually.’

Absa Africa Financial Markets Index 2018 showed that the greatest area for improvement across the continent remains the ‘capacity of local investors’. Excluding the top five economies, the remaining countries average a score of just 22 out of 100 in this pillar. Survey respondents highlighted that the lack of knowledge and expertise of pension fund trustees and other asset owners hinders the development of new financial products, by reducing their demand for more sophisticated assets and strategies to diversify returns. The index also shows that improvements in market infrastructure and regulatory frameworks could boost the performance of countries in the middle of the index over coming years.

The 20 economies surveyed were: Angola, Botswana, Cameroon, Egypt, Ethiopia, Ghana, Ivory Coast, Kenya, Mauritius, Morocco, Mozambique, Namibia, Nigeria, Rwanda, Senegal, Seychelles, South Africa, Tanzania, Uganda and Zambia.

The 2018 edition showed Uganda as having a stable performance with good foreign exchange access but low local investor capacity.

The index provides a toolkit for countries wishing to build financial infrastructure by tracking progress annually across six pillars: market depth; access to foreign exchange; tax and regulatory environment and market transparency; capacity of local investors; macroeconomic opportunity; and enforceability of financial contracts, collateral positions and insolvency frameworks.

[…] READ MORE FROM ORIGINAL SOURCE […]