Dfcu Bank has finally conceded, as ruled by court, and has kicked out lawyers of Sebalu, Lule and Company Advocates from representing the lender in the case filed against it (Dfcu) by tycoon Sudhir Ruparelia’s real estate and property management firm, Meera Investment Limited.

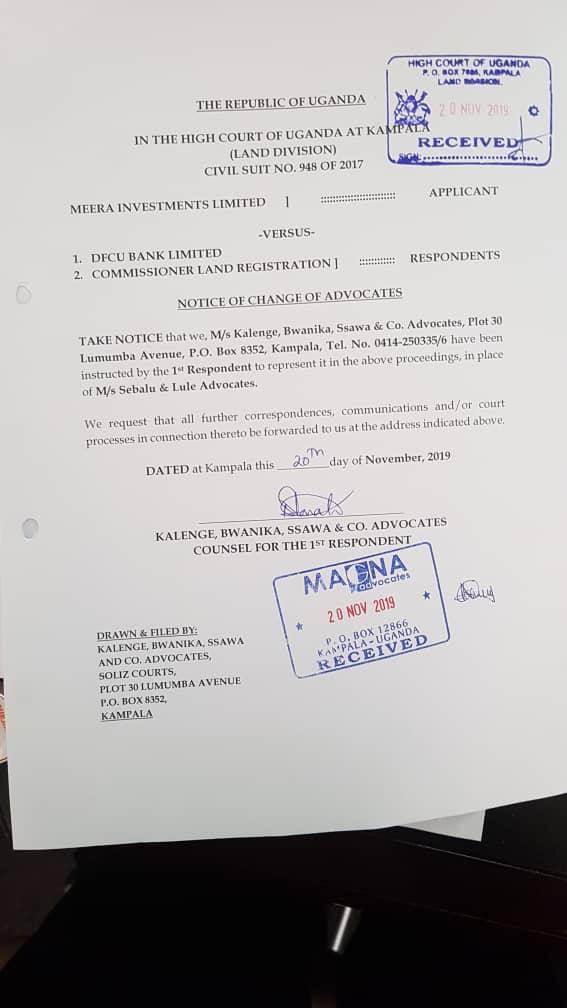

Dfcu Bank has now recruited new lawyers of yet another Kampala law firm M/S Kalenge, Bwanika, Ssawa & Co Advocates, according to the notice of change of advocates dated November 20, 2019.

The High Court on April 29, 2019 declared Sebalu & Lule Advocates as conflicted, and therefore, unfit to represent the Dfcu Bank in a longstanding a commercial dispute.

Court agreed with Meera Investments Limited that the lawyers had relevant information concerning Crane Management Services having participated in the review of its tenancy agreements.

“The Applicant has made out a case that the first respondent has relevant information of the applicant. The information is relevant and I accordingly grant an injunction restraining the first respondent from handling any case involving the applicant,” court said then.

Meera Investment Limited sued Dfcu Bank demanding rental arrears amounting to Shs2.9b and US $385,728.54 in respect of tenancies of suit properties that are owned by the Meera Investment Limited which is part of the Ruparelia Group of Companies.

In the suit, Meera Investment Limited contended that when Dfcu Bank took over management of Crane Bank Limited, it illegally took possession of the rental facilities from which the real estate company seeks to recover its arrears.

However, in defence, Dfcu Bank contracted the Law firm of Sebalu & Lule Advocates but Mr. Rupareria says he contracted the same law firm in 2006 to draw and review tenancy agreements in respect of the said rental premises thus there is conflict between the lawyer and his client.

The company also asked the court to issue a permanent injunction, restraining Sebalu & Lule Advocates from appearing as defence counsel for Dfcu Bank in the other court case that the two principals are battling out.

Section 4 of Advocates Act regulations, provide that an advocate shall not accept instructions from any person in respect of a contentious or non-contentious matter if the matter involves a former client and the advocate as a result of acting for the former client is aware of any facts which may be prejudicial to the client in that matter.

As if that was not bad enough, Sebalu and Lule Advocates misadvised Dfcu Bank that it could take over Meera Investment Limited properties which had been leased to Crane Bank Limited before Dfcu Bank to some assets of the latter in January 2017.

The transaction has brought Dfcu Bank and the Bank of Uganda (BoU) into a financial misunderstanding after former decided that it could not takeover the freehold Meera Investment properties. Dfcu Bank now wants Shs47 billion from BoU as compensation for the loss of the properties. But BoU says it cannot pay that money. However, reports indicate that the governor of BoU, Emmanuel Tumusiime Mutebile and the board refused to pay Shs47 billion to Dfcu stating the transaction was illegal.

Also in December 2017, the Commercial disqualified city lawyers Mr Kanyererezi Masembe of MMAKS Advocates and Mr David Mpanga of Bowmans Advocates from the Sh397 billion Sudhir Ruparelia’s case against Bank of Uganda (BoU), citing conflict of interest.

In his ruling delivered on December 21, 2017, the head of the Commercial Court Division, Justice Wangutusi stated that Mr. David Mpanga of A.F. Mpanga Advocates and Timothy Masembe of MMAKS Advocates acted in violation of the Advocates (Professional Conduct) regulations.