By Patrick Kiconco Katabaazi

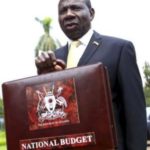

Ministry of Finance, Planning and Economic Development recently informed the nation that Uganda’s gross domestic product (GDP) had grown to Shs122.7 trillion ($32.8 billion) from Shs109.9 trillion ($29.4 billion) reported at the end of 2018/2019 financial year.

The increase in the value of the economy arises out of a rebasing of the Uganda’s GDP calculations by the Ministry of Finance, Planning and Economic Development to tap into emerging sectors such as gold exports and oil projects.

It is worth noting that Uganda’s debt to GDP ratio which had previously been estimated at 42.1 per cent and reported to be in the region of 47% at the end of FY 2018/19 declined to 37.2 % after the rebase.

According to projections by the International Monetary Fund (IMF) Uganda’s ratio of debt to GDP was projected to hit the 50% threshold set by the East African Community Macroeconomic convergence criteria. Going beyond the 50% mark would mean that the national debt has hit unsustainable levels.

There has been mounting pressure from civil society organisations, academia and the development partners in regard to the issue of debt sustainability and numbers from the rebasing of the economy is a relief to government. At 37% of debt to GDP ratio, the government has solid answers.

It should be recalled that there are a number of loans yet to be approved and in the next three years it is very possible that the country’s debt will soon get to 40% and beyond. There, therefore, need for government to rethink the debt strategy especially since rebasing can only provide relief in terms of threshold but cannot take away the fact that the country needs UGX 46 trillion (more than the total national budget for 2019/20) to deal with the current debt stock.

Civil society organisations, technocrats, development partners, academia and other policymakers should work together to ensure that the national debt is kept within sustainable . There is a need for the government to improve on the issue of effectiveness and absorption capacity to minimize waste and promote value for money culture in project implementation.

Government is urged to build capacity and finance the newly created department of projects appraisal and evaluation to ensure that all loans contracted are properly appraised.

The writer is Writer Executive Director, Centre for Budget and Tax Policy (CBTP)

[…] READ MORE FROM ORIGINAL SOURCE […]