Attempts by Britain’s Commonwealth Development Corporation (CDC) to conclude the sale of their 9.97 per cent shares to the Danish Investment Fund for Development Countries has been hampered by internal squabbles at Dfcu bank as it emerges.

Eagle Online has reliable learnt that what is hampering the conclusion of the exercise is lack of support documents to some of the dealings Dfcu undertook and one such is the acquiring of Crane Bank.

Unlike CDC which participated in the acquisition of Crane bank without documents, Danish Investment Fund for Development Countries is reportedly insisting on all documents surrounding the acquisition of Crane bank and other important transaction be availed so that in future, there shouldn’t be any litigation involving the new buyer.

CDC late last year announced their exit from Dfcu bank as shareholders.

The British firm didn’t want to their reputation to be associated with the scandal in which Dfcu acquired Crane bank and therefore, it would damage the standings.

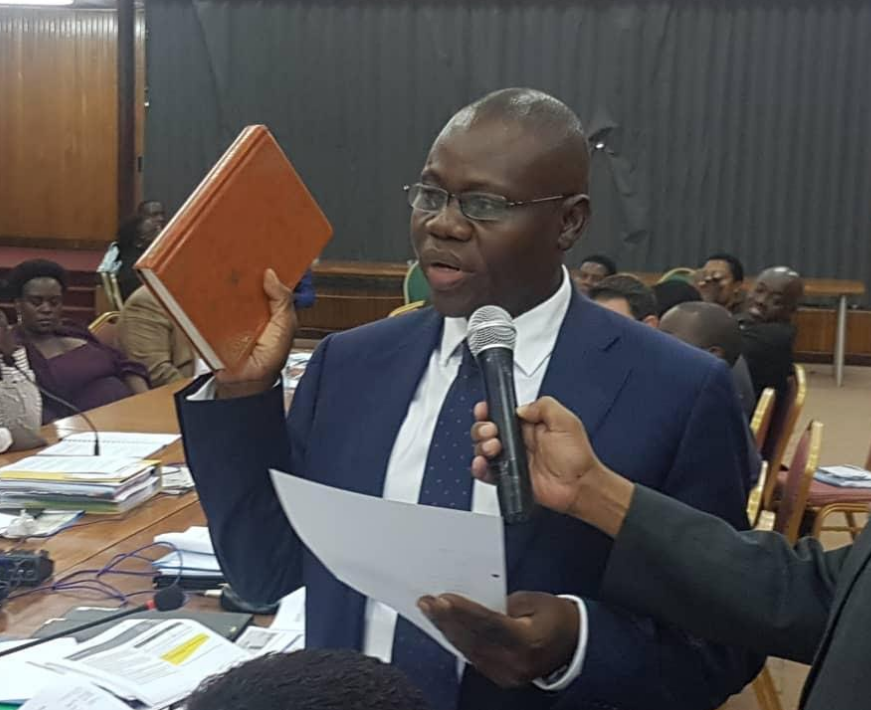

During the parliamentary probe into the closure of commercial banks by Bank of Uganda, it was revealed that most banks were sold with no support documents. In fact for the case of Crane Bank, the then Executive Director in charge of supervision, Justine Bagyenda admitted having sold the bank on phone.

The issue of minutes is reported to have halted the smooth transfer of the shareholding until it is resolved. Eagle Online has learnt that faced with this challenge, the board and top managers decided to call Mr. Kisaame back to handle the matter since he was the one in charge of the transaction.

The Danish fund are said to be straight that nobody at the body can convince them accept concluding the transfer.

Last year in February parliament’s Committee on Commissions, Statutory Authorities and State Enterprises (COSASE) has Wednesday evening chased away Dfcu Bank officials from parliament for presenting documents which were unconvincing as they were not signed.

Bagyenda, Kisaame own up, ‘we didn’t have any minutes and documents in acquiring Crane bank’

During presentation, Dfcu officials led by chairman board of directors Jimmy Mugerwa who appeared before COSASE as witnesses in the closure and purchase of Crane bank, made a defense presentation in regards to the terms of purchase of Crane bank agreement, however, the presentation was backed by fake documents which were neither dated nor signed by the bank authority. However, this prompted MPs of the committee to kick them out and allow them reorganize themselves.

“It’s prudent for this committee to throw out Dfcu team because they are so confused and disorganised; they are fidgeting with their own documents. It is in the best interest that dfcu withdraws and reorganizes themselves. The then COSASE chairman, Abdu Katuntu said.

Some of the documents that caused the MPs to chase away Dfcu bank officials led by Chairman Juma Mugerwa and new MD Mathias Katamba included one on “Fair valued loans and advances of customers of Crane Bank Limited (CBL). The other included schedules of CBL loans and advances.

Mr Muwanga in his report on defunct banks faults Dfcu bank for engaging in transactions that did not follow proper guidelines as it bought of CBL assets at Shs200 billion, paid in installments. Dfcu Bank also bought the assets of Global Trust Bank without following guidelines as laid in the Financial Institutions Act, 2004.

However, matters were made worse when former Chief Executive Officer of Dfcu, Juma Kisaame confirmed to MPs on the Committee on Commissions, Statutory Authorities and State Enterprises that the invite for Dfcu to come and buy Crane bank was done on phone.

Kisaame who was appearing before the committee confirmed earlier remarks by Ms Bagyenda which she had earlier told the committee last year that she simply picked up her phone, called Kisaame to discuss matters of the liquidation of Crane bank.

Kisami informed the committee that Bagyenda contacted him on phone to come to her office where he was informed of a potential bank that they would acquire.

.