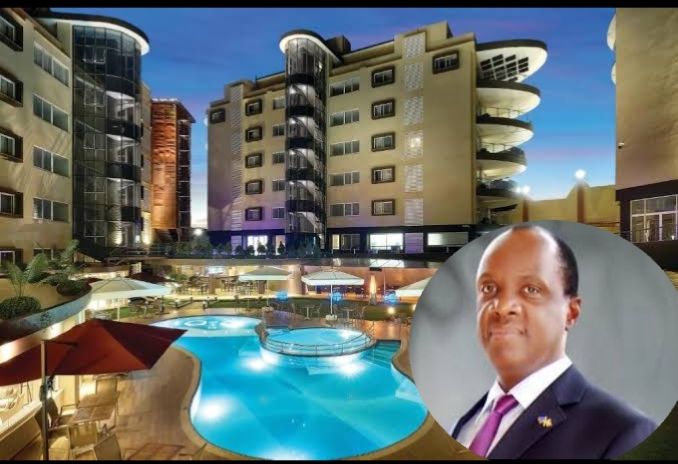

Skyz Hotel Naguru along with other two properties owned by Patrick Bitature under Simba Group have been listed for auctioning over defaulting bank loans.

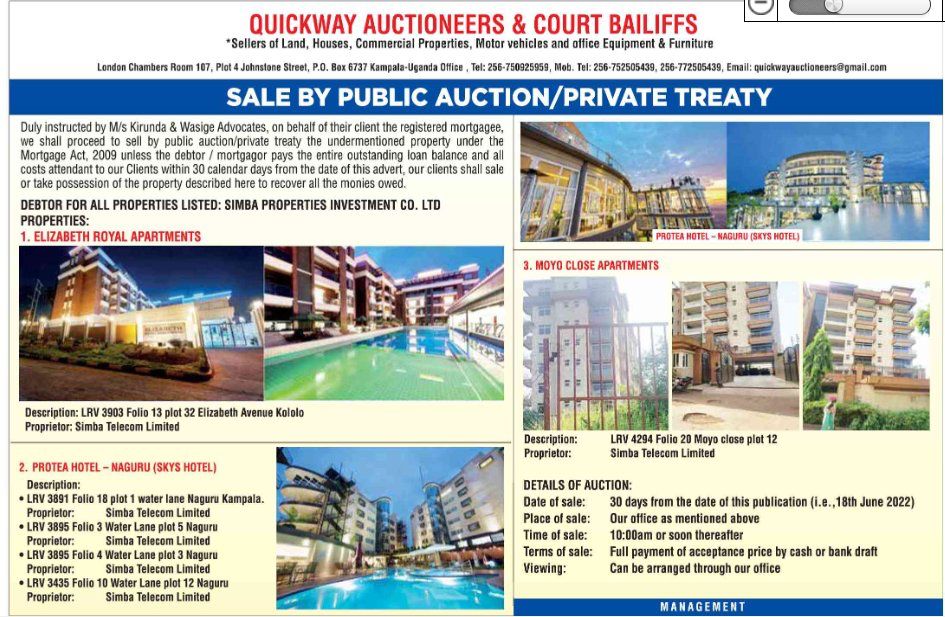

“Duly instructed by M/s Kirunda & Wasige Advocates, on behalf of their client the registered mortgagee, we shall proceed to sell by public auction/private treaty the undermentioned property under the Mortgage Act, 2009 unless the debtor/mortgagor pays the entire outstanding loan balance and all costs attendant to our clients within 30 calendar days from the date of this advert, our client shall sake or take possession of the property described here to recover all the monies owed,” the notice reads.

The other properties are Elizabeth Royal Apartments in Kololo and Moyo Close Apartments.

However, the High Court has temporarily halted the auction and given Bitature more time to raise money and pay back the loan.

In 2014, Bitature under Simba Property Investment secured $10 million (Shs36 billion) from a South African money lender, Vantage Mezzanine Fund to expand his empire.

Simba Property Investment houses Protea Hotel Kampala, Elizabeth Royal Apartments, which consists of 30 high end apartments. Skyz Hotel Naguru and Moyo Close Apartments – made up of 14 high end apartments located in Kololo, Kampala.

Under the agreement, Bitature was convinced to surrender all his businesses as securities for purposes of covering the debt.

Years later, the debt had skyrocketed and Bitature was struggling to pay back the debt, finding himself at risk of having to surrender his entire business empire to auction.

However in a high court ruling on May 9, 2022, Justice Musa Ssekaana declared the transaction illegal and untenable.

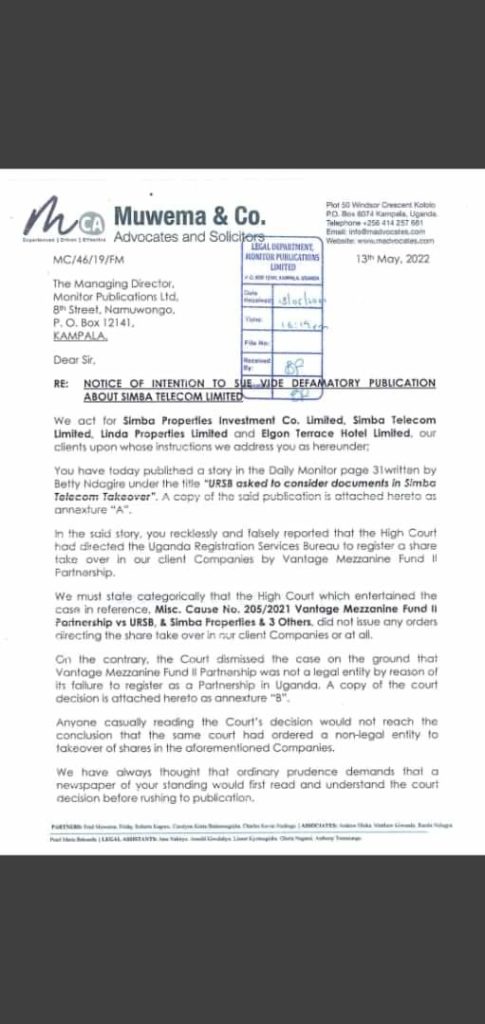

The South African money lender had instructed its Ugandan lawyers led by Robert Kirunda to demand the Uganda Registration Services Bureau (URSB) execute the transfer forms, allowing it to take over the tycoon’s business empire.

However, Vantage Capital had failed to adhere to the mandatory legal process of registering its business in Uganda before conducting business here. Operating as a partnership in the country, it was legally required to register with the URSB before entering into the loan agreement with Mr Bitature.

URSB refused to change the ownership of the securities which Mr Bitature had purportedly transferred into Vantage Fund’s name. The URSB managers said they couldn’t do so because the transfer they were pursuing was a matter of contestation before Justice Boniface Wamala.

URSB contended that the main reason for refusal to continue to consider the registration of the documents was that there was a dispute which in their view was referred to arbitration by Justice Wamala in his ruling when he noted thus; “ Impugned arbitration agreement exists, is valid, operative and capable of being performed, and that there is an arbitrable dispute between the parties herein, it is ordered that this matter be and is accordingly referred to arbitration in accordance with section 5 of the Arbitration and Conciliation Act”.

URSB Lawyer Mr. Birungi Dennis submitted that the Vantage Capital is a non-existent legal entity and hence incapable of instituting these proceedings because there is no entity in the names of the Applicant. The bureau averred that no such entity exists in the territorial jurisdiction of the Republic of Uganda and therefore this application cannot be instituted by a non-existent entity.

Vinatge cited Order 14 of the South African Rules stating that a partnership may sue in its names the same way our Civil Procedure Rules provide, however, nowhere do they show that they are a valid partnership. They attached the High Court Rules of Procedure of the Republic of South Africa as proof of existence of a partnership, but those Rules do not apply in Uganda a sovereign state with its own Rules.

“The applicant may indeed be a partnership in South Africa but it is not clear to this court whether it was registered or not in the same country or the same laws applicable in that country are in pari materia with the legal position in Uganda. Therefore this court will interrogate this fact to come to its finding and determination,” Justice Ssekaana said.

“In the same vain, this Court rejects the submission of counsel for the applicant, that foreign partnerships are free to operate in Uganda outside the regulatory registration requirements contained in the Partnerships Act, 2010 and the Business Names Registration Act (Cap 109). Order 30 of the Civil Procedure Rules provides suing and being sued once the partnership has satisfied the mandatory requirements of the law. Therefore, the international partnerships or foreign partnerships just like the Ugandan partnership cannot be recognized once they are not registered since their identities are unknown and it may open the door wide for fraud in their transactions and dealings.”

Vintage Mezzanine Fund 11 was represented by Mr. Robert Kirunda while Mr. Birungi Dennis represented URSB and Mr. Fredrick Muwema and Mr. Charles Nsubuga represented Simba Group.

Justice Ssekaana therefore ruled; “This court would have issued an order of certiorari quashing the decision of the 1st respondent (URSB) not to consider the applicant’s documents for registration because there are arbitration proceedings.”

“This court would have issued an order of mandamus compelling the applicant’s request to consider the registration of their documents on merit or advance reasons for denial or refusal to register the same in accordance with the law.

“The rest of the orders sought would not have been granted. Each party shall bear its costs.”