South African Vantage Capital has asked troubled businessman Patrick Bitature to be honest and pay US$34 million debt instead of trying to avoid it by abusing court processes and public institutions.

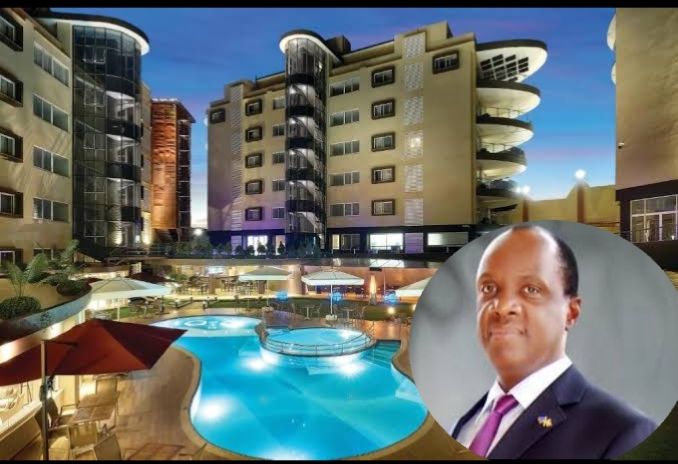

According to Vantage Capital Bitature and his Simba Properties Investment Properties Limited (SPIC) borrowed from them US$10m in December 2014 bad has not paid a single cent even if the repayment debt of December 2019. The money was meant to pay a portion of Simba Group’s existing debt then as well as completing Skyz Hotel in Naguru, Kampala.

“Vantage will not be deterred by the Simba Group’s and Mr. Bitature’s continued abuse of court processes and public institutions, nor by their recent “PR Campaign”, in their ongoing efforts to avoid their creditors and lawful obligation,” Vantage warns in a public statement, adding that investors in its fund are major international investors of repute, including several European development finance institutions, African pension funds, as well as development banks.

Vantage has brushed aside the High Court’s decision that it is not registered in Uganda and therefore has no right to sue or be sued, much as the same court said that if Vantage was a registered entity in Uganda, it would have ruled in its favour to compel Bitature to pay the loan he so badly needed to complete his business activities.

Vantage is perturbed Bitature’s behavior and Simba Group has negatively impacted on Uganda’s international image. The behavior of Mr. Bitature and Simba Group of borrowing money from international lenders and then denying its obligations does not reflect well on Uganda’s international image as an investment destination,” Vantage says.

The South African company says Bitature alongside his three other companies, Linda Properties Limited, Elgon Terrace Limited, and Simba Telecom Limited signed the loan agreement and guaranteed the loan and provided securities for the loan.

Vantage says Bitature has tried to default a loan before, including trying to dodge a loan given to him by a South African bank.

In 2019 Bitature ran to court under HCCC 988 claiming that the loan was illegal and that he signed it under duress, which the court did not agree with after Vantage filed miscellaneous application 201 of 2020, which Vantage says court based on to dismiss Bitature’s baseless suit and related court orders.

“I find this claim by the Respondents […Bitature] escapist and unserious. This is more so because this court is in position to take judicial notice of the fact that the persons behind the Respondents, particularly the third plaintiff in the amended plaint (Bitature), are some of the most polished and astute business professionals there are in Uganda. The Respondents were well and independently advised by senior and prominent legal professionals in Uganda. Faced with such facts, my view is that a feeble claim of duress and/or undue influence of the nature as this one amounts to an insult of own intelligence, on the part of the Respondents and their advocates.”

The above ruling, according to Vantage puts to rest any contentions as to the fairness of the bargain between the two parties.

Vantage says despite the court order of May 9, 2022, that said it is not registered in Uganda, the same court did not say whether Bitature should pay the money or not.

Vintage says it is not a ghost company and that it will base on the documents signed with Bitature to enforce its rights, especially after Bitature denied it to have equity shares in his company that it lent the money as agreed, so that the loan can be catered for, and given that the Commercial Division of the High Court under Miscellaneous application 201 of 2020 said High Court has no jurisdiction to determine the validity of the agreement between the two parties.