The Government of Uganda is seeking to borrow 500 million euros (about Shs2 trillion) to fund its budget through international creditors, including a Eurobond.

The proposed borrowing is likely to stoke fresh concern over Uganda’s ability to repay its rapidly expanding debt.

As a percentage of gross domestic product, public debt is now just short of 50%, finance ministry data shows, and the World Bank warned in June that Uganda needed to reign in ballooning public debt.

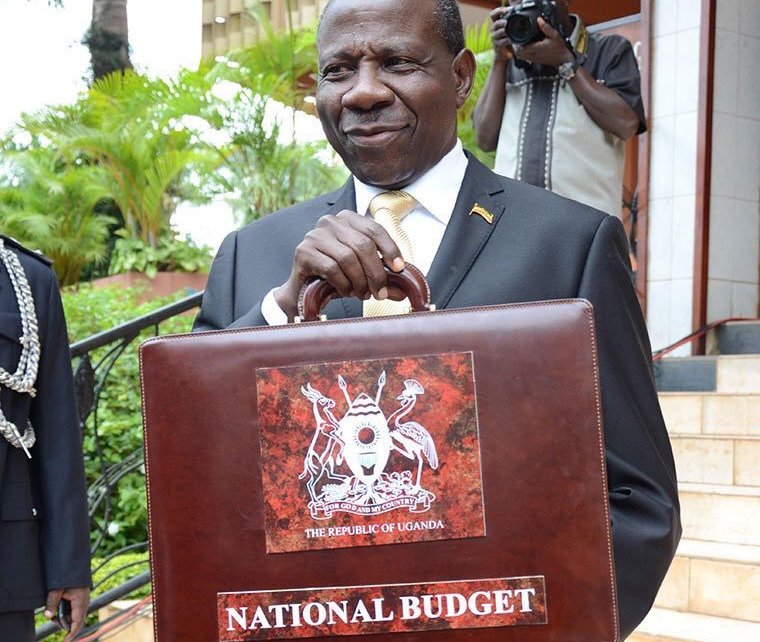

According to a letter written by Finance Minister Matia Kasaija, the government is inviting possible lenders to structure medium-term and long-term financing, including a possible Eurobond issue.

“Government is, therefore, seeking financing partners to structure medium-term and long-term financing, using all available financing options including the eurobond,” Kasaija said in the letter.

The minister added, “the credit proposals should have minimum 10-year terms and must be submitted by Nov. 18.”

A Eurobond is a debt instrument that’s denominated in a currency other than the home currency of the country or market in which it is issued.

Uganda in 2014 considered eurobonds for government funding but later abandoned the idea, saying it was costly and opted for credit from low-interest bilateral lenders such as China.

The then Bank of Uganda governor Emmanuel Tumusiime-Mutebile (Late) said Uganda would use concessional loans for its development because the lending rates are lower and the loans are usually accompanied by grants of up to a quarter of the borrowed amount.

“We should not be complacent about the dangers of big projects built on sovereign debt because it would be unwise for African countries, which will never again get debt relief. From what we are seeing in Ghana, we are not yet ready to issue sovereign bonds,” Mr Mutebile said.

… [Trackback]

[…] Find More Informations here: eagle.co.ug/2022/11/14/uganda-seeks-to-borrow-e500-million-from-eurobond-to-fund-national-budget.html […]

… [Trackback]

[…] Information on that Topic: eagle.co.ug/2022/11/14/uganda-seeks-to-borrow-e500-million-from-eurobond-to-fund-national-budget.html […]

… [Trackback]

[…] Read More Information here on that Topic: eagle.co.ug/2022/11/14/uganda-seeks-to-borrow-e500-million-from-eurobond-to-fund-national-budget.html […]

… [Trackback]

[…] Find More to that Topic: eagle.co.ug/2022/11/14/uganda-seeks-to-borrow-e500-million-from-eurobond-to-fund-national-budget.html […]

… [Trackback]

[…] Here you can find 97204 additional Info on that Topic: eagle.co.ug/2022/11/14/uganda-seeks-to-borrow-e500-million-from-eurobond-to-fund-national-budget.html […]

… [Trackback]

[…] Read More on on that Topic: eagle.co.ug/2022/11/14/uganda-seeks-to-borrow-e500-million-from-eurobond-to-fund-national-budget.html […]

This is very interesting, You are a very skilled blogger.

I have joined your rss feed and look forward to seeking more of

your fantastic post. Also, I have shared your website in my social networks!

Great info. Lucky me I discovered your website by chance (stumbleupon).

I’ve saved as a favorite for later!

It’s a shame you don’t have a donate button! I’d without a doubt donate

to this excellent blog! I suppose for now i’ll settle for book-marking

and adding your RSS feed to my Google account. I look forward to new updates and will

talk about this blog with my Facebook group.

Chat soon!

Hello! I’ve been following your blog for a while now and finally got the bravery to

go ahead and give you a shout out from Houston Tx!

Just wanted to tell you keep up the fantastic work!