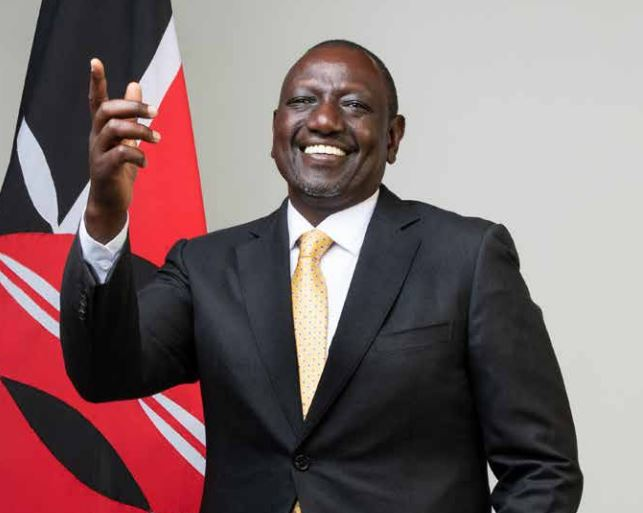

The International Monetary Fund (IMF) has pledged support for Kenyan President William Ruto’s proposal for revenue mobilization, which calls for hiking taxes, going after tax evaders, and broadening the tax base, despite its worries about the high cost of living in the nation.

Kenya aims to have tax collections over 17.8% of GDP in 2023 and above 18% of GDP throughout the medium term.

Tobias Rasmussen, the IMF’s resident representative in Kenya, remarked that rising prices for necessities hurt people worldwide and urged that Kenya should provide aid to those most in need while limiting the budget deficit.

“This calls for increased revenue mobilization and targeted interventions, such as cash transfers to the poor. The IMF-supported program in Kenya strongly emphasizes these areas,” he said.

He also added to that noting that “the IMF has welcomed the new administration’s firm stance on reducing debt risks, backed by strong actions to preserve fiscal discipline in a difficult environment,” the representative is quoted as saying via a statement.

Nairobi has set its sights on Ksh3 trillion ($24 billion) in revenue collection by the Kenya Revenue Authority (KRA) in the 2023–2024 fiscal year and Ksh4 trillion over the medium term through tax administrative and policy changes. This is all part of Kenya’s goal to turn around its economy.

According to the Kenyan Government Budget Policy Statement of 2023, they include expanding the tax base by including the informal sector, which has an estimated potential of Ksh2.8 trillion ($22.4 billion) and taxing rental properties.

Following worries over potential under-declaration on transactions, the Kenyan National Treasury has also suggested integrating the KRA tax system with telecommunications firms to monitor mobile money transactions in real time.

Additional approaches include utilising technology and improved data analytics by Customs and Border Control. President William Ruto reintroduced a plan to tax Kenya’s super-rich and high incomes more heavily last year.