The shilling opened the week trading at the 3715/3725 levels. The unit weakened marginally to trade at the 3720/3730 levels but later settled to trade at the 3695/3705 levels on Friday morning.

It was a relatively quiet week as clients worked out their requirements for the month. The few demand tickets during the week were outweighed by inflows from NGOs and commodity exporters. The unit is still likely to buoy within the 3660 – 3750 trading range in the near term as some companies prepare to purchase for dividends and flows should continue to trickle in from NGOs and other sectors.

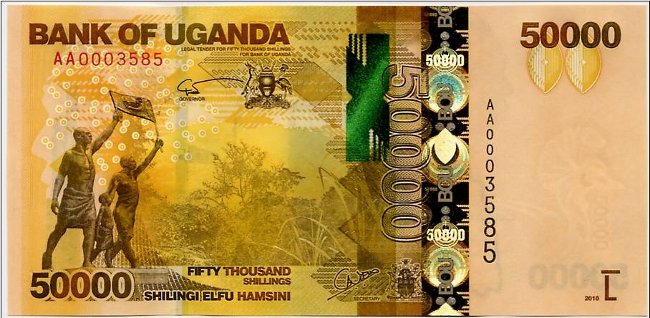

Speaking to Catherine Kijjagulwe, the Head of Trading at Absa Bank Uganda said Money Markets were fairly liquid during the week as overnight yields continued to trade within the 11.50% -12.50% levels. Bank of Uganda held a Treasury Bill auction on Wednesday and yields in the 91-day, 182-day and 364-day tenors traded at averages of 10.384%, 10.512% and 12.302% respectively. There is no government securities auction scheduled during the week.

Dollars remain scare in the Kenyan market with the currency continuing to weaken. Tea flows were seen during the week but bid at high levels as dollar buyers continue to look for dollars. The unit is expected to trade within the 127.00 -137.00 trading range in the near term.

She said yields in the US Treasuries edged upward during the week. Jobless claims data declined to 190k indicating an improvement in the labour market and further cementing view that the Fed will hike rates. The dollar remained strong against most major currencies.

The Euro weakened on Thursday to touch lows of $1.0600 as the dollar strengthened. Inflation in the Eurozone softened to 8.5% versus 8.6% in January as market players gear up for a possible 50bps rate hike by the European Central Bank.

The Pound also weakened during the Thursday session as the dollar strengthened, touching lows of $1.1924 before closing the session at $1.1946. There is speculation of a halt or slowdown in rate hikes by the Bank of England.

Brent Crude traded at $84.61 a barrel, West Texas Intermediate traded at $78.04 a barrel. Positive China factory activity had boosted oil prices during the week however there are still concerns about the continued build up in US oil inventories.

Gold traded at $1844.76 an ounce.