The Uganda Green Enterprise Finance Accelerator (UGEFA) and Dfcu Bank have signed a memorandum of understanding to facilitate the provision of credit to support SMEs across the sectors of clean energy, green manufacturing, sustainable tourism, waste management and green mobility and transportation.

The partnership also aims to amplify green impacts generated by SMEs and the creation of direct and indirect jobs.

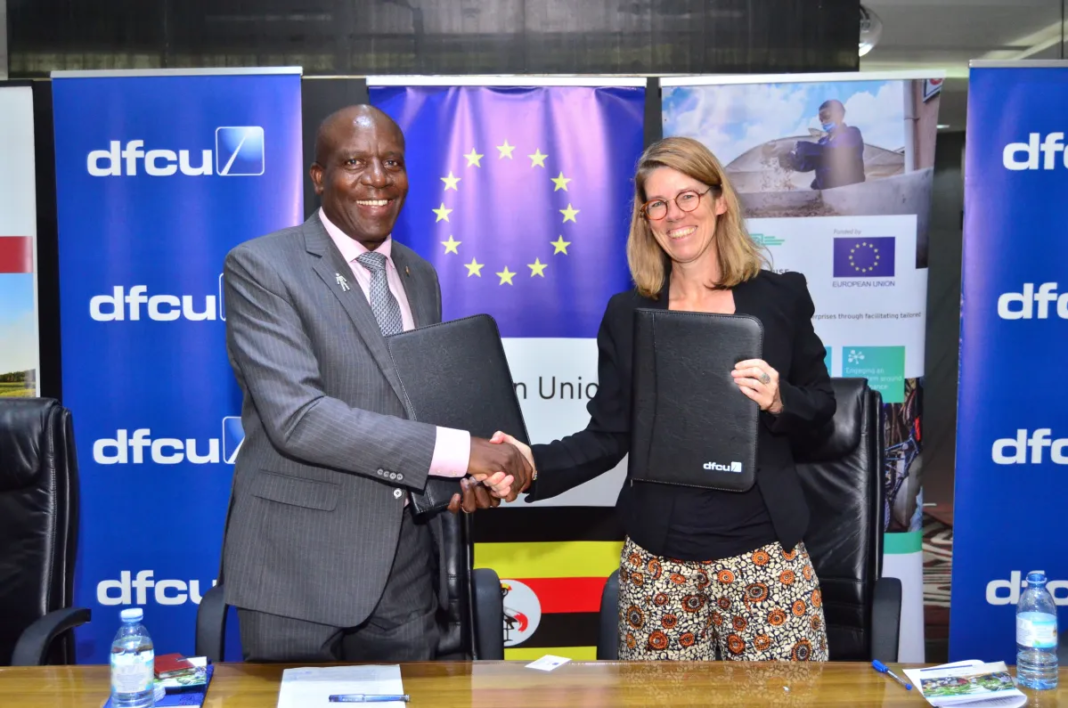

The partnership agreement was signed between UGEFA, represented by the European Union Delegation to Uganda as its donor and Adelphi as its implementing organization, and Dfcu Bank.

Charles Mudiwa, CEO of Dfcu Bank, and Sanne Willems, Head of Sustainable Development at the European Union Delegation to Uganda, joined by other project and bank representatives, attended the signature ceremony at the headquarters of Dfcu Bank in Kampala.

With this partnership, Dfcu Bank joins a community of financial institutions spearheading the commitment to drive forward environmentally sustainable initiatives in the country. Joint work between commercial banks and UGEFA creates opportunities to establish innovative green finance instruments which facilitate access to finance for green SMEs.

Speaking at the partnership announcement, Charles Mudiwa, CEO of Dfcu Bank noted that the partnership is a symbol of the Bank’s commitment to fulfilling its purpose of Transforming Lives and Businesses in Uganda. “Dfcu has been at the helm of enabling businesses at various stages realize their dreams to grow responsibly while attaining profitability. We are confident that this partnership will allow us to continue on this journey, which will undoubtedly benefit multiple individuals, businesses, and communities.”

Christine Meyer, UGEFA Project Lead: “We are honoured to welcome Dfcu Bank to a community of committed role models financing change in Uganda. We believe that this partnership between Dfcu Bank and UGEFA will create lasting impacts – it will further increase access to finance for green SMEs in Uganda and scale green sector financing.”