The High Court of Justice Business and Property has dismissed an application by Dfcu bank for the deposit of security for costs.

Dfcu bank wanted Crane bank to deposit the security of costs in the case they (Dfcu) lost in London of about Shs825 billion.

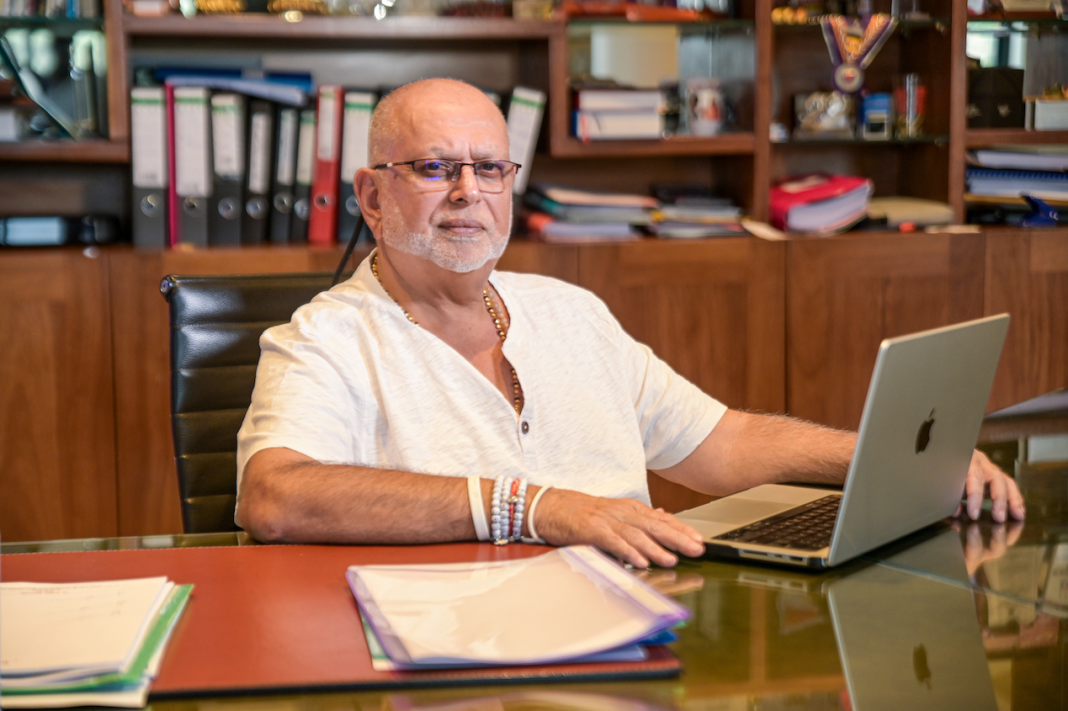

Justice Stephen Hofmeyr KC ruled that Crane bank and its stakeholders including city tycoon, Sudhir Ruparelia had demonstrated to court their financial ability to pay the costs in case they lost the case to Dfcu bank, thus no need to direct them to first deposit security of costs in court.

“It is theoretically true that there is no certainty as to the future value of his assets (Ruparelia’s), the same could be said of any party and any assets. Given the extent of the second claimant’s wealth, it would be in extraordinary circumstances that his assets would be depleted by the end of these proceedings that he would not be in a position promptly to pay any costs order made against him at the end of trial,” Justice Homfmeyr ruled.

He added that it contends that the second claimant’s assets are inaccessible because some are illiquid and some are co-owned.

“On the evidence before me, I do not find the submission compelling. The evidence satisfies me that there is good reason to believe that the second claimant (Mr. Ruparelia) will be able to pay the defendants’ costs promptly if ordered to do so. None of these six contentions undermine the conclusion to which I have come based on the totality of the evidence. I remain satisfied that if a costs order were to be made against the claimants, the second claimant (Ruparelia) would be able to pay it promptly. For the reasons I have given, the applications for the security are dismissed,” he ordered.

Court is now set to hear the main case at a later date in London.

Ruparelia, chairman of the Ruparelia Group, reported that Bank of Uganda officials conspired with Dfcu bank and its directors to seize Crane Bank and sell its assets at a gross undervalue.

The lawsuit claims unlawful means of conspiracy against Dfcu bank, its executives, and four development finance institutions.

Crane bank was one of Uganda’s largest commercial banks until 2016, when Bank of Uganda placed it under receivership citing financial instability. Dfcu bank subsequently acquired Crane bank’s assets.