Shareholders of the Crane Bank (in receivership) have joined the battle and threatened to sue the Bank of Uganda and some individuals for selling off their financial institution to the DFCU Bank without taking into consideration their interests.

‘Bank of Uganda is (also) going to face legal liability from shareholders for the fraud perpetrated in this transaction against them. Bank of Uganda’s immunity under the Financial Institutions Act, does not cover fraud. Because there is fraud against the shareholders, bank of Uganda, Bank of Uganda’s employees and legal advisors involved in the fraud shall also face ruinous civil and criminal liability,’ a 4-page leaked document drawn by the shareholders indicates.

In the document, the shareholders say that among other miscreant acts, Crane Bank (CBL) was sold off by the central bank for a paltry Shs200 billion yet its value at the time of takeover by BoU was Shs1.3 trillion, to their detriment.

Further, in reference to the January 25, 2017 Agreement between BoU and DFCU Bank in respect to the acquisition of CBL, the shareholders emphasise that the BoU also undervalued the listed leases of the Crane Bank, set at a paltry Shs10 billion by PriceWaterHouseCoopers.

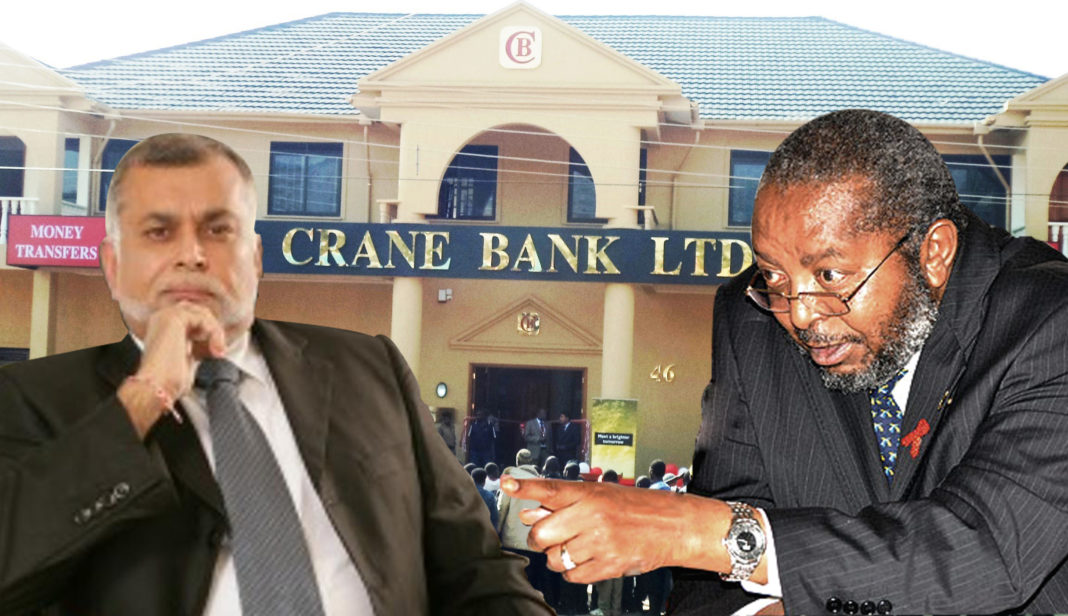

‘The Agreement does not list assets (outside branches) that DFCU was taking over. The Agreement does not itemize the list of assets acquired (save for the leases). This is very strange given that CBL’s total assets were worth Shs1.3 trillion at the time of BoU’s takeover of the Bank, but the listed leases in the agreement were given an undervalued book value of only 10 billion by BoU’s accountants, PWC. How can this agreement covering assets only itemise Shs10 billion only worth of assets?’ the shareholders aver in the document, indicating that they are intent on suing the BoU, its legal advisors and employees, specifically pointing out the former Executive Director of Bank Supervision Justin Bagyenda, who were reportedly involved in the transaction.

‘The Agreement does not state the amounts of money to be paid by DFCU as a net purchase price. What kind of sale agreement doesn’t state a purchase price?’ the leaked document by the shareholders indicates in part, adding: ‘The Agreement does not state payment terms for monies DFCU was supposed to pay to BoU. How can an agreement not state terms?’

Further, in the listed litany of reported breaches the shareholders say were carried out by the receiver, the Bank of Uganda, in respect to the agreement with DFCU Bank, they accused the central bank of acting contrary to the Financial Institutions Act, more so in a transaction that involved a public institution (BoU) and a publicly listed financial institution (Crane Bank).

Citing Recital B on page 3 of the Agreement, the shareholders also fault BoU for negotiating for the benefit of the depositors and creditors, ignoring the shareholders.

‘This is wrong because the Receiver is also obliged by law to cater for the interests of the shareholders of CBL’, the statement indicates in part.

The shareholders also take swipe at the BoU and DFCU bank, accusing them of unilaterally taking over the properties/leases of Meera Investment Limited (MIL) with consent.

‘Both BoU and DFCU Bank were aware when they were entering into this Agreement that they could not transfer the leases from CBL to DFCU without the knowledge or written consent of the Owner (Meera Investments Limited). Nevertheless, they went ahead to purport to transfer them on the understanding that BoU would try to procure the Freehold ownership and sell the same to DFCU within two years’, the shareholders indicate.

Recently, Crane Management Services, a real estate company that lets out properties on behalf of Meera Investments Limited, demanded over Shs4 billion from the DFCU Bank as rent arrears accruing from 13 properties, some with multiple units, which were being rented by Crane Bank, now in receivership.

In the plaint filed by Messrs. Magna Advocates dated February 15, the Bank of Uganda was also dragged into the picture for transferring the assets and liabilities managed by Crane Management Services including the 13 properties to DFCU Bank on January 25, 2017, in error.

‘On the 25th day of January 2017, the Bank of Uganda as a Receiver represented that it had transferred the assets and liabilities of Crane Bank Limited to the Defendant (DFCU Bank)’, Magna Advocates averred, adding that the latter also acknowledged acquiring the properties now under contestation.

The various rent obligations claimed by the plaintiff, all in one-year pre-paid contract in the period between March 2016 and July 2021 and now being demanded are US$385, 728.54 (approx. Shs1.15 billion) and Shs 2, 998, 558, 624, and for Plot 9 Market Street (Crane Bank branch and ATM); Plot 1-13 Jinja Road (Crane Bank branch); Plot 47 Republic Road Mbale (branch); Speke Hotel (ATM); Plot 9 Cooper Road (Crane Plaza/branch) and Plot 20 Kampala Road (branch).

Other rental arrears being demanded include those for apartments on Bombo Road, Kira Road, William Street, Market Street and Nkrumah Road; Plot 28 Luwum Street, and eight staff apartments on Snay Bin Amir Street and several flats on Plot 22/24/26 on Kampala Road.

According to the plaint, the DFCU Bank, as acknowledgment that it had taken over tenancy from Crane Bank, made a series of payments among them that of US $81, 408 and Shs219, 210, 728 to Crane Management Services.

Other payments made include that of Shs410, 303, 436 for utilities; US $531.000; US $362, 524 and US $168, 476.

‘Subsequently, by a letter dated 4th May 2017, Bank of Uganda as the receiver of Crane Bank Limited (in receivership) informed the plaintiff as the duly letting agent of Meera Investments Ltd that BOU in its capacity as the receiver had transferred the right to and benefit of the pre-paid rent in respect of some of the suit properties formerly occupied by Crane Bank Ltd (in receivership) and managed by the Plaintiff to the Defendant as at the 25th of January 2017’, the plaint by Magna Advocates stated in part.

Click on the link below to read entire agreement