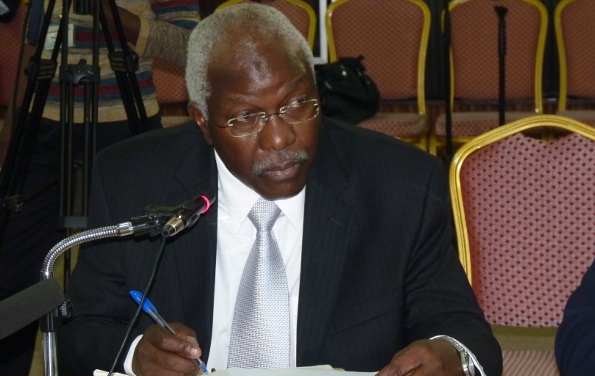

Parliament has directed the Auditor General John Muwanga to conduct a comprehensive audit into Bank of Uganda’s contentious sale of Crane Bank with a particular interest into the role played by the former director of bank supervision Justine Bagyenda.

AG Muwanga has 30 days to clear the air over why the central bank closed Crane Bank in October 2016 and why its shareholders and directors have not been explained the circumstances surrounding the bank’s closure.

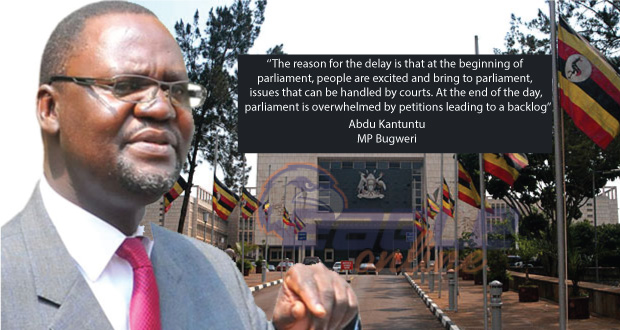

Abdu Katuntu, the Chairman of the Committee on Commissions, Statutory Authorities and State Enterprises (COSASE) confirmed this afternoon that his committee will handle the inquiry.

Bagyenda, the former head of supervision at BoU, will be probed for potential money laundering following leaks from Diamond Trust Bank and Barclays Bank, exposing bank accounts teeming with thousands of unexplained dollars.

Budadiri East MP Nandala Mafabi and one of the senior MPs on the Committee told journalists at Parliament on Monday that Bagyenda faces charges of flouting the Anti-Money laundering Act 2013, given her unexplained money running into thousands of dollars.

“We are going to carryout investigations and we are going to deal with those banks because they have been doing illegal things with Bagyenda. Actually those banks should be closed because they have been involved in money laundering,”Mr Mafabi said.

Recently, the Eagle Online broke investigative stories which revealed that Bagyenda had a bank balance of Shs19, 302, 441,183, details of three bank accounts which were seen.

At about the same time the Diamond Trust Bank (DTB) apologized to Ms. Bagyenda about the ‘leaking’ of confidential documents, subsequently suspending one of its staff. The BoU followed suit, also suspending one Shafiq Mpanga, an official in the supervision department.