“When COVID- 19 struck, Equity Group sought its true north, its purpose and commitment to support its members. The Board and Management decided to focus on saving lives and livelihoods, giving dignity, and expanding opportunities for wealth creation while keeping the lights of the economies on.

Against a backdrop of uncertainty, the Group focused on supporting customers and in the process increased and accelerated loan disbursements and growth by over 29% and 23% for the two years respectively while the economy was plummeting to a GDP growth rate of negative 0.1% from a high of 5.8%. Equity was committed to save the businesses of its customers while maintaining livelihoods. As the COVID-19 pandemic mutated into a social, humanitarian, and economic crisis, Equity Group rolled out social investments of Kshs 5.8 billion to complement Government’s health and social responses in the East and Central Africa region. Equity Group MD and CEO Dr. James Mwangi served on the Kenya National Emergency Response Fund for COVID-19 Board as Chairman of the Health Committee.

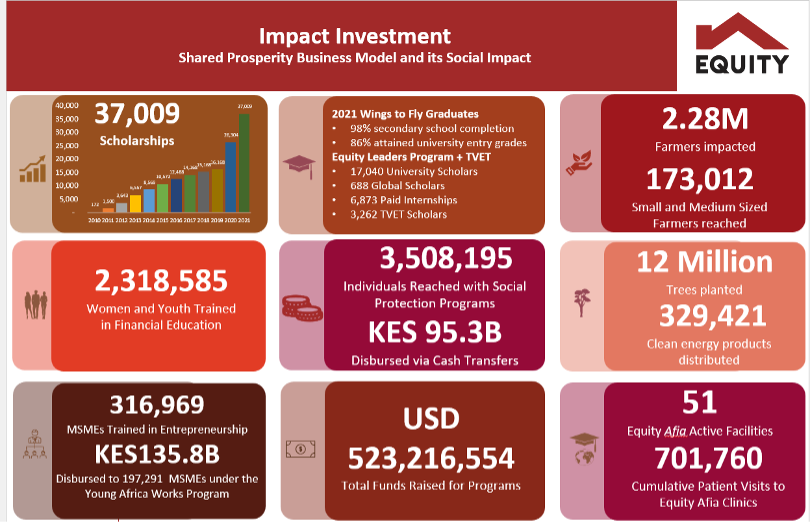

Equity Group Chairman Professor Isaac Macharia served as the Chairman of the Board’s Health Technical Advisory Committee while Dr. Joanne Korir, Equity Group Foundation’s Head of Health, served as the Committee Secretary. The Group leveraged on its Equity Afia clinic network to spearhead a COVID- 19 health awareness campaign for staff and customers, keeping the doors of its 51 clinics open and cumulatively recording over 701,000 patient visits. The Group, jointly with Mastercard Foundation and Dr. Mwangi’s family contributed Kshs 1.7 billion of which Kshs 1.3 billion went into the COVID-19 health response focused on building capacity, including repurposing and funding local manufacturers to establish PPE manufacturing facilities, and supporting 116 National Referral, County and faith-based hospitals with free PPEs and comprehensive supplies in Kenya. This was accomplished over the last 2 years in collaboration with the Kenya COVID-19 Emergency Response Fund Board.

Under the coordination of the Kenya Medical Association, the funding also helped to scale up the psychosocial wellness and case management program for frontline medical workers. In Rwanda, Equity Group supported the Government in its COVID- 19 testing and tracking measures through a Ksh100 million initiative to provide testing kits, while in Uganda, the Group presented logistics support to the national emergency response centre. In the Democratic Republic of Congo (DRC), 41 hospitals received Kshs100million in PPE support to safeguard healthcare workers. Kshs 428 million went into supporting 14,600, Wings to Fly and Elimu scholars in Secondary Schools and TVET scholars through provision of a monthly allowance of between Kshs 3,500 to Kshs 4,000 for the 9 months that schools were closed while also providing them with a solar panel, a radio and a charger to enable them to continue their studies and to charge their phones which kept them engaged with their teachers, classmates, and the educational broadcast programs.

To strengthen resilience and expand economic opportunities for young people and women, Equity Group Foundation (EGF) scaled up capacity building for Micro, Small and Medium Enterprises (MSMEs) through provision of Financial Literacy, Entrepreneurship Training and Digital Literacy under the Young Africa Works (YAW) program in partnership with Mastercard Foundation. This resulted in 436,000 MSMEs being enrolled into the program, with over 316,000 of these MSMEs cumulatively trained, 200,000 MSMEs accessing Kshs 136 billion in loans and 1.2 million jobs created. To date EGF has provided Financial Literacy training to over 2.3 million youth and women to enhance their financial inclusion.

Our initiatives in Energy and Environment kept young people gainfully engaged in tree nurseries where Equity sourced seedlings to plant 12 million trees to date. More than 329,000 households were reached with clean energy solutions, domestic water harvesting and storage as well as household water purifier initiatives. In the mission to transform agriculture, over 2.2 million farmers and micro small and medium agriculture enterprises were supported with various interventions and partnerships, to access financing to expand their scope, scale, resourcefulness, and capacity in Food & Agriculture production. To cushion small holder farmers from access challenges presented by COVID-19 restrictions, the bank collaborated with like-minded partners to distribute inputs through a digital technology innovation – the E-Voucher system. Cumulatively Kshs 1.9 billion worth of inputs have been distributed to 91,000 farmers through agro dealers enrolled in the system. In leveraging partnerships to expand Social Protection, Equity worked with Governments, development partners and global foundations to extend safety net payments reaching 3.5 million people cumulatively.

EGF is scaling its initiatives in the subsidiaries. In education, to cement the objective of creating the next generation of leaders, the Equity Leadership Program (ELP) was rolled out in the Democratic Republic of Congo, DRC and Rwanda with 131 scholars and 32 scholars respectively on boarded for internship, coaching, and mentorship. This marked the regionalization of the ELP program.

In social protection, through Cash Transfer Programmes, the Group provided inclusive financial services through fully fledged bank accounts and biometric smart cards to millions of marginalized and vulnerable households living in Uganda, Rwanda, and South Sudan. Equity leveraged innovative delivery models to co-create enrolment and payment solutions for Elderly Persons, Orphans, Persons with Severe Disabilities, Persons living in ASALs, Internally Displaced Persons, Refugees and other vulnerable segments.

EGF under its Enterprise Development & Financial Inclusion pillar is replicating its MSMEs capacity building initiatives across the region to enhance Financial Inclusion. Under the YAW-Uganda program, Equity bank Uganda trained 18,341 MSMEs in financial education and disbursed loans worth Kshs 420 million to over 3,700 youth ventures. EquityBCDC, under the Mastercard Foundation (MCF) and Financial Sector Deepening (FSD) Fund for Financial Inclusion program, trained over 1200 women owned MSMEs.

To enhance regional expansion into Rwanda, Uganda, DRC and Tanzania, EGF scaled up its operations in Food & Agriculture and started establishing private public partnerships jointly with various development partners to drive the growth of the sector.

In support of the economy during the COVID-19 crisis, the Group waived mobile banking transaction fees amounting to Kshs 2.9 billion and Kshs 1.2 billion of loan rescheduling fees to enhance disposable income of clients while easing cost of living pressure to low-income households. The Group rescheduled loans amounting to 32% of all client loans to support businesses to survive, and households to realign to new and emerging opportunities. The shareholders paid the price for two consecutive years foregoing dividends to backstop the risk of uncertainty and enable the Group to enhance its capital buffers. International financial and development partners worked with Equity to strengthen its capital buffers through USD 265 million of Tier 2 capital, and partial credit guarantees in a credit risk sharing mechanism for sectors adversely affected by COVID – 19. “This fortified our capital buffers and increased our ability to support our customers, enhanced liquidity buffers to 64% while mitigating cashflow risk during the uncertain times,” said Dr. James Mwangi while releasing the results.

After 2 years of operating in a COVID-19 environment, Equity has emerged as the regional financial sector market leader as defined by financial parameters; balance sheet, asset size, profitability, customer base and market capitalisation at the Nairobi Securities Exchange. Equity has emerged stronger, transformed, and registered record financial performance and has strengthened its social contract with society, remaining focused on its purpose while learning valuable lessons;

- Human resilience through innovation and creativity; humanity has in a record time developed a COVID-19 vaccine giving hope to overcome the health crisis.

- Sustainability is built on social contract of shared prosperity.

- You can do good while doing well and the two are not mutually exclusive; purpose can be profitable if executed sustainably on an appropriate business model.

- Business can be a force for development if it operates with a twin economic and social engine and can achieve sustainability and harmony with society when the two engines are in sync and parity.

- The power of a compelling and inspiring purpose helped to rally the staff, customers, and other stakeholders against adversity. The Equity Group family has an excellent track record in this regard and was able to overcome the fear of uncertainty and COVID-19 related deaths to carry on the purpose of saving and transforming lives, giving dignity while expanding opportunities for wealth creation and keeping the lights of the economies on.

- A crisis is an opportunity to innovate and act expeditiously to facilitate and support customers; never waste a crisis.

Equity Group has recorded superior performance for the year ended 31st December 2021 despite the challenging operating environment characterised by a global COVID-19 pandemic.

Profit After Tax increased by 99% to Kshs 40.1 billion from Kshs 20.1 billion with Profit Before Tax recording a growth of 134% to Kshs 51.9 billion up from Kshs 22.2 billion the previous year. The Group has recommended a record dividend pay-out of Kshs 3 per share totalling Kshs 11.3 billion which is a 50% jump from previous dividend pay-out after earnings per share grew by 98% to Kshs 10.40 up from Kshs 5.20 the previous year.

Net interest income grew by 25% to Kshs 68.8 billion up from Kshs 55.1 billion. This was driven by a 23% growth in loan book to Kshs 587.8 billion up from Kshs 477.8 billion and an 81% growth in investment in Government securities to Kshs 394.1 billion up from Kshs 217.4 billion. Non funded income grew by 15% to Kshs 43.6 billion up from Kshs 37.8 billion driven mainly by trade finance, payment channels and foreign exchange trading income. Trade finance registered a 55% growth in revenue to Kshs 3.2 billion up from Kshs 2.1 billion.

Despite zero rating mobile transaction offerings, transaction income grew by 37% to Kshs 10.4 billion up from Kshs 7.6 billion on the back of E-commerce and Merchant banking business. Foreign exchange trading income grew by 33% to Kshs 8.3 billion up from Kshs 6.2 billion driven by diaspora inflows that grew 37% to reach Kshs 383.5 billion up from Kshs 279.4 billion.

Total income grew by 21% to surpass the psychological USD 1 billion mark to record Kshs 112.4 billion up from Kshs 92.9 billion the previous year. Despite a 24% growth in staff costs to Kshs 19.1 billion, growth in other operating costs to Kshs 36.5 billion up from the Kshs 30.6 billion, total costs recorded a decline of 16% to Kshs 60.5 billion down from Kshs 71.9 billion driven by an 81% decline in loan loss provision to Kshs 4.9 billion down from Kshs 25.9 billion the previous year. Portfolio at risk declined to 8.3% down from 11% with non-performing loan coverage increasing to 98% up from 89%. In absolute terms, total non-performing loans declined to Kshs 44.5 billion down from Kshs 50.6 billion.

Total Assets grew by 29% to Kshs 1.305 trillion up from Kshs 1.015 trillion driven by a corresponding 29% growth in customer deposits to Kshs 959 billion up from Kshs 740.8 billion resulting in excess cash being deployed in low yielding government securities at 9.6 %, while cost to income remained fairly constant at 49.1% up from 48.5%. Return on Average Equity expanded to 26.1% up from 15.3% while Return on Average Assets grew to 3.5% up from 2.3% on the back of benefits of economies of scale and efficiencies of digitisation and a shift of business model from fixed costs to variable cost resulting in the enhanced returns.

The bulk of customers’ engagement and consumption of banking products and services is now on digital channels of internet and mobile on self-service devices delivering 24-hour banking experience and convenience. Banking has largely shifted from where you go to what you on do on your devices compressing geography and distance.

The Group’s offensive and defensive strategy has led to achievement of the twin objective of securing the future while securing market gains of customer consolidation. Equity Group has now strategically positioned itself as a systemic regional diversified business in six countries with the dominant market in Kenya contributing only 59% and 63% of the Assets and Revenues respectively. Strict adherence to IFRS 9 has led to full recognition of lifetime risk in the Asset portfolio with provisions for portfolio at risk being 98% and at 128% with credit risk guarantees.

“We have strengthened our business model to achieve an embedded shared value concept in our twin engine of social and economic aspirations and deliverables. We have scaled our social and environmental impact investments in capacity building and enhancement through education, health, and entrepreneurship training,” said Dr. Mwangi, adding, “We have strengthened our participation in formalising and integrating the informal sector in the real economy with the formal supply chains and ecosystems of agriculture, micro, small and medium enterprises. To strengthen the social contract of shared prosperity, Equity is celebrating the strong social brand and exceptional performance by offering 2,000 comprehensive Wings to Fly scholarships for 4 years at an anticipated cost of Kshs 2 billion representing shared prosperity with host communities.”

The Group has a positive outlook of the future. We have launched a Marshall Plan ‘Africa Recovery and Resilience Plan’ with a seed fund of USD 6 billion equivalent to Kshs 690 billion to act as a stimulus for the private sector. The ‘Africa Recovery and Resilience Plan’ is built on a platform of collaboration and cooperation for Public Private Partnerships to transform the region through value addition and ecosystem development in 5 key areas:

- Primary sectors of Food and Agriculture, and extractive sectors

- Manufacturing and Logistics

- Trade and Investments

- Micro Small and Medium Enterprises

- Social and Environmental impact investments

The strategy aims at funding and financing 5 million businesses and 25 million households to reach 100 million people in Africa and to create 50 million jobs both directly and indirectly. By offering its rails and capability to drive this ambition, Equity hopes to be equally transformed to sustain its growth trajectory that has led it to sustain 10-fold growth every five years and to exponentially grow value for its shareholders.