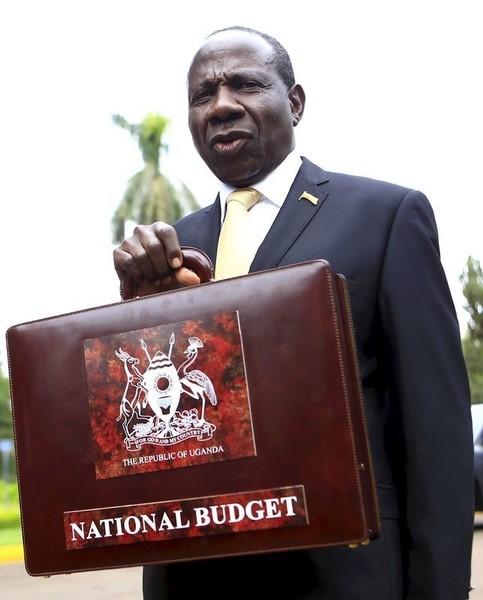

The fiscal risks statement, prepared by the Ministry of Finance, Planning and Economic Development (MoFPED) shows a number of risks facing the government of Uganda over the short to medium term as 2019/20 Shs41 trillion national budget sets in. Fiscal risks are factors that may cause fiscal outcomes to deviate from expectations or forecasts. They include potential shocks to state revenue, expenditure, assets, or liabilities that may not be reflected in budget forecasts.

“The realisation of any or all of these risks can lead to additional government obligations, expanded public debt, refinancing difficulties or more serious fiscal events. Identifying, analysing and mitigating such risks is an important aspect of fiscal planning. The government recognises that sound overall management of the public finances is the starting point for managing risk,” says the ministry in a statement.

It notes that in recent years, Uganda has made substantial progress in implementing financial reforms under the Public Finance Management Act of 2015 (PFM), improving the state’s ability to raise revenue, strengthen budget credibility and increase transparency.

The statement which covers budget outcomes for 2019/20 and examines some longer-term concerns, is Uganda’s first standalone fiscal risk statement. The current statement expands the range of risks assessed as put below:

External risks

The primary external risks to Uganda’s fiscal plans stem from the global economic and trade environment, regional conflict and commodity price volatility. In recent years, the global economy has been marked by rising geopolitical tensions – including trade conflicts – alongside higher debt levels in both developed and developing economies. Growing trade tensions, which affect a range of Uganda’s major trading partners, could put pressure on foreign investment and remittance inflows, with negative consequences for the exchange value of the shilling.

At the regional level, civil strife in the South Sudan, Congo and Burundi have severely disrupted trade and welfare. These conflicts have led to both economic and fiscal costs, including loss of earnings, property, employment, and remittances. Before the recent conflict, South Sudan accounted for about 20 per cent of Uganda’s exports, and was one of the leading remitters of income into the country.

As a member of the East African Community, Uganda is a signatory to the East African Monetary Union protocol, which plans to establish a single regional currency by 2024. The convergence criteria for monetary union include benchmarks for debt, inflation, fiscal balances and external reserves. At present there are significant imbalances within the region, and the pace of achieving and maintaining these benchmarks could lead to future fiscal risks.

Volatility in global commodity prices has a major impact on economic growth, with knock-on effects for the public finances. Rising oil prices would impose large costs on Uganda given our level of oil imports. Subdued global prices for export commodities such as coffee and cotton – and increased competition from other commodity producers – creates greater uncertainty and risks to foreign earnings and the value of the currency. The government recognises these risks and works to ensure that prudent management of risks.

Grants revenue has consistently underperformed relative to expectations. The average shortfall in grants is about 0.5 per cent of GDP each year, and reached nearly 1.0 per cent of GDP in 2009/10. This persistent shortfall poses a significant risk to the fiscal outlook, requiring the government to either delay projects or borrow unexpectedly to cover the funding gap.

Total Expenditure

Expenditure forecasts and outcomes since 2009/10 have underperformed in all years except 2010/11. This, according to analysts mirrors the shortfall in grants, which are usually tied to key projects. The resulting delay of these projects reduces government expenditure and lowers GDP growth. The notable exception was 2010/11, where expenditure was higher than projected given unanticipated election costs and exchange rate depreciation.

Analysis of recurrent and development expenditure performance

According to the statement, since 2015/16, Expenditure and Lending has averaged around 90 per cent of the forecast, but this masks notable differences in recurrent and development expenditure. Recurrent expenditure (or the spending by Government on wages and salaries of its employees, and the goods and services the government uses) has averaged 112 per cent of the forecast, whereas development expenditure (or the spending on growth-supporting infrastructure and activities) has averaged only 85 per cent of the forecast. The figure below shows performance of recurrent and development expenditure against forecast.

The performance of development expenditure reflects the performance of grants, which are tied to financing development expenditure yet they have performed below their forecast for most years. The resulting underperformance of development expenditure could have a negative impact on economic growth. Additionally, the performance of development expenditure is partly explained by the variations in domestic and external financing outcomes compared to their forecast. External financing is usually linked to development expenditure yet it has performed below the anticipated levels especially for FY 2016/17 and FY 2017/18.

Budget Sensitivity Changes in macroeconomic conditions can affect the fiscal accounts to varying degrees. Revenue estimates are particularly sensitive to changes in macroeconomic assumptions given the effect of these changes on the tax base. A one percentage point reduction in real GDP, for example, would reduce revenue by Shs55 billion. Expenditure is generally sensitive to changes in prices (inflation) and exchange rate.

Public debt

At the end of June 2018, Uganda’s total public debt, defined as the outstanding stock of government securities and foreign loans, stood at US $10.74 billion. This was equivalent to 41.5 per cent of GDP. Debt as a share of GDP is expected to increase to a peak of about 52 per cent in FY 2021/22 and then decline to about 40 per cent by FY 2024/25. Foreign debt accounts for 68 per cent of Uganda’s total public debt. The main fiscal risk associated with foreign debt is the possibility of large, sustained movements in the exchange rate. A depreciation in the Ugandan shilling could result in higher debt-service costs.

However, the external debt is mainly on concessional terms and denominated in longer maturities, which provide some buffer against this risk. Much of the public domestic debt is denominated in instruments with a one-year maturity or less. The short-term nature of the domestic debt portfolio creates a large re-financing requirement and higher costs than longer-dated debt. In addition, the practice of rolling over existing debt creates risks if interest rates rise. At the end of June 2018, nearly 37 per cent of domestic debt was due to mature within one year. While this is close to the benchmark of 40 per cent established in the 2013 Public Debt Management Framework, it is down slightly from over 38 per cent in June 2017.

To manage the fiscal risk associated with public domestic debt, the government will continue to restructure the debt portfolio, shifting from shorter-dated to longer-dated securities. The government will also ensure that annual domestic borrowing remains under one per cent of GDP. Interest payments as a share of domestic revenue have been on an upward trend for the past six years. This reflects both expanded borrowing and higher interest rates over this period. In 2018/19, interest is expected to be about 18 per cent of revenue, up from 6 percent in 2010/11. This increasing non-discretionary expenditure can present a risk for the government, particularly if economic conditions change unexpectedly.

Contingent Liabilities

Contingent liabilities are payment obligations that only arise if a particular event occurs. The government’s main contingent liabilities stem from loan guarantees and the debts of public corporations.

Loan guarantees

The government’s main contingent liabilities are associated with loan guarantees. The government’s guarantee portfolio is currently about US $55 million. Exposure to these guarantees stood at US $53 million at the end of June 2018, equivalent to about 0.2 per cent of GDP. This is a 34 per cent increase in exposure from US $40 million in June 2017, mainly as a result of the recently issued guarantee to Islamic University in Uganda worth just under US $14 million. Default on any of these guarantees would result in an unbudgeted commitment of funding. However, despite the increase in exposure, all loans are performing well, and the risk associated with the portfolio is low.

Debt of Public Corporations

Public entities contribute to the country’s development by providing energy, water, environmental, development finance, civil aviation and other services. In order to maintain fiscal sustainability, these need to be financially sound. Debt acquired through on-lending from the government to public corporations can create fiscal risk where these entities fail to service these debts. However, this debt forms part of the stock of Uganda’s total public debt. The debt of public corporations amounted to about Shs6 trillion (US $1.7 billion), equivalent to about 6 per cent of GDP as at June 2017. Of this debt, 87 per cent is held by two entities: the Uganda Electricity Generation Company and the Uganda Electricity Transmission Company. The government monitors these corporations to ensure they are operating optimally and that they are on course to repay the funds on-lent to them.

Mitigation measures for contingent liabilities

The government maintains a proactive policy stance to mitigate contingent liability risks: For example; all borrowing by public corporations and sub-national governments, and government-issued guarantees, must be approved by the Minister of Finance, all public corporations that intend to borrow, as well as entities requesting guarantees, are required to be financially sound, as determined by MoFPED and all projects to be funded must be in line with the National Development Plan and sector priorities.

Natural disasters

Drought, landslides and floods are relatively common occurrences in Uganda. Such events pose risks to economic growth and social welfare, and can have significant consequences for the national budget in the form of unplanned or emergency spending. In the years ahead, an increase in extreme weather events associated with climate change is expected to put increased pressure on government budgets.

Over the past four years, government has spent an annual average of Shs114 billion on disaster mitigation measures. Significant events included drought in the western district of Isingiro in 2016/17, and the army-worm outbreak that affected agricultural harvests in 2017/18. In 2017/18, the government allocated Shs35 billion for disaster relief following landslides in eastern Uganda. Long-term planning to mitigate the effects of natural disasters includes budgeting for costs related to disaster and refugee management, and building new dams, irrigation and bulk water supply schemes.

The government is also working to increase the functionality and use of meteorological data to support sector-specific early warning to combat the effects of extreme weather events. A contingency fund has been established to respond to unforeseeable and unavoidable expenditure, including natural disasters. The law requires this fund to be replenished with 0.5 per cent of the budget each year, though this commitment is yet to be met.

Legal Claims

The government continues to accumulate liabilities arising from court awards. The stock of arrears from these awards stood at about 33.2 per cent of the total domestic arrears as at end of June 2018. The MoFPED is devising a mechanism to halt the accumulation of arrears using commitment control systems.

Pension Liabilities

Under the state’s pension plan for public-sector employees, pension payments for each financial year are budgeted and paid out of government revenues for that year. The structure of this plan, combined with changes in staffing levels and demographic shifts, is a source of fiscal risk.

Government is accumulating future pension liabilities without setting aside resources to fund these liabilities, even as demand on the fund grows. Uganda’s public service grew from 300,372 in 2015 to 308,451 persons in 2016. Between 2002 and 2016, life expectancy improved from 50.4 to 63.3. Pension payments have grown from less than 1 per cent of the budget in 2015/16 to more than 2 per cent in 2017/18. As a percentage of GDP, pension pay-outs have doubled from 0.2 per cent to 0.4 per cent over the same period. Even though these are relatively small shares, over the long term, the share of the budget allocated to meeting pension liabilities is expected to increase.

To reduce the risk of a growing, unfunded liability, a contributory public sector pension scheme, to which both public service employees and the government contribute, is under consideration in the retirement benefits liberalisation bill before parliament.

The ministry says sound public financial management is the most important contribution to managing fiscal risks, and Uganda intends to build on the progress it has registered in this respect in recent years. While a number of external risks to fiscal plans are not within our control, the government is expanding its assessment and monitoring of fiscal risks, and putting mitigating measures in place to reduce their impact on the public finances.