Evelyne Birungi Turumanya, a sole proprietor from Hoima Municipality, is doing her utmost to get set for engaging in Uganda’s expected oil and gas sector. Her restaurant/mobile food business is one of the 1004 Ugandan enterprises registered in the National Oil Suppliers database (NSD) for possible supply of services and goods based majorly on competitive bidding.

As the big oil companies continue to negotiate with government on the investments that will help start oil production in Uganda, Ms Turumanya is also making her own moves. “Since I registered I have been improving my services and taking my business seriously by keeping records,” she says. As required by the Petroleum Authority of Uganda, prior to being registered in the database, she made her business tax compliant registered her employees with the National Social Security Fund (NSSF).

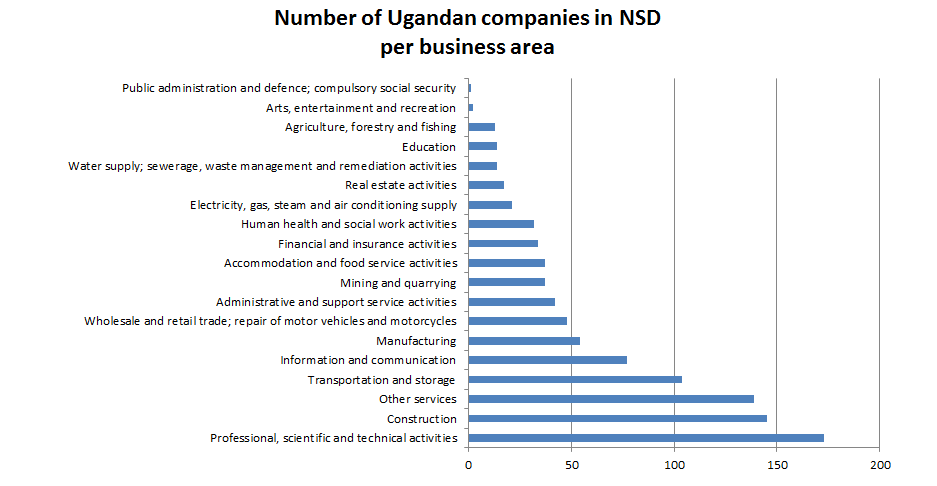

However, Ms Turumanya is fearful that she does not have the technical and financial capacity to compete with foreign companies or hotels owned by foreigners but are registered in Uganda. In addition to the 1004 Ugandan businesses, there are 424 Foreign Service providers in the database that has 19 sectors that will deliver services and goods to players in the oil sector.

For instance, there are three registered companies in the food/restaurant and hotels business, like Turumanya’s. They are; Newest Catering Tanzania Limited, Les vins Yannick de VERMONT from France and Ecolog International from United Arab Emirates.

Like Ms Turumanya, other local companies/ individuals are concerned that they may not compete favorably with the Chinese, British, German, Russian and other foreign companies, which have far more experience in the sector that requires high standards.

“Much as I registered in the NSD I expect stiff competition from foreign companies which have both technical and financial capacity to do the job,” said Aisha Tumusiime who wants to participate as sole proprietor in providing transport and storage services.

Ugandan firms are expected to join foreign ones in providing services and goods for the construction of US$4 billion oil refinery and the US$ 309 million Kabaale International Airport in Hoima, the US$ 3.5 billion East African Crude Oil Pipeline (EACOP), as well as the Kampala Storage Terminal, whose tender is out.

Source-PAU

The Petroleum Authority of Uganda (PAU) says that registration on the NSD does not necessary lead to automatic award of contracts but is a mandatory legal requirement for all buyers and sellers of goods and services in the country’s oil and gas sector.

A baseline study of the industry in 2013, highlighted many obstacles for Ugandan firms that may try to get oil and gas contract. Many remain unresolved for many firms. The study, for instance, highlighted access to cheap credit as a major barrier. Rates for loans in Uganda are still extremely high making it nearly impossible for interested parties to develop any business. Local bankers say the cost of capital is too high, which explains high interest rates.

The survey also highlighted quality assurance and corporate governance as lacking. “All sectors will need to upgrade the quality of their overall management standards and quality of delivery to align with oil and gas expectations,” it says. Indeed, it called for a complete transformation of sectors like transport, logistics and hazardous waste management.

Ernst Rubondo, the executive director of PAU, says several strategies are being developed to ensure that locally owned companies partake of the activities in the oil and gas sector where they are expected to supply services and materials.

He says government has reserved 15 categories of goods and services for Ugandan enterprises to provide. They include; transportation, security, foods and beverages, hotel, accommodation and catering, human resource management, office supplies, fuel supply, land surveying, clearing and forwarding and IT services among a few others.

Rubondo also says the Authority does quarterly workshops where information regarding major requirements and investment opportunities in oil and gas sector is disseminated. Upon the completion of the Front-End Engineering Design (FEED), over 1000 Ugandan companies received information on the requirements of Tilenga, Kingfisher and EACOP projects, he says.

He also adds that government is planning to establish an Industry Enhancement Centre (IEC) which be key in raising standards in health, safety, international business operations that will in the end improve competitiveness of local enterprises in oil and gas sector. Already, government and the oil companies launched the Agriculture Development Programme for the Albertine Graben. It is expected to build the capacity of farmers in the region to meet the expected demand for food.

Private players like Stanbic Bank are also supporting capacity growth in the sector has helped a total of 514 entrepreneurs from 153 companies have been trained on standards and business management for the oil sector, in the Stanbic Bank Business Incubator Programme.

However, the 2013 baseline survey pointed out that some of Uganda’s industries like those cement and steel will simply be unable to meet the sheer size of oil & gas needs, at peak demand, given the gap between the current supply and expected future demand.

Emmanuel Mugarura, the Executive officer of the Association of Uganda Oil and Gas Service Providers (AUGOS) urges local firms to partner with foreign companies, to meet these demands.

Indeed, partnerships were an effective strategy for those that are already participating. John Bosco Lubega, General Manager Geotech Solutions (U) Ltd, involved in geotechnical, geophysical and specialised construction works and services, says their entry into the oil and gas sector started in 2013 when they responded to an advert in the print media run by Total E & P Uganda B.V., for geophysical survey services at the Central Processing Facility (CPF) in Buliisa.

“We did not have the capability to go it alone then. Nonetheless, we had in 2012 worked with Geo2X S.A (Switzerland) on a geophysical component of feasibility studies for Ayago Hydropower Project. We contacted Geo2X and successfully worked together on the CPF tender, and execution of the assignment. We again worked together on the geophysical survey for the well pads in 2017/18. In 2018, we worked on the Tilenga soil investigation for enabling infrastructure trial pits and core drilling. Recently, Saipem SpA have engaged us on Topographical (Lidar Survey), Geotechnical and Hydrogeological Studies at the oil refinery in Hoima, pipeline corridor and tank farm area.”

Edgar Mugisha, Managing Partner Atacama Consulting says his firm that focuses on environment was able to get the capacity and skills and international exposure after partnering with international players in the oil and gas sector. “Partnerships are another key to consider, as they are key in the mobilisation of resources; both human and financial, he says.

He advises other local firms that they should aim at quality work as it makes one get referrals that can sustain their businesses. “There are no short-cuts when it comes to delivering quality work in the oil and gas sector,” he says.

[…] READ MORE FROM ORIGINAL SOURCE […]