City businessman Sudhir Ruparelia’s lawyers have insisted that the Bank of Uganda (BOU) must pay costs of the long-running legal battle between the tycoon and his Meera Investments Ltd and the BoU, in the aftermath of the fallout resulting from the closure of Crane Bank Ltd.

The lawyers led by Counsel Peter Kabatsi of the Kampala Associated Advocates said both the High Court and the Court of Appeal ordered that the Bank of Uganda must pay costs because the central bank has been handling this matter from the beginning and not its shadow (Crane bank in receivership).

This is a contention of whether BOU or Crane Bank (in receivership) should pay costs after the central bank lost a case in which it had sought to recover Shs 397 billion from Sudhir. Both the High Court and Court of Appeal ruled that there was no reason to deny costs to be paid to Sudhir.

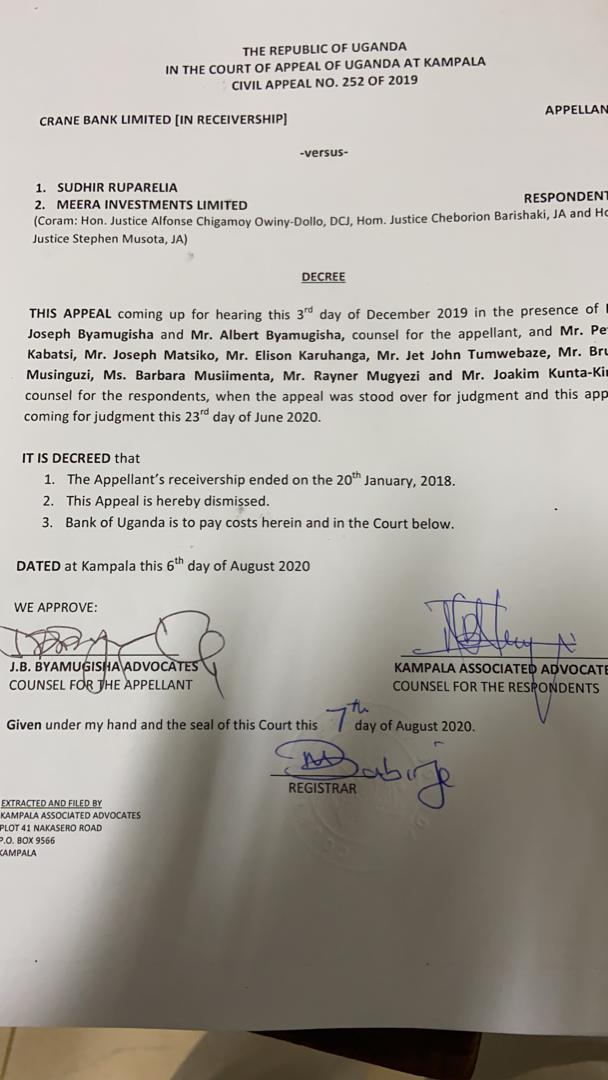

Sudhir’s lawyers cited the decree from Court of Appeal dated 6th August 2020 signed and approved by J.B. Byamugisha Advocates and KAA whereby BoU is ordered to pay the cost.

“It would cause a lot of injustice if BOU lawyers turn around to say the ‘shadow’ would bear the costs of the suit,” Kabatsi said, rejecting the arguments that the case had been withdrawn.

Through his lawyers, Sudhir said the move by BOU is prejudicial and, if not stopped, he would suffer irreparable damages. He argued that he has already incurred losses because of BOU actions.

The Supreme Court in August this year, dismissed with costs, an application by lawyers representing the Bank of Uganda in which they sought to substitute the court record from Crane Bank Ltd (in receivership) to Crane Bank Ltd (in Liquidation), with the court rejecting the move, as in bad faith and intended to circumvent facts.

BoU later withdrew the suit, after suffering successive defeats to Sudhir’s lawyers.

A panel of the Supreme Court Justices including Ruby Opio-Aweri, Faith Mwondha, Lillian Tibatemwa, Ezekiel Muhanguzi and Night Tuhaise, in a ruling issued on August 12 rejected arguments by BoU lawyers led by veteran attorney the late Dr. Joseph Byamugisha, reasoning that Crane Bank Ltd (in Receivership), Crane Bank Ltd (in Liquidation), and Crane Bank Ltd are three distinct entities with different rights, powers and obligations.

Earlier in the High Court, Justice David Wangutusi noted in his ruling that at the time BoU and Crane Bank (in receivership) filed the suit against Mr Ruparelia and his Meera Investments in January 2017, Crane Bank Ltd was a non-existing entity, having been terminated when the Central Bank sold its assets to dfcu Bank in October 2016.

On Monday, October 4, 2021, Supreme Court quashed attempts by the BOU to hold on to the jurisdiction of the defunct Crane Bank Ltd, arguing that once the commercial bank was closed, it was no longer a financial institution and therefore outside the legal care of the central bank.