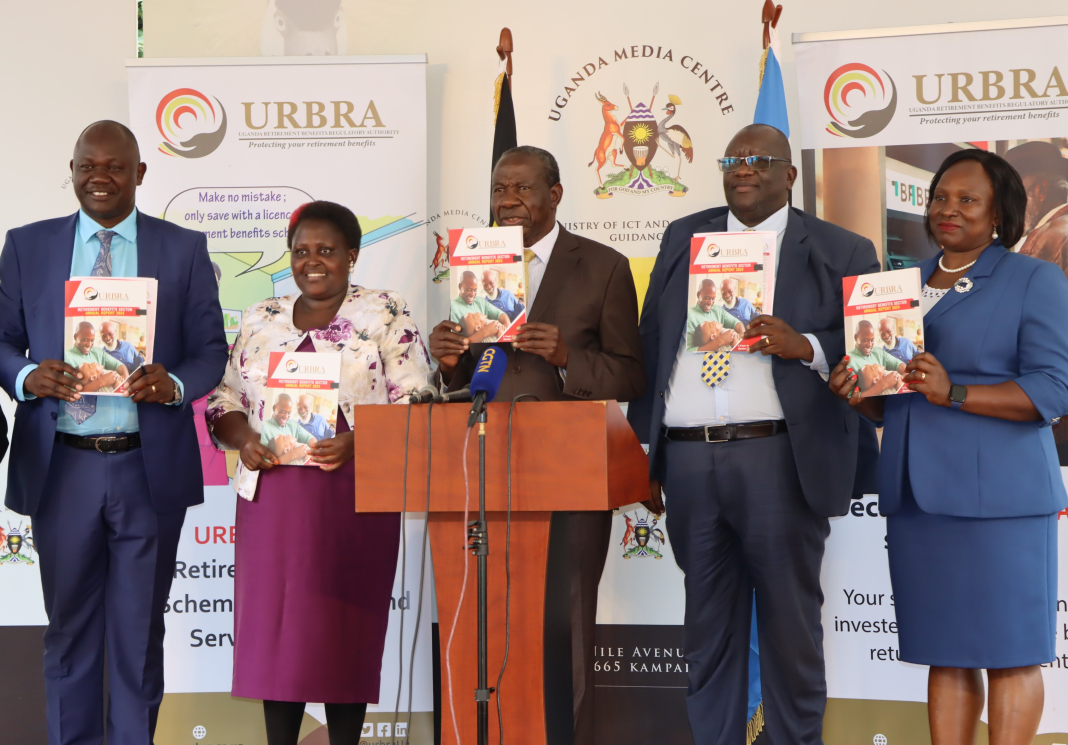

The Minister for Finance Planning and Economic Development Matia Kasaija has revealed that funds saved under retirement benefits schemes have reached Shs25.40 trillion,

The latest figures are indicated in the Uganda Retirement Benefit Regulatory Authority (URBRA) which marks an 18.6% increment from Shs21.4 trillion in 2023.

Speaking at the release of the 2024 URBRA report in Kampala Matia Kasaija said the growth of the schemes was driven by a combination of net income amounting to Shs3.10 trillion and net member contributions of Shs989.94 billion.

He said income from fixed-income securities accounted for over 90 percent of the total income, enabling retirement benefits schemes to declare an average interest rate of 10.99 percent.

In the financial year under review, Shs1.3 trillion was paid out in retirement benefits, ensuring that retirees could live with dignity and financial security.

Meanwhile, unremitted contributions collected during the period amounted to Shs15.75 billion, further strengthening the sector’s financial base.

“URBRA’s supervisory approach ensures that the funds collected are invested prudently, focusing on security and better returns for members,” Kasaija explained.

Rita Nansasi Wasswa, URBRA’s Acting CEO, said “Our risk-based supervision system played a crucial role in recovering Shs23.3 billion for members, emphasizing transparency and risk management,” said Mrs.

She underscored the need for members of retirement benefits schemes to actively oversee their savings and hold trustees accountable for managing schemes effectively and transparently.

“Trustees are pivotal in ensuring prudent investment decisions and transparent communication with members,” she noted, emphasizing the importance of empowering members to take an active role in their financial futures.

Nansasi also highlighted the importance of sustainability, particularly for schemes operating on a defined contribution model.

“Deficits can lead to over payments to existing members at the expense of those who remain in the scheme,” she explained.

She said URBRA is closely monitoring interest declarations and advocating for balanced financial management to protect all members equitably.

According to the report, membership in retirement benefits schemes grew by 7%, totaling 3.37 million accounts. Contributions increased by 8.3% to Shs2.39 trillion, driven by enhanced employer compliance, new registrations, and salary increments.

Average member balances rose to Shs10.22 million, reflecting improved member confidence. Despite significant achievements, URBRA remains committed to addressing low coverage in Uganda’s informal sector, which comprises 85% of the workforce.

The Authority is spearheading the National Long-term Savings Scheme (NLTSS) to enable informal workers to save for retirement, leveraging digital platforms for accessibility.

URBRA Chairman Board of Directors Julius Junjura Bigirwa said they are aiming at bridging the gap by tailoring solutions for the informal sector, ensuring every Ugandan has a pathway to financial security post-retirement.

One of the key highlights of the year was the deployment of the “URBRA Bridge,” a Risk-Based Supervision System designed to enhance oversight and operational efficiency.

This technological advancement enables licensed schemes and service providers to submit statutory returns efficiently while allowing URBRA to conduct real-time analysis of the information provided. “The URBRA Bridge marks a significant milestone in our supervisory efforts, enabling a more focused risk-based approach,” Kasaijja said.

Looking ahead, URBRA is prioritizing efforts to expand retirement benefits coverage to informal sector workers, a group that constitutes a significant portion of Uganda’s workforce but remains largely uncovered by traditional retirement schemes.