Among the key decisions taken by FUFA last week was to cancel the 2019/20 season of the Stanbic Bank Uganda Cup declaring it null and void with no winner due to the continued COVID-19 restrictions on sports.

A subsequent press conference held at FUFA House in Mengo on Tuesday, October 13, 2020 indicated that despite the Cup cancellation, the main sponsors Stanbic Bank will honour its commitment by paying prize monies to clubs that had progressed to the Round of 16 and the Quarter Finals.

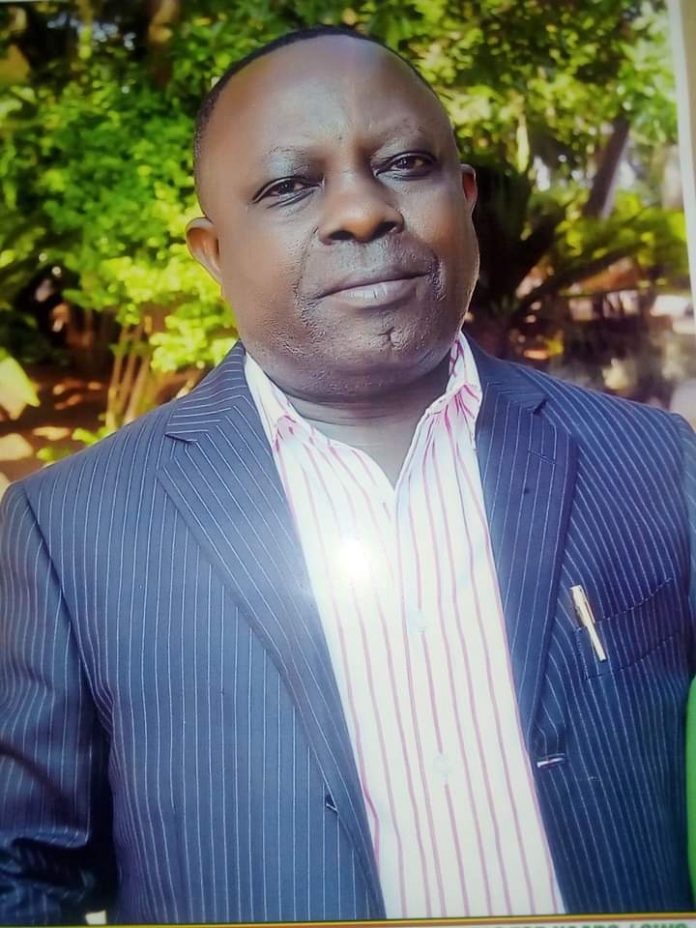

The press conference was attended by the FUFA CEO Edgar Watson, FUFA Executive Committee Member Hamid Juma, FUFA Deputy CEO- Football Decolas Kiiza, communications director Ahmed Hussein and Daniel Ogong, the Stanbic Bank Marketing Manager.

Ogong recommitted Stanbic Bank’s desire to associate with FUFA and the Stanbic Uganda Cup in particular.

“As an organization, we do believe that football and sports in general is part of the society. We therefore believe in financing businesses and impressions, education and sport. Sport in general has potential to employ millions. The Stanbic Uganda Cup is the oldest football competition in the country as it has had its ups and downs. Because of the Coronavirus pandemic for this edition, the money will be issued to the clubs at the earliest time possible,” Ogong said.

Edgar Watson, FUFA Chief Executive Officer (CEO) was excited for Stanbic Bank to pay the clubs at such a material time when most clubs have been affected by the Coronavirus pandemic.

“I wish to extend my appreciation for this gesture from our sponsors Stanbic Uganda. At this time when all clubs are struggling for incomes, we really appreciate for this gesture. We intend to upgrade the Uganda Cup competition with other partners and broadcast live,” Watson remarked.

Decolas Kiiza, Deputy CEO – Football confirmed that there will be no winner because of the pandemic, and KCCA was picked by the Executive Committee to represent the country at the 2020 CAF Confederation Cup.

“The prevailing conditions brought by the COVID-19 pandemic fought the Stanbic Uganda Cup to the cancelled. The decision of KCCA Football Club to represent the country at the CAF Confederation Cup was purely based on the powers granted by the FUFA Executive,” Kiiza stated.

According to FUFA President Eng. Moses Magogo, the Federation had hoped to complete the season but due to the continued restrictions on sports, the Federation reluctantly decided to declare the 2019/20 season of the Stanbic Bank Uganda Cup null and void with no winner.

Prize Money for the Cancelled 2019/20 season will be paid out as follows:

The 6 teams that qualified for the quarter finals will each receive UGX 6 million. The teams are; Proline FC, KCCA FC, Kyetume FC, Light SS FC, Kitara FC and Kataka FC.

The 6 teams that were knocked out at the Round of 16 will each receive UGX 3 million: Kiboga Young FC, Dove FC, Maroons FC, UPDF FC, Tooro Utd FC and Free Stars FC.

And the 4 teams that were yet to play their Round of 16 matches will share the prize money for their ties. Each will receive UGX 1.5 million: URA, Wakiso Giants, SC Villa and Mbarara City.

The details for Corporate Social Responsibility (CSR) attached to the 46th Stanbic Uganda Cup will be communicated.