Centenary Bank and MasterCard have signed an agreement to boost the National Financial Inclusion Strategy aimed at bringing more Ugandans into the financial system through savings and payments.

The partnership realised in Kampala days ago is expected to roll out digital payment solutions and also help strengthen the national payment system through the introduction of payment solutions such as Masterpass QR, debit, prepaid, credit as well as premium solutions, officials said.

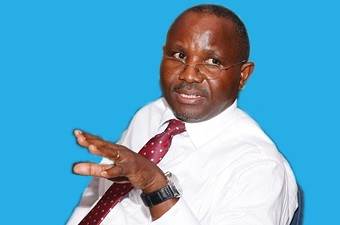

Centenary Bank Managing Director Fabian Kasi said the partnership would help boost the accessibility of financial services, credit infrastructure, digitisation of the bank’s financial services and products that can be consumed by clients.

According to Mr. Kasi, such innovations will help address findings of the 2016 Financial Inclusion Insights Survey, which established that only 11 out of every 100 adults in Uganda have access to a bank account, with 53 percent of adults using mobile payment solutions to transact business.

“In our position as the largest commercial microfinance bank in country, with over 1.4 million customers, we are committed to delivering solutions that meet the diverse needs of people, especially those living in rural areas,” Kasi said, adding that MasterCard would work with the bank to diversify its services and solutions.

The introduction of the mobile-driven person-to-merchant (P2M) solution (Masterpass QR) by MasterCard will help turn mobile phones into a payment and acceptance tool.

Chris Bwakira, Vice President and Area Business Head for East Africa, said the partnership is part of the MasterCard commitment to financially empower 100 million people in Africa by the year 2020 in which Uganda targets to become a middle income country.

“We have made significant strides this year in Uganda, with our recent agreement with the Uganda Bankers’ Association and the work we are doing through the MasterCard Labs for Financial Inclusion,” Bwakira said

He further said MasterCard would support new financial tools to empower more Ugandans to build a stronger future through participation in the financial system.

MasterCard is a payments technology company, operating payments processing network, connecting consumers, financial institutions, merchants, governments and businesses. MasterCard products and solutions make everyday commerce activities such as shopping, traveling, running a business and managing finances easier, more secure and more efficient.