The world doesn’t address Africa as ‘hopeless’ continent anymore. The big nations, the multi-national companies, economists all have remolded their opinion on Africa to the next investment destination after Asia in the coming decades.

A decade ago one of the leading financial magazines had called Africa as a ‘hopeless continent.’ The winds started blowing in favour of Africa in a bigger way, and 10 years later all are queueing up for Africa as it is the second fastest growing region after Asia. This trend, all believe, will continue in the foreseeable future. The World Economic Forum (WEF) in one of its reports highlighted that “Africa is home to seven of the 10 fastest-growing economies in the world.”

Green shoots in African economy in 2017 after a sharp decline in 2016 is a clear indication that the continent is getting back on the track.

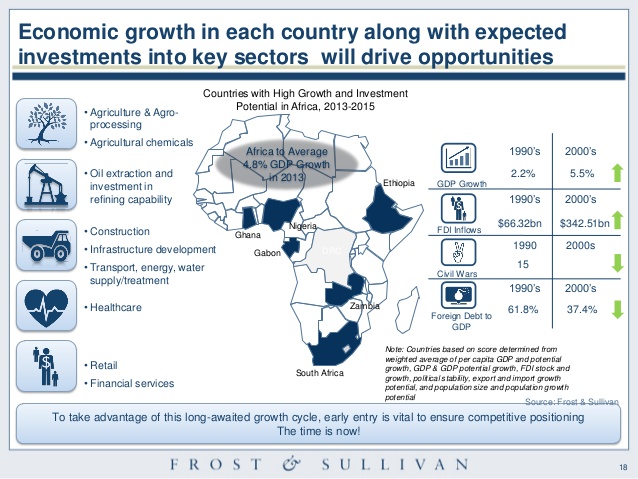

The untapped potential in the Sub-Saharan African region came to the forefront when the multi-national companies started focusing on Africa more. The sudden surge in investments in infrastructure development (road, rail and transport connectivity) from China, clubbed with conducive regulatory and policy support and regaining momentum in economy have brought Africa into the global centre stage.

The advancement in economy trickles down to all segments of the business. The latest Logistics Performance Index (LPI) by the World Bank shows that the African countries have moved itself to the upward trajectory. South Africa continues to lead the pack by positioning itself at 20 in the world ranking. Countries like Tanzania and Mozambique significantly improved its performance in comparison to the 2014 ranking.

World Economic Forum report painted a different picture on the ground reality when the African economy plunged into slumber in 2016, “An environment where private sector-led investments is starting to flourish, in large part thanks to government-led far-reaching economic and political reforms.” That means the adversities gave birth to new opportunities.

Investment attractiveness

Multinational consulting firm, Ernst & Young’s (EY) ‘Attractive Programme Report 2017’ which was released in May 2017 is very bullish on Africa. “Even as Sub Saharan Africa’s (SSA) three largest economies — Nigeria, South Africa and Angola — saw sharp downward revisions in growth forecasts, a diverse group of the second tier economies in Africa — including Cote d’Ivoire, Senegal, Ethiopia, Kenya, Tanzania, Mozambique and Egypt — are expected to sustain high growth rates over the next five years.”

They attributed it to the increased regional mobility, rapid urbanisation and population growth. EY report also says “The flow of foreign direct investments (FDI) into Africa registered an upward trend. During 2016, capital investment into Africa rose 31.9 percent. Investment per project averaged $139m, against $92.5m in 2015. This surge was driven by several large, capital intensive projects in the real estate, hospitality and construction (RHC), and transport & logistics sectors. The continent’s share of global FDI capital flows increased to 11.4 percent, up from 9.4 percent in 2015. That made Africa the second fastest growing destination when measured by FDI capital.”

Global transport and logistics providers see an opportunity to act as “connectors” for Africans and markets, considering the relatively underdeveloped state of infrastructure. In 2016, automotive FDI projects increased 6.5 percent. With 14 FDI projects Morocco retained the top spot for investment, followed by South Africa, Algeria, Tunisia and Nigeria.

By registering a 20.9 percent increase in FDI projects, transport and logistics became the fifth largest sector in 2016. The sector also ranked second by FDI investment and was the fourth largest contributor to FDI jobs.

Setting the stage

Especially in the past decade, Africa witnessed a sizable development in transport and logistics infrastructure segment. New airports, opening up of skies for international carriers with supporting aviation policies, inter country and intra-country rail networks, construction of road networks with cross border access, and larger sea ports.

Dedicated efforts are put into further accelerate Africa’s trade potential. Initiatives like MoveAfrica by NEPAD (New Partnership for Africa’s Development) aimed at the free movement of goods across the continent, establishment of the CFTA (Continental Free Trade Area) by December 2017; preceded by the Tripartite FTA launched by Heads of State and Government of COMESA (Common Market for Eastern and Southern Africa), EAC (East African Community) and SADC (Southern African Development Community) in June 2015 are the steps in this direction.

Open skies

Economists are upbeat about the African aviation segment as it will be one of the fastest-growing aviation regions over the next 20 years, with annual expansion averaging nearly 5 percent. Currently its contribution to the economic activity of the continent is $80 billion annually.

Five African countries lead international air trade to/from Africa – South Africa contributing 16.1 percent, followed by Egypt with 15.9 percent, Kenya holding 12.9 percent, Nigeria 10.7 percent, and Ethiopia with 10 percent in 2015. African carriers’ posted the largest year-on-year increase in demand of all regions in March 2017 with freight volumes growing 33.5 percent.

The growth of air cargo segment in Africa mainly depends on technological innovation, regulatory reforms and investment in infrastructure. To fuel the growth further the International Civil Aviation Organisation (ICAO) had called for a faster implementation of the Lome Declaration. The primary objective of the Lome Declaration is to promote the unobstructed flow and rapid release of goods through enhanced trade facilitation and custom clearance frameworks.

Air freight is key enabler of international trade, especially the high value and time-sensitive goods. Interestingly air freight carries around 35 percent of world trade by value.

“The growth in African freight traffic outpaced the global average last year and that cargo capacity offered by African carriers in the region surged by over 20 percent in 2016. And the implementation of the Lomé Declaration in total will drive the air cargo further,” said the president of the ICAO Council, Dr Olumuyiwa Benard Aliu while addressing the Second Meeting on Air Cargo Development in Africa.

According to IATA, Africa’s share of world air freight market is only 1.6 percent as against the whopping 37.5 percent in Asia Pacific. But this drastically will change as soon as more countries within the continent liberalise the sky.

Europe accounts for 60 percent of the African cargo and commands the majority of international air trade. In the recent past Africa has become the largest contributor to the global flower exporting market. Kenya accounts for about 38 percent of cut roses sold in the European Union making it the third largest exporter of cut flowers in the world. Ethiopia and Tanzania are other East African countries with significant share in global cut flower export.

Keeping pace with the demand growth in cargo segment most of the operators are building new capabilities. Kenya Airways (KQ) opened a state-of-the-art cargo express centre at Jomo Kenyatta International Airport in April. Ethiopian Airlines joined the bandwagon by opening Africa’s largest cargo terminal recently in pursuit to offer its customers the best.

Mrisho Yassin, CEO, Swissport Tanzania, spoke about Tanzania emerging as logistic hub in the region. “There are a number of factors which makes Tanzania as one of the emerging logistics country in Africa. That includes investment needs (prospects in oil and gas and minerals deposits). For the satisfaction of internal consumables requirements, we are importing a number of products from abroad due to limited local manufacturing capacity. In Agricultural prospects – we have a potential to export horticulture products, animal products and in transit point – especially for sea freight for landlocked neighboring countries.”

On the civil aviation side, signing of a ‘Solemn Declaration’ by 21 African heads of state re-affirming their commitment to breaking down the artificial barriers obstructing air transport service expansion between African nations by implementing the Yamoussoukro Decision also a crucial step.

Store safe

Advancement in technology has put the warehousing management in an advantageous position. However to enhance efficiency and optimise the supply chain capacity addition in warehousing is essential.

Leading the pack is Agility which plans to set up a network of logistics hubs across Africa. It is building a 100,000 sqm logistics park on a 40 acre site at Tema Free Zone, east of Accra. PK24 industrial zone is on the northern outskirts of Abidjan, Côte d’Ivoire, covering 940 hectares. The first phase of 200 hectares is being constructed by China Harbour Engineering Company (CHEC), and Heineken has been announced as the first occupier.

Kenya is not too far behind. Africa Logistics Park (ALP) is Kenya’s first international standard modern logistics and distribution complex. It is of 50,000 sqm and currently under construction at Tatu Industrial Park. It is expected to be operational by October 2018.

The Momentum Africa Real Estate Fund that has announced plans to invest in the development of the Agbara Estate, an industrial andlogistics hub in Ogun State, west of Lagos, Nigeria.

Fortress Income Fund has begun the construction of a major logistics park on the former Clairwood Race Course in South Durban, South Africa. The park is planned to have 350,000 sqm of warehousing space, with completion expected in 2020.

The volume carriers

Like any other country, around 90 percent of Africa’s trade happens by sea, making its ports crucial points in logistics networks. Africa though known as a landlocked continent, one would be surprised with the number of ports in each region. West Africa has 18 ports: East Africa has 3 ports and Southern Africa has 8 ports. According to the latest estimates, Africa’s ports need about $5 billion in investments every year to cope with the increasing container and cargo traffic.

Development in this segment is more visible may be because of the sheer size and the volume handled through the terminals. Transnet Port Terminals, one of the leading names in port development and managing entity in Africa, have made an investment totaling to Rand 17,304 million over the last 10 years.

In an email interaction Transnet Port Terminals elaborated on the major developments in the port infrastructure in the last decade. “Commissioning of the Ngqura Container Terminal in the Eastern Cape was a major achievement. And in 2011: Acquisition of 7 Ship-To-Shore Cranes for DCT Pier2, first tandem lift STS cranes in Africa. 2012 saw the delivery of a R70 million Liebherr crane in East London with a lifting capacity of 144 tonnes, a standard load operation of 77 tonnes and a spreader load operation of 63 tonnes. Arrival of a R140 million ship-loader in the Richards Bay terminal with a 2500-tonne per hour capacity happened in 2013. In the same year, took the delivery of 21 Hyundai forklifts in Richards Bay for break-bulk operations. And July 2017 witnessed the commencement of the assembly of 2 of 23 Straddle cranes at DCT Pier2.”

While looking forward, by 2020, 13m TEU new deepwater capacity is foreseen in West Africa; In Southern and East Africa, 23.2m TEU new deep water capacity projects is planned, of which 22m TEU are part of 3 mega multipurpose port complex projects.

APM Terminals is investing $1.5 billion for a new multi-purpose port in Tema and also has similar plans in Nigeria. Lamu Port is planned for construction about 300 km north of the existing port at Mombasa in Kenya. The China Communications Construction Company (CCCC) has won a contract to build the first three berths of the port.

Algerian government announced plans for a $3.3 billion investment into construction of a new deep water port at El Hamdania.

DP World Berbera complements its investment of $442 million in Djibouti. It had added 2.2 million TEUs of capacity in Africa over the past three to five years, bringing the total annual capacity to 6.2 million TEUs.

Railways

The shift in investments in Africa happened swiftly. The infrastructure development segment which was dominated by European investments once is now being handled by Chinese funding and companies.

The major achievement in this segment was the opening of the Mombasa-Nairobi SGR line this year. The 609 km long line cost $3.8 billion. This is part of the $13 billion line that eventually will link Kenya, Tanzania, Uganda, Rwanda, Burundi, and even South Sudanand Ethiopia.

Last year, the $4.2 billion railway line of 750 kilometres long, connecting Addis Ababa and Djibouti Railway was opened. In the 10-year period between 2004 and 2014, African countries borrowed nearly $10 billion for railway projects from China, facilitated by the China Export Import Bank.

Zambia-Malawi railway that is pegged at a cost of $2.26 billion will be constructed by China Civil Engineering Construction Corporation (CCECC). Lagos Rail Mass Transit System in Nigeria is another project that is handled by the CCECC. The Chinese company also handles the $876 million Abuja-Kaduna Rail Line in Nigeria. The $8.3bn contract for the Lagos-Kano standard gauge modernisation project is also in CCECC kitty.

Changing gears

According to a report jointly prepared by the Boston Consulting Group and the Africa Finance Corporation estimates that the annual infrastructure investment gap in Africa is at around $100 billion. Power accounts for 40 percent of total spending needs, followed by water supply, sanitation, and transport.

The report also listed out the key challenges faced in infrastructure funding in Africa and they are: limited public sector capabilities, insufficient political will, policy uncertainty, weak regulatory environments, shortage of man power with technical skills, financing complexities attributable to narrow financial markets, higher actual and provisional risks, longer project durations, significant cost overruns, and currency mismatches.

However in the past decade and a half the inter country and intra-country road network have improve tremendously.

“Although Sub Saharan Africa is rich in opportunities, it cannot fully unlock its potential unless it closes its significant infrastructure gap. Closing this gap and accelerating social and economic growth and development will certainly take time,” added the report.

Albert G Zeufack, World Bank Chief Economist for the Africa Region, in the LPI report says, “We need to implement reforms that increase the productivity of African workers and create a stable macroeconomic environment. Better and more productive jobs are instrumental to tackling poverty on the continent.”

While we see buoyancy in investments in Africa, many a times the lack of policy and regulatory support dampens the projects resulting in delays. The need of the hour for Africa is to encourage more private participation in projects as many of the countries are unable to fund their projects.

The Sub Saharan Africa region has nearly a billion people and by 2030 will have the world’s largest and youngest labor force. And if the SSA is able to connect the region with a stronger infrastructure network, then this generation would unlock Africa’s full potential and place the continent on par with any other world country.

Source: Logistics Update Africa