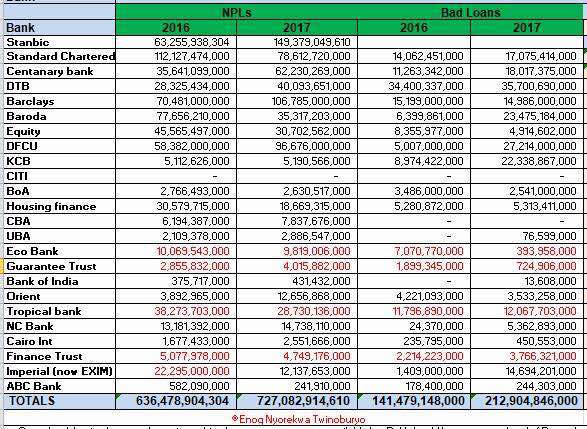

The loan business in Uganda’s banking sector was not good for 24 commercial banks in the year ended December 2017 as they realized a combined bad loan of over Shs212.90 billion compared to over Shs141.48 billion of bad loans posted in the year 2016.

The Longman Business English Dictionary defines a bad loan as; a loan where repayments are not being made as originally agreed between the borrower and the lender, and which may never be repaid.

Data indicates that Diamond Trust Bank (DTB), DFCU, Bank of Baroda and Kenya Commercial Bank Uganda had the worst loans in that reporting period.

DTB’s bad loans rose 3.8 per cent to reach Shs35.7 billion from Shs34.4 billion in the 2016.

DFCU, which acquired Crane Bank in January 2017, had 444 per cent rise in bad loans that year as the amount hit Shs27.2 billion from about Shs5.01 billion.

Bank of Baroda in 2017 had a sharp rise of 267.2 per cent in bad loans which were estimated at Shs23.5 billion from Shs6.4 billion recorded in 2016.

KCB’s bad loans in 2017 jumped 149 per cent to an estimated Shs22.34 billion from Shs8.97 billion in the previous year.

NC Bank had the sharpest rise of 21906 per cent in 2017 as bad loans went up to about Shs5.36 billion from Shs24.37 million.

However some banks like Equity Bank and Eco Bank had business of loans transactions improve slightly in 2017. Equity Bank had its bad loans come down to Shs4.91billion from Shs8.36 billion in 2016. On the other hand Eco Bank eased its bad loans to about Shs394 million in 2017 from Shs7.07 billion in 2016.

On the side of the non-performing loans (NPLs), all the 24 commercial banks in the year 2017 accumulated Shs727.08 billion compared to Shs636.48 billion in the year 2016.

Data shows that Stanbic Bank had the highest figure of Shs149.38 billion as NPLs in the year 2017 from Shs63.26 billion in 2016. On the other hand ABC Bank had the lowest NPLs of about Shs241 billion in 2017 compared to Shs582.09 million in 2016.

Banks supervisors consider a loan to be non-performing when more than 90 days have elapsed without the borrower paying the agreed installments.

a bank needs to keep the level of bad loans at a minimum so that it can still earn a profit from giving out loans. NPLs are a fact of life in the banking industry, as borrowers lose their jobs or businesses and fail to pay back.

Analysts say that once the value of non-performing loans exceeds a certain level, the bank’s profitability suffers because it earns less money from its credit business. As such banks need to put money aside a provision of some money, as a safety net, in case they need to write down or write off the loan.

A bank with too much bad loan, economists say, cannot properly provide investors with the credit they need to invest. If this happens to many banks on a large scale, it affects the whole economy.