The Constitutional Court has ruled that Section 15 of the Tax Appeals Tribunal Act that gives Uganda Revenue Authority (URA) powers to collect 30 per cent of the assessed tax pending final resolution of the notice of objection is unconstitutional.

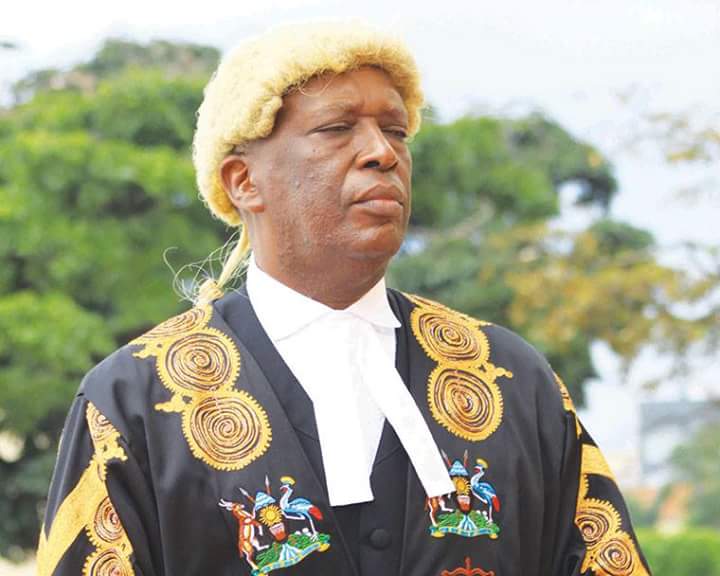

In a ruling delivered on July 24, 2020 by a panel of five justices led by the Acting Chief Justice Alphonse Owiny-Dollo, the Constitutional Court ruled that Section 15 of the Tax Appeals Tribunal Act that compels an objector to a tax assessment whose challenge is not with regard to the amount of tax payable, to pay to the tax authority 30 per cent of the tax assessed is inconsistent with Article 44 of the constitution.

The other judges on the panel were Justice Kenneth Kakuru, Justice Hellen Obura, Justice Egonda Ntende and Justice Ezekiel Muhanguzi.

“By majority decision, Section 15 of the Tax Appeals Tribunal Act-in so far as it compels an objector to a tax assessment whose challenge is not with regard to the amount of tax payable, to pay to the tax authority 30 per cent of the tax assessed is inconsistent with Article 44 of the constitution ,hence it is unconstitutional,” reads the judgment.

The case was filed by Fuelex (U) limited against the tax body.

“It may be argued that, whenever the Tax Appeals Tribunals Act finds for the objector, the Uganda Revenue Authority has to refund the money. But usually this is too late, for an objector who does not have the 30 per cent, his/her objection however plausible cannot be heard and therefore he/she cannot get an opportunity to be heard, “Justice Kakuru wrote in his ruling.

Justice Kakuru’s ruling added that: “Once the opportunity to be heard is denied on account of failure to raise the 30 per cent of the assessed tax, URA is at liberty to recover the whole of the disputed sum whether that amount is legally owing or not and irrespective of what decision the Tax Appeals would have been made. That, in my opinion, cannot be consistent with the right to a fair hearing as envisaged under Article 44 of the constitution.”

THE RULING:

Whether Section 15 of the Tax Appeals Tribunal contravenes Article 21 and Article 126(2) (a) of the Constitution in as far as it requires a taxpayer who has lodged a notice of objection to an assessment shall pending final resolution of the objection, pay 30 per cent of the tax assessed or that part of the tax assessed not in dispute, whichever is greater.