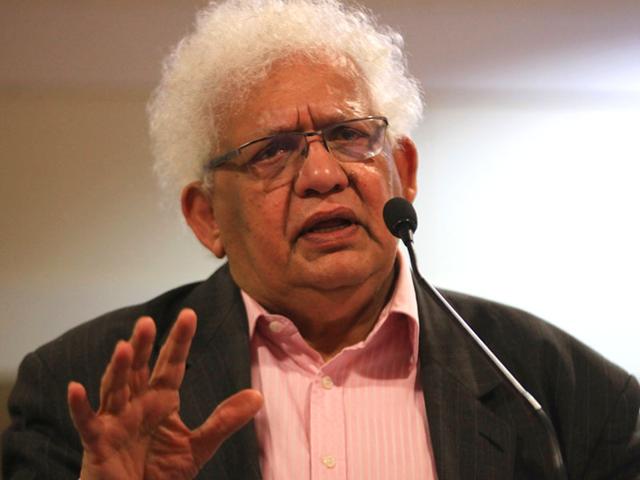

By Meghnad Desai

Many commentators are alarmed that US President Donald Trump’s trade actions will impose huge costs on the world economy. The direct effect of tariffs is to raise the cost of goods as trade wars escalate.

The total volume of trade may fall, with more expensive domestic products substituting for cheaper foreign-made goods. This would boost employment in countries that have hitherto relied on imports, and it would increase inflation – meeting the current needs of central bankers in most advanced economies.

That, at least, would be the effect for final products. Analysts are more anxious about trade in intermediate input products, which are crucial to the geographically dispersed production systems that arose in the 1970s. Before then, production systems were mainly domestic and vertical integration was much prized.

The disruption of production with international supply chains is the most worrisome possible outcome of Trump’s actions. But, as always, constraints will promote innovation. After all, the system that arose in the 1970s was concocted by Japan to overcome its shortage of raw materials. Tokyo concluded that the country did not need to own coal mines or iron ore deposits to produce steel, as these materials could be imported. While US steel was vertically integrated, Japan had flat structures.

In the light of advances in technologies such as 3D printing and artificial intelligence, it is not far-fetched to imagine that businesses could manufacture domestically the intermediate products that they currently import. International trade would continue, but the product mix would shift from intermediate to final products.

Trump’s handling of North Korea shows that, through his bluster, his goal is accommodation with an irksome country. He has shown the same approach with Iran, making threats first and offering talks later. He wants a bilateral deal with Tehran, regardless of what the European Union or Russia may think. With Moscow, he wants a bilateral relationship void of belligerence. If Europe’s leaders have a problem with Russia, they should address it themselves.

We should not fear Trump’s post-Davos world. It simply represents the next phase of capitalism after the liberal trading order that started in 1995. With a plethora of interested parties, rather than just two competing superpowers, there will be winners and losers. The Trump alternative favours larger continental economies that can develop domestic production systems with imports of raw materials but few intermediate products needed for ‘just in time’ inventory. In this category we could include regional trade groupings such as the Association of Southeast Asian Nations and the EU. India will benefit as it has an autarky mindset.

Further free flows of capital (and Trump has not been worried about that), will facilitate trade. As it is, the developed economies have outsourced supply of standard manufactured goods to Asia. Trump may encourage Asian countries to move up the value chain and become more industrialised. For the developed economies, services would become an even larger focus as they are not the topic of tariff retaliation as of now. The West can sell its expertise in high-tech industrial production to Asia rather than manufacture at home. Activities such as artificial intelligence and fintech innovation will grow rapidly as the trade environment becomes challenging. These can also be exported by the developed economies to Asia.

The redesigned geopolitical order is trickier to assess. The end of the cold war almost 30 years ago has made the North Atlantic Treaty Organisation obsolete. Most conflicts involving the US in the last 25 years, mainly in the Middle East, have been fought with minimal if any help from its Nato partners, with the exception of the UK. The free-riding European members do not think of security as their concern; they believe the US will take care of it.

European countries (apart from the Visegrad states, namely the Czech Republic, Slovakia, Poland and Hungary) have failed to spend money on their own security. They couldn’t tackle the Yugoslavia crisis without US help. The UK and France mishandled Libya, and the US refused to bail them out. Europe’s defence challenges may not come so much from Russia as from the Mediterranean and the Middle East.

The EU has been under the delusion of living in a post-Kantian world of universal peace. It will now have to spend serious money on defence. It will also need a formal security pact with the UK after it exits the European Union. The only European countries that may still need to rely on US protection are the Baltic states. The rest of Europe will have to grow up and defend itself.

The US will pursue a variety of bilateral relationships in trade and security. It will no longer explicitly lead the world, nor pay for global public goods. The rest can go about their trade and security as they please, striking deals and coming to arrangements as befits national purposes and preferences.

The much-desired multipolar world is here. This does not herald the return of anarchy. The world system of the past quarter-century was never as faultless as often advertised. We should get on with making the best of circumstances which are neither as new nor as troublesome as many imagine.

Lord (Meghnad) Desai is Emeritus Professor of Economics at the London School of Economics and Political Science, and Chair of the OMFIF Advisers Council.