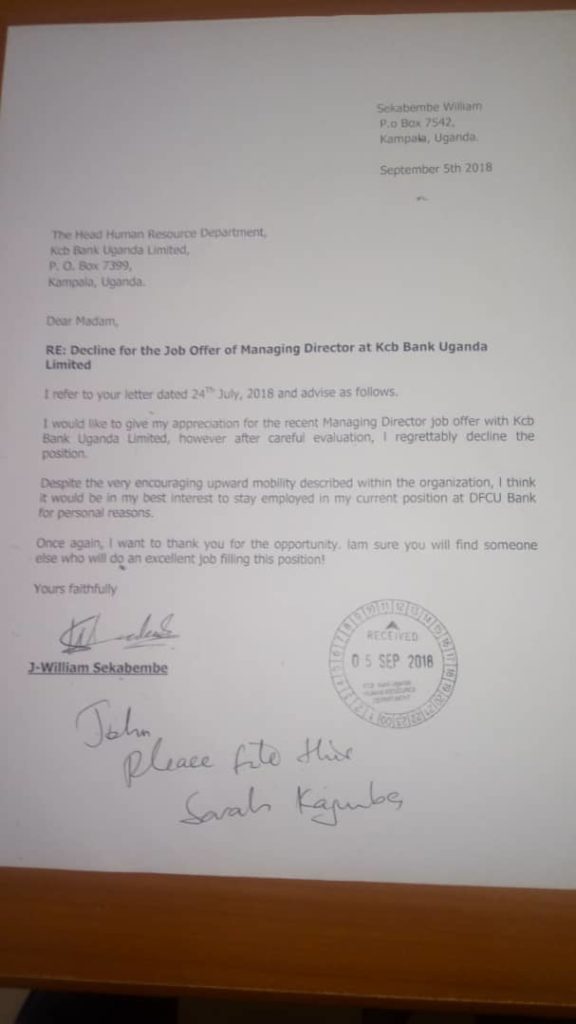

Former Chief of Business and Executive Director of Dfcu Bank William Sekabembe has declined a job offer at KCB Uganda as Managing Director. Sekabembe declined the job offer in a letter dated September 5, 2018 which Eagle Online has obtained.

In July reports came out indicating Sekabembe had resigned from Dfcu, with many sources predicting he was to join KCB Uganda, even though the resignation from Dfcu didn’t take immediate effect as he has to wait for three months to elapse.

KCB Uganda had in a letter dated July 24, approached Sekabembe to become its Managing Director, following changes at Dfcu Bank.

But in reply to KCB Uganda’s Head of Human Resources Department, Sekabembe said: “I would like to give my appreciation for the recent Managing Director job offer with KCB…Limited, however, after careful evaluation, I regrettably decline the position.”

Sekabembe further said in a letter that it would be in his best interest to stay employed in “my current position at Dfcu Bank for personal reasons.”

Sources say Sekabembe was supposed to assume the position of MD at early last year, but current MD Kisaame was given more time to manage Dfcu’s acquisition of Crane Bank.

Meanwhile there have been shareholder and individual staff exits at Dfcu in the past few months leaving industry analysts and the public wondering what was happening at the bank.

Mid-June, British government owned development firm CDC indicated that they are leaving Dfcu, which they have partnered with for over 50 years.

After CDC’s announcement, Deepak Malik, the CEO of Arise B.V; Dfcu’s majority shareholder also resigned from the board without giving reasons, though Board Chairman Elly Karuhanga would letter come out to explain Malik’s decision to resign. Karuhanga also confirmed to the media a month ago that indeed the bank was having liquidity problems.

Insider sources indicate that there two camps created among the shareholders, one led by board chairman Elly Karuhanga insisting on current MD Juma Kisaame and the other camp-mainly led by 58.71 majority shareholder Arise BV and Britain’s CDC Group in favouring William Ssekabembe who they think can turn around the fortunes of the bank whose current problems seem to have emerged from the controversial purchase of Crane Bank in January 2017.

DFCU Shareholding percentages

Arise BV 58.71 per cent

CDC Group of the United Kingdom 9.97 per cent

National Social Security Fund (Uganda) 7.69 per cent

Kimberlite Frontier Africa Naster Fund 6.15 per cent

2 undisclosed Institutional Investors 3.22 per cent

SSB-Conrad N. Hilton Foundation 0.98 per cent

Vanderbilt University 0.87 per cent

Blakeney Management 0.63 per cent

Retail investors 11.19 per cent

BoU staff retirement benefit scheme is 0.59 per cent