By Capulet King

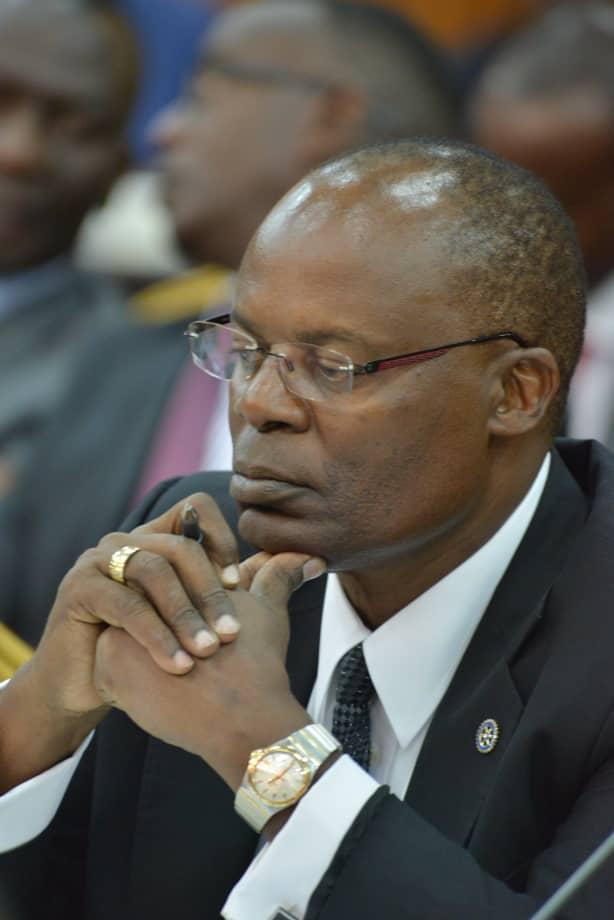

Disgraced former Bank of Uganda Deputy Governor Louis Kasekende’s tumble from the top echelons of the banking sector to a troubled man was always a matter of when and not if, going by the manner in which he handled affairs at the central bank.

Under the tumultuous reign of Kasekende, the central bank dubiously closed four banks, with all the closures directly linked to the Deputy Governor.

Between 1999-2002, when Kasekende first served as Deputy Governor, Bank of Uganda controversially closed Greenland Bank and The Co-operative Bank, actions that sent the economy into tailspin as the two banks were critical to the sector then.

It is important to note that when Kasekende was first fired from the central bank in 2002, no commercial bank was closed up to 2010 when the bespectacled economist found his way back at the central bank through the back door.

When Kasekende came back as Deputy Governor in 2010, three banks were closed in a period of six years.

In 10 years as Deputy Governor between 2010-2020, Kasekende presided over the closures of National Bank of Commerce (2012), Global Trust Bank (2014) and Crane Bank Ltd (CBL) in 2016.

The closure and sale of Crane Bank to DFCU was the final nail in the coffin for Kasekende as separate audits by Parliament, the Inspectorate of Government and State House squarely laid the blame over the closure of the then largest commercial bank in the country at the feet of Kasekende.

As unanswered questions over the illegal closure of Crane Bank swirled in 2018, a furious President Museveni summoned BoU officials led by Kasekende, to explain why a commercial bank with a clean bill of health like Crane Bank would suddenly-and inexplicably, be in turmoil.

During the meeting at State House Entebbe, an agitated Museveni asked Kasekende to explain how Crane Bank, with a paid-up capital of Shs 210bn, almost ten times the BoU Minimum Capital Bank requirement of Shs 25bn, would be in trouble. Kasekende and his team had no ready answers.

The President also quizzed Kasekende over how Crane Bank, with a portfolio of 500,000 customers, the biggest market share in the banking industry then, would be in dire straits. Again, Kasekende had no response.

To compound Kasekende’s troubles, the President further interrogated him regarding dubious transactions that had been made under his name.

Kasekende was asked regarding a $1m (about Shs3.7b)transfer to his wife- Ms Edith Kasekende’s account by a Chinese firm, Shs1.9b from MMAKS Advocates and $71,000 (Shs262 million) that was wired to Kasekende’s account by Tororo District Local Government. Still, he had no answers.

Multiple sources that attended that meeting-from BoU and Ministry of Finance, told this website that Kasekende was inconsolably distraught and left State House cocksure that his scandal-ridden tenure at the central bank had come to an end.

In a last-ditch attempt to save his position and somehow either secure a contract extension or join the race to replace Emmanuel Mutebile as Governor, Kasekende secured the services of the Catholic Church and some officials in Mango to help him with the lobbying.

However, senior clerics from the Catholic Church and Mengo failed to secure an appointment with President Museveni on several occasions, leaving Kasekende with no option but to disgracefully bow out of the Central Bank.

With all options of securing a contract extension hitting a dead hit, the tainted Kasekende resigned to his fate and wrote a letter on January 19th, thanking the President for appointing him to the position and bade farewell to the central bank staff.