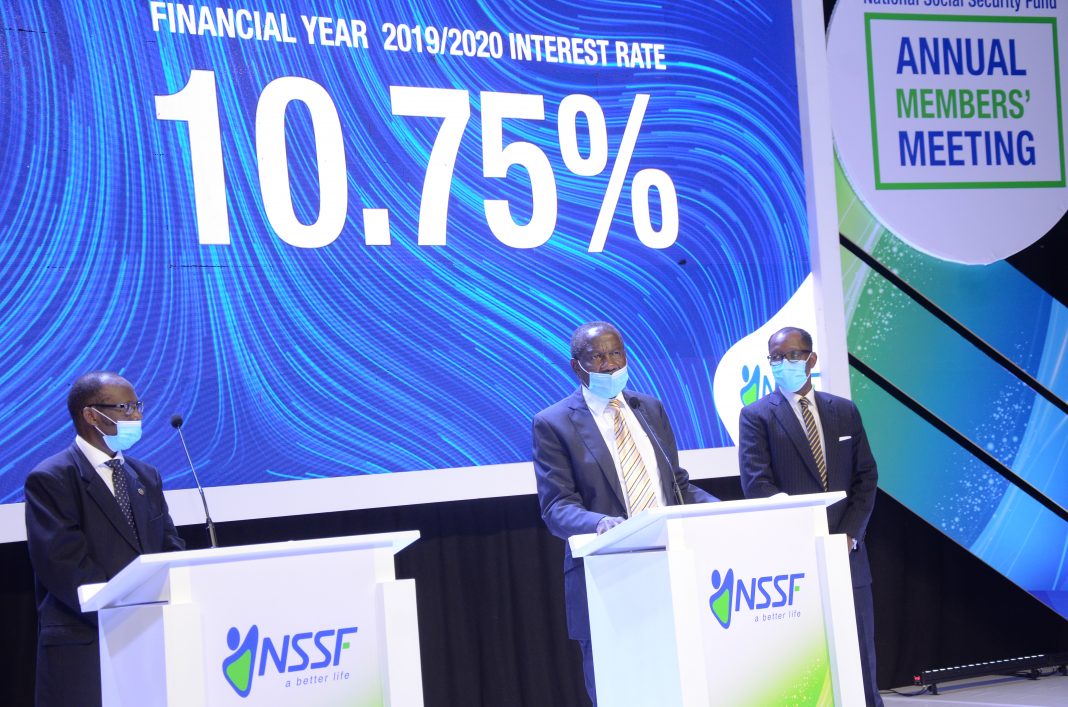

The National Social Security Fund (NSSF) has today declared an interest rate of 10.75 per cent for the financial year 2019/2020. This was announced by the Minister of Finance, Planning and Economic Development, Matia Kasaija, during the Fund’s 8th Annual Members Meeting at Kampala Serena Hotel.

The rate declared translates into a total of UGX1.14 trillion that will be credited to the Fund’s more than two million members’ accounts. This is higher than the UGX933 billion that was paid to members in the previous financial year.

The 10.75 per cent interest rate is a few points lower than last year’s 11 per cent interest majorly due to the economic slowdown occasioned by the COVID-19 pandemic and deferment of dividend payments by Bank of Uganda, among other factors, that affected the Fund’s performance.

“Despite the COVID-19 pandemic that has affected the economy and many businesses, NSSF has remained resilient, meeting its annual business objectives especially in the areas of Assets Under Management that grew by 17 per cent from UGX11.3 trillion to UGX13.3trillion and the total revenue that increased by 17 per cent,” Hon Kasaija said upon declaring the interest rate.

“I would therefore like to congratulate the NSSF team upon delivering a remarkable performance in the 2019/2020 in spite of the challenging macro environment,” Kasaija added.

Richard Byarugaba, NSSF Managing Director, reechoed the Fund’s resilience in the tough operating environment. “Many businesses both locally and globally are either closing down or seeking solutions for survival rather than expansion. I am happy that the Fund has been able to absorb the shocks as evidenced from our performance.”

The NSSF Chairman, Board of Directors, Patrick Kaberenge reassured members that the Fund was still committed to preserving value for their savings. “Despite a tough investment environment characterized by a strong shilling and depressed equity markets, the return earned has remained stable,” he said.

The 10.75 per cent interest earned is above the 10 year average inflation rate of 5.82.

Performance Highlights

Assets under Management increased by 17% from UGX 11.3 trillion to UGX 13.38 Trillion as at June 30, 2020, mainly driven by increased contributions and interest income.

Total Revenue increased by 17% from UGX 1.25 trillion in 2018/19 to Ugx 1.47 trillion as at June 30, 2020, driven by growth in interest income as a result of exposure to high yielding fixed income investments and rental income.

However, dividend income reduced by 19% from UGX 77 billion as at June 30, 2019 to UGX 62 billion as at June 30, 2020 due to cancellation of dividend payouts by commercial banks.

Member contributions increased by only 5% from UGX 1.22 trillion to UGX 1.28 trillion. The marginal growth is attributed to the amnesty we offered to business that were affected by COVID-19 pandemic. To put into context, the Fund deferred a total of about UGX 22 billion.

The money paid in benefits to qualifying members increased by 8% from UGX 450 billion in 2018/2019 to UGX 486 billion in 2019/20. Again, the marginal growth is as a result of COVID-19 when the country was in lockdown and a significant number of claimants opted to defer their claims.

Cost of Administration improved from 1.28% in 2018/2019 to 1.20% in 2019/2020, while the cost income ratio also improved by 7% from 13.02% to 12.05%. This was due to improved efficiency and cancellation of activities that we did not take place due to COVID-19 pandemic.