Veteran journalist Andrew Mwenda has advised Bank of Uganda to concede in the four-year legal battle with city tycoon Sudhir Ruparelia and his Meera Investments Ltd following the latest Supreme Court ruling that quashed the central bank bid to liquidate the defunct Crane Bank Ltd.

On Monday October 4, Supreme Court ruled that BoU had no jurisdiction over the defunct Crane Bank Ltd, arguing that once the commercial bank was closed, it was no longer a financial institution.

“The 1st respondent was closed as a financial institution and placed under receivership. Upon closure, it ceased being a financial institution under the Act (Financial Institutions Act 2004 and it could therefore not be progressed into liquidation,” a panel of five justices — Rubby Opio-Aweri, Faith Mwondha, Prof. Lillian Tibatemwa Ekirikubinza, Ezekiel Muhanguzi and Percy Night Tuhaise ruled.

Mwenda, known for his incisive analysis of public policy, weighed in after the ruling; “With one loss after another in every court, it is clear Bank of Uganda made and continues to make grave mistakes on Crane Bank. One wonders why they keep this legal fight instead of settling with Sudhir out of court! Unless, of course, they are making money in legal fees!” He wrote, before criticising BoU Governor Emmanuel Tumusiime Mutebile for failing to handle the matter.

“Governor Mutebile has failed to solve this quandary and this calls for an outside intervention. The thuggery in the sale of Crane Bank shook my faith in the independence of the central bank. The entire Crane bank saga is a gravy train for BOU legal department to enrich themselves,” Mwenda said.

The October 4 ruling came weeks after the BoU, whose closure of Crane Bank in January 2017 and later on sold to dfcu Bank for a song, attracted ramifications across the industry, a few weeks ago, withdrew its main suit in which they tried to recover UGX397 billion from Mr. Ruparelia and his Meera Investments Ltd, and 40 land titles.

In the ensuing legal battle following the controversial closure and sale of Crane Bank, the central bank has been defeated at all levels of the court system, as Sudhir and his lawyers the Kampala Associated advocates took on the hitherto feared central bank.

Bank of Uganda has since withdrawn Civil Appeal No. 7 of 2020- which in effect should mean that both the Central Bank’s main case and its attempts to move Crane Bank in Receivership into liquidation have both crashed.

The long standing legal dispute started on the 20th of October 2016 when the Bank of Uganda, invoking its powers under Sections 87 (3) and 88 (1) (a) of the Financial Institutions Act (FIA) took over Crane Bank Limited. Subsequently, the central bank placed it under receivership on 20th January 2017, before summarily selling its assets and liabilities to dfcu Bank on the 25th of January 2017.

Thereafter Bank of Uganda, through Crane Bank (In Receivership) sued Mr. Ruparelia, one of the shareholders of the bank, together with Meera Investments Ltd vide High Court Civil Suit No. 493 of 2017. Before the main case could be heard, Mr. Sudhir lawyers the Kampala Associated Advocates, raised preliminary objections through High Court Miscellaneous Application No. 320 of 2017, that among others contended that Crane Bank (In Receivership) had no basis for suing since the FIA did not allow a company in receivership any powers to sue or be sued.

The High Court sustained the preliminary objections and dismissed HCCS 493 of 2017 and ordered that the costs of the suit be paid by BOU. Dissatisfied with the High Court ruling, BoU through Crane Bank Limited (In Receivership) filed Civil Appeal No. 252 of 2019 in the Court of Appeal, but the appellate court maintained that a company under receivership can’t sue or be sued.

The central bank then proceeded to the Supreme Court with Civil Appeal No. 7 of 2020 in the Supreme Court. Along the way, it lost a couple of applications before it withdrew the main suit on 15th September 2021.

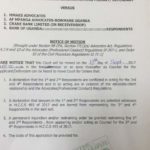

“Take notice that the Appellant (BoU through Crane Bank under receivership) does not intend further to prosecute the appeal. Take further notice that the Appellant will pay the costs of the appeal and in the courts below to the Respondents,” read the notice filed by BoU with the Supreme Court on 15th August 2021. Just weeks before it withdrew its case, on 12th August 2021, five Supreme Court Justices had unanimously dismissed Bank of Uganda’s application to replace Crane Bank (In Receivership) with Crane Bank (In Liquidation), saying that the application was in bad faith and intended to circumvent facts of the original appeal.

The justices also reiterated that in law, Crane Bank Limited (in Receivership), Crane Bank Limited (in Liquidation), and Crane Bank Limited are three distinct entities with different rights, powers and obligations.