Embattled Kampala businessman Patrick Bitature was days ago dealt a blow as court dismissed his application seeking to stop Vantage from going on with a case to prosecute him privately to recover $34 million.

In December 2014, Bitature’s Simba Properties Investment Company (SPIC) acquired $10 million loan from Vantage to pay an outstanding loan but also complete his Skyz Hotel in Kampala.

Bitature at the time praised Vantage for the timely financial help. Now he does not want to pay the loan arguing that it is illegal, the date of repayment having elapsed in December 2019.

However, after establishing that he will not fool courts of law, like it happened recently when court threw his application against Vantage, Bitature is looking for ways of dragging other people into his financial scandal that has tarnished his name. Now it appears he also wants to tarnish names of others.

For instance, he has said part of the loan he acquired from Vantage was paid to Crane Bank Limited (CBL), formerly owned by Sudhir Ruparelia, the Chairman of Ruparelia Group. CBL was unfairly sold by Bank of Uganda (BoU) to DFCU in January 2017 in a transaction worth Shs200 billion, paid in installments.

Bitature in trying to make himself clean and has also gone ahead to say he partly engaged in smuggling to build his business empire. “But this does not mean that when you willingly borrow money, you run to court to avoid paying back and then you bring other people into your saga,” said a top lawyer who is not happy that Bitature mentioned defunct CBL and its major shareholder then.

Muwema bad lawyer for Bitature!

Some people were wondering why Bitature hired Fred Muwema of Muwema &Co Advocates. But now they know. Muwema is a lawyer who thinks he can use the law to have his Ugandan clients dodge paying loans borrowed from foreign lenders.

He usually bases his arguments on the Financial Institutions’ Act, 2004. He has tried this with another businessman Hamis Kiggundu of Ham Enterprises Limited that does want to pay back a loan that Diamond Trust Bank Uganda and Diamond Trust Bank Kenya gave him, saying it was illegal.

BoU, the Ministry of Finance as well as Uganda Bankers’ Association (UBA) say syndicated loans that come from outside of the country cannot be seen to be illegal as long as they come from registered and licensed business entities of other countries. UBA members say about Shs7 trillion worth of loans in Uganda are loans obtained from outside and people like Bitature are a threat to this important source of credit for the country.

What Bitature does not realise is that Counsel Muwema is there to earn as much money from him as the lawyer continues to mislead the businessman who seem to be bend on the Ugandan law, forgetting that the country is part of the international community that operates on international laws that do not exclude loan transactions.

For instance, Muwema in Bitature’s application lied to court that he had filed a case with High Court stopping private prosecution of Bitature. It turned out to be a lie. And for this lie, court held Muwema personally liable and he was asked to pay costs of the suit. But they say birds of the same feathers fly together.

Top govt officials blast business men who don’t want to pay debts

Though they didn’t mention names, the Finance Ministry’s Permanent Secretary and Secretary to the Treasury, Ramathan Ggoobi and BoU Deputy Governor Michael Atingi-Ego recently said they are not happy with Ugandans who don’t want to pay their loans, saying they are creating a bad image for the country that wants to be a top investment destination in Africa.

Foreign creditors now fear to lend their money to Ugandans, the two officials said. Antigi-Ego is not happy with people like Bitature who run to courts after failing to pay their debts. Ego said over Shs4 trillion is being held up by court cases.

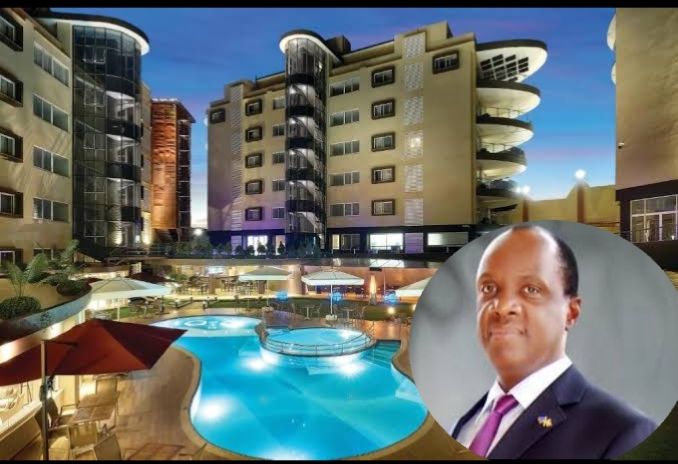

Bitature’s properties that could be auctioned after failing to pay back a loan; are; Skyz Hotel, Elizabeth Royal Apartments in the upscale Kololo and Moyo Close Apartments in Bukoto, all located in Kampala.

Vantage serious on selling Bitature’s properties

Kirunda’s law firm, M/S Kirunda & Wasige Advocates has given Quick Auctioneers and Court Bailiffs a job to look for buyers as per the May 18, 2022 advert in the newspapers to recover from $34 million, saying Vantage regulated in South Africa has the right to recover its money.

“The Simba Group and Mr. Bitature have not paid a single cent of their indebtedness under the loan. The result of not servicing any interest, compounding over seven years, is that the indebtedness has ballooned to over $34,000, 000,” says Vantage in a public statement published on April 23, 2022.

M/S Kirunda & Wasige Advocates insist Bitature’s mentioned properties will be sold unless he pays his debt owed to Vantage.

Playing games will not help on the side of Bitature.