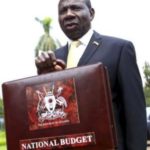

The Ministry of Finance Permanent Secretary, Ramathan Ggoobi, has revealed that the government is doing its best to ensure that the huge public debt does not affect the country’s economic growth.

Speaking in an interview on Thursday, Mr Ggoobi, who is also the Secretary to the Treasury, said economic growth is key to sustaining debt.

“The fast way of sustaining debt is to make sure the economy grows. Some countries like Japan have debt bigger than their GDP,” he said.

“In Uganda, we are debating the debt being 40% of the GDP but I want to assure you that fiscal consolidation is on. Those that are in charge of the fiscal and monetary policy, we are coordinating to make sure that the debt doesn’t affect the economy,” he added.

Uganda’s public debt has risen to Shs96.1 trillion ($25.3 billion or 52 percent of GDP) as of June 2023, according to the Auditor General’s report released recently.

Of this Shs44.6 trillion is domestic while Shs52.8 trillion is from foreign sources. This amount excludes the Shs7 trillion worth of loans that was later approved by Parliament. Each of the 45 million Ugandans is now indebted to the tune of Shs2.5 million.

Rising public debt coupled with growing debt servicing costs, stagnating domestic tax revenues, and declining export revenues are putting Uganda in debt distress and at greater risk of debt crisis.

Uganda faces a critical financial challenge as interest payments on loans now consume a significant portion of the budget and domestic revenues. According to the December 2023 report from the Bank of Uganda, escalating debt servicing costs are straining tax revenue collection, with Shs32 out of every Shs100 collected going towards debt service

But Ggoobi on Thursday assured the country that the economy has recovered from the shocks that affected us since the Covid-19 pandemic time.

He said Uganda has withstood all these shocks including high inflation and interest rates, ebola etc and that the economy is projected to grow at 6% this FY 2023/24.

The PS noted that the size of the economy has expanded to about $53 billion, inflation is under control, export receipts have increased, more jobs have been created and foreign direct investments have grown impressively, adding that all this has happened because of good economic management.

According to Ggoobi, government interventions especially in financial inclusion initiatives (PDM, Emyooga, UDB money) etc, slowdown in inflation which has increased aggregate demand especially manufacturing and fast-moving goods, good weather which is driving agriculture and oil and gas sector investments which have brought in big money, including the East African Crude Oil Pipeline (EACOP)

The PSST said all the four shareholders in EACOP have contributed Equity and the government of Uganda has also put additional equity. He said soon, the final investment decision (FDI) for the Oil Refinery will be announced.

The Bank of Uganda projects that external debt servicing will account for 35 percent of GDP in 2024/2025. However, this is not unique to Uganda.

According to a recent International Debt Report by the World Bank, “record debt levels coupled with high-interest rates have set many countries on a path to crisis”. The report further notes that “every quarter that interest rates stay high, results in developing countries becoming distressed – and facing the tough choice of servicing their debts or investing in public health, education or infrastructure”.