The newly released United Nations Development Programme (UNDP) Human Development Report the in Uganda, indicates that new dimensions of inequalities are opening up around education, technology and climate change pushing the wealthiest ahead, undermining further progress and making it harder for those left behind to catch up.

According to the report, the new face of inequality is not beyond solutions and warns that climate change will affect the poor and widen existing inequalities.

These inequalities extend to essential services like education and health, 42 percent of adults in low human development countries have primary education compared with 94 percent in very high human development countries. Similarly, “Only 3.2 percent of adults in low human development countries have a tertiary education compared with 29 percent in developed countries.

The report also shows that in most cases, inequality begins before birth, grow and may be passed across generations. To that end, it recommends that measures to address inequalities must start at or before birth from pre-natal care, to education, to the labour market and retirement.

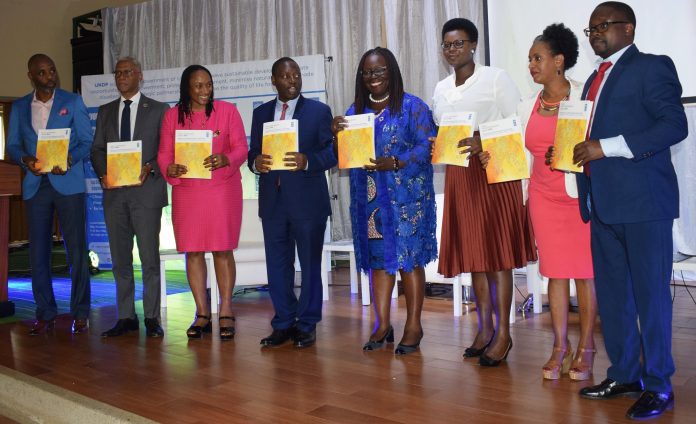

“Between 2030 and 2050 climate change is expected to cause an additional 250,000 deaths a year from malnutrition, malaria, diarrhea and heat stress. Hundreds of millions more people could be exposed to deadly heat by 2050, and the geographical range for disease vectors such as mosquitoes that transmit malaria or dengue will likely shift and expand.” reads in part of the report Launched by David Bahati, the State Minister for Planning today at the Golf Course Hotel

The report adds that, Climate change will hit the tropics harder first, and many developing countries are tropical.

In agreement with the report findings, Ms. Elsie Attafuah, the Resident Representative UNDP said, “What is clear is that inequalities, once they exist among people, regions and several divides, tend to be intergenerational and extremely difficult to break. The poor have higher chances of remaining poor. Once ill-educated, with poor health standards, the off- springs and their descendants will most likely follow the same path.”

She said the report gives us a message of hope; that inequalities can be addressed if action is taken now before imbalances in economic power become entrenched.

According to the report, Africa has experienced one of the most significant improvements in human development as measured by Human Development Index (HDI). Between 1990 and 2018 life expectancy increased by more than 11 years.

For the first time this year, an African country, Seychelles –has moved into the very high human development group. Four countries Botswana, Gabon, Mauritius and South Africa are also now in the high human development group, while 12 countries Angola, Cabo Verde, Cameroon, Congo, Equatorial Guinea, Eswatini, Ghana, Kenya, Namibia, Sao Tome and Principe, Zambia, and Zimbabwe are in the medium human development group. Botswana enjoys the region’s highest increase in HDI rank between 2013 and 2018, rising 11 places in the rankings.

While poverty rates have declined across the continent, progress has been uneven. If current trends continue, the report asserts that, nearly 9 of 10 people in extreme poverty more than 300 million will be in Sub-Saharan Africa in 2030.

And among countries that are off track to achieve the SDGs by 2030, most are in Africa. South Africa experiences the highest rate of income inequality in the world with over half the country’s income is held by the richest 10 percent.

The report puts Uganda’s HDI value for 2018 to 0.528 which places it in the low human development category positioning it at 159 out of 189 countries and territories. The rank is shared with Tanzania. Between 1990 and 2018, Uganda’s HDI value increased from 0.312 to 0.528, an increase of 69.1 percent.

Uganda’s 2018 HDI of 0.528 is above the average of 0.507 for countries in the low human development group and below the average of 0.541 for countries in Sub-Saharan Africa. From Sub-Saharan Africa, countries which are close to Uganda in 2018 HDI rank and to some extent in population size are Madagascar and Tanzania, which have HDIs ranked 162 and 159 respectively.

In terms of HDI indicators, between 1990 and 2018, Uganda’s life expectancy at birth increased by 17.1 years, mean years of schooling increased by 3.3 years and expected years of schooling increased by 5.6 years. Uganda’s GNI per capita increased by about 131.0 percent between 1990 and 2018.

The publication also reports on the performance of nations in Gender Inequality Index (GII), which reflects gender-based inequalities in three dimensions reproductive health, empowerment, and economic activity. Reproductive health is measured by maternal mortality and adolescent birth rates; empowerment is measured by the share of parliamentary seats held by women and attainment in secondary and higher education by each gender while economic activity is measured by the labour market participation rate for women and men.

According to the report, Uganda has a GII value of 0.531, ranking it 127 out of 162 countries in the 2018 index. The report says that 34.3 percent of parliamentary seats in Uganda are held by women, and 27.4 percent of adult women have reached at least a secondary level of education compared to 34.7 percent of their male counterparts.

On the other hand, for every 100,000 live births, 343.0women die from pregnancy related causes; and the adolescent birth rate is 118.8 births per 1,000 women of ages 15-19. Female participation in the labour market is 67.2 percent compared to 75.0 for men.

The report also goes beyond income and reports on the deprivations that people face using a

Multidimensional Poverty Index (MPI) which identifies deprivations suffered by individuals in health, education and standard of living and 10 indicators. The report shows that 55.1 percent of the Ugandan population are multidimensionally poor while 24.9 percent are vulnerable to multidimensional poverty.

If the deprivation score is 33.3 percent or greater, the household (and everyone in it) is classified as multidimensional poor. Individuals with a deprivation score greater than or equal to 20 percent but less than 33.3 percent are classified as vulnerable to multidimensional poverty.

Prof. Pamela Mbabazi, the Chairperson National Planning Authority said that most of the report findings align with observations made in Uganda’s national planning frameworks and its prescription of areas for redress align with development priorities identified in Uganda’s third National Development Plan now in its final stages of design.

These include improving the quality of education, jobs creation, reducing dependency on subsistence economy, combatting climate change cover, enhancing value addition in key growth opportunities, digitization of the economy and reducing vulnerabilities.