Thanks to mobile money, any person with a basic phone can now make cash transfers, pay bills, and send money to family members abroad without having a bank account. This is a game-changing innovation, particularly for the world’s poor as it is easy and cheap.

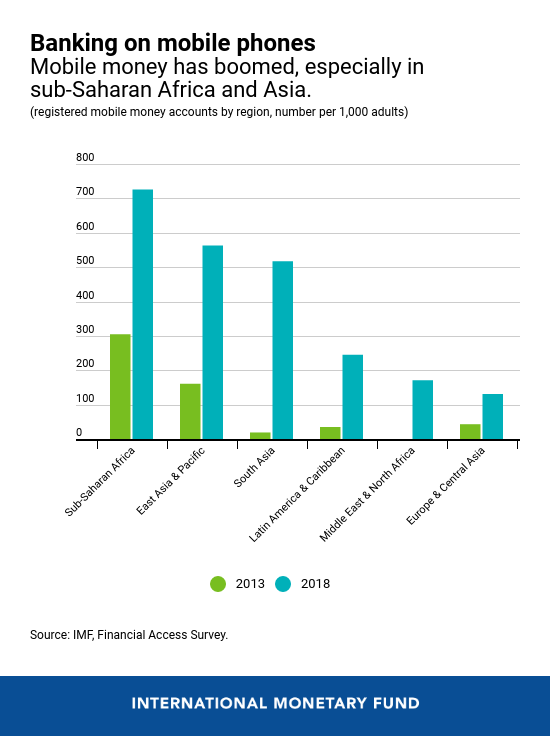

Our chart of the week from the IMF’s Financial Access Survey shows the growth in mobile money accounts across regions. While mobile money continues to grow in its epicenter in Africa, it’s also taking off in Asia. Mobile money is just one aspect of the survey, which also provides a wealth of information on the access to and use of basic financial services, including breakdowns by gender.

Asia’s mobile money uptake

Over the past five years, mobile money has gained traction in South Asia, which is experiencing an average annual growth rate of 46 percent in mobile money accounts the highest across all regions. Bangladesh, Indonesia, and Pakistan are a few examples of countries experiencing high mobile money growth in Asia.

Mobile money services grew early on in sub-Saharan Africa because some countries lacked deep banking penetration. The launch of M-PESA in Kenya in 2007 completely transformed the way the unbanked access financial services.

After a rapid expansion in Kenya, Tanzania, and Uganda, mobile money has spread to other parts of the region. In fact, sub-Saharan Africa still leads in the number of mobile money accounts and in some countries, mobile money accounts now surpass bank accounts.

Mobile money also continues to grow in some fragile states.

Factors behind rapid uptake in new frontiers

In Afghanistan, for example, where only 200 out of 1,000 adults have bank accounts but more than 80 percent of the population has access to a cellular phone, mobile money is picking up. The value of mobile money transactions grew by a factor of four in the past five years to 1.2 percent of GDP in 2018.

The ability of mobile money services to reach remote customers has contributed to this growth. Mobile network operators employ agents typically small, local retail stores to offer services even in remote areas where banks have limited reach.

In Afghanistan, there are, on average, three mobile money agents compared to one or less automated teller machine or commercial bank branch every 1,000 square kilometres. This expansion in mobile money services has helped meet a significant pent-up demand for financial services.

With mobile money becoming more pervasive, governments will need to create regulations to protect new customers against fraud and liquidity risks the inability of service providers to return funds on demand.