By Richard Wanambwa

DFCU Bank recently came out saying some online media outlets were spreading malicious information concerning its business operations, stating that it would use the same to lodge a case in courts of law against the media houses it thinks are being paid to write such stories against it.

The local media took an interest in Dfcu especially when it controversially bought its competitor Crane Bank Limited (CBL) in January 2017, as offered by the Bank of Uganda (BoU). It is not the media but the financial analysts and the Parliament of Uganda who thought the deal was controversial given that BoU invested Shs478 billion of the taxpayers’ money in CBL sale yet sold it to Dfcu Bank at only Shs200 billion, yet the money is being paid in installments.

The Auditor General’s Special Audit Report of Bank of Uganda on Defunct Banks released in late August says not all was fine as Dfcu bought off Crane Bank limited and Global Trust Bank Uganda Limited (GTBU) as some documents were not availed to him by BoU top managers for scrutiny. It is parliament that ordered for the special audit.

“I noted that BoU did not carry out a requisite valuation of assets and liabilities of the three defunct banks (GTB… and CBL) resolved using the purchase and assumption arrangement at the time of signing the P&A. In absence of the valuation and or documented evaluation of alternatives and assumptions used, I could not establish how the terms for the transfer of assets and liabilities in the P&A were determined,” the Auditor General (AG) John Muwanga says in his report. A good reader based on this statement will not take time to think that the purchase of CBL and GBTB by Dfcu leaves many questions to be answered and that is what the media has been writing about. The media is not spreading malicious information against Dfcu as management there alleges.

The public has not forgotten that BoU Deputy Governor Dr Louise Kasekende worked so hard to stop Mr. Muwanga’s investigation to the extent that he reached the Solicit General who advised him not to cooperate with the AG’s investigators who had been asked by parliament to investigate BoU over the closure of several banks. True, Kasekende wanted to hide the rot in the transactions, some of which has been revealed by the AG’s report. So it makes no sense when Dfcu top managers say this is all false.

The AG’s report clearly states that BoU used the inventory of report of Dfcu bank to sell CBL. There were no negotiations between Dfcu and BoU on how much to be paid for Cbl. Dfcu determined the price and BoU’s role was to accept what Dfcu had offered. So when the media writes that there was no fairness in this deal, it true. It is not false propaganda against Dfcu.

On some of the shareholders wanting to leave Dfcu, the articles that the media have written are true. They are not against the bank as managers would want to the public to believe. For instance, Britain’s Commonwealth Development Corporation (CDC) Group is on record for wanting to exit Dfcu, and this cannot be taken to be a rumour or fake news as there is a letter to that effect.

In a letter dated June 14, 2018, Irina Grigorenko, Chief Financial Officer of CDC Group Plc said the company was looking for buyers of its shares of 9.97 per cent from within Dfcu or outside. “After a period of more than 50 years as a shareholder, we aspire to exit in a manner that disrupts business as little as possible and ensures the orderly trading of Dfcu’s stock,” adds the letter, adding that “the goal of the CDC is to identify investors who could support the Dfcu in its new phase of growth,” read part of the letter. Before the letter finally had landed in the hands of reporters, Dfcu top managers were saying it was false/fake news as stated below through their lawyers of Ligomarc Advocates:

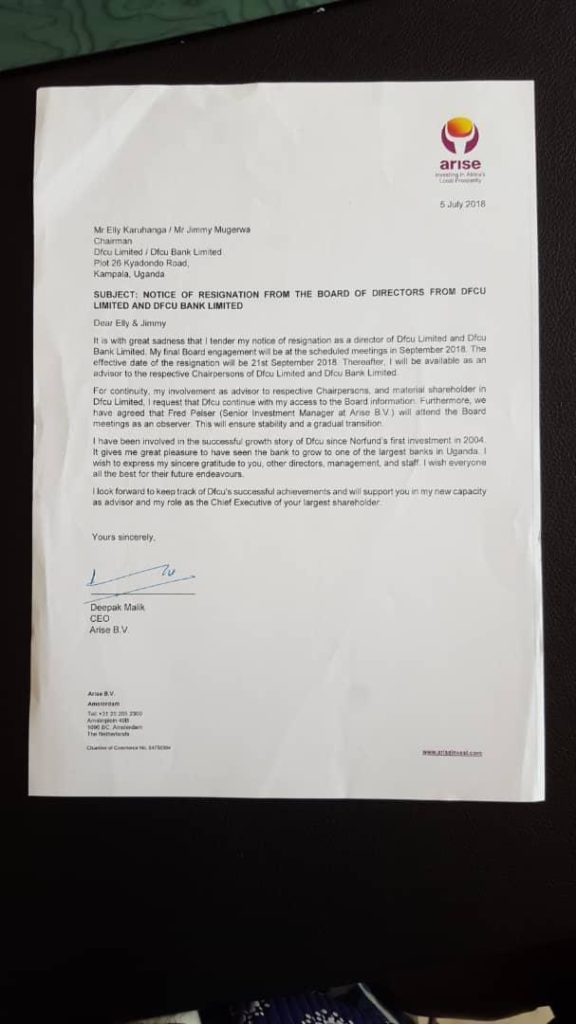

“Dfcu Limited (‘Dfcu’) has become aware of several inaccurate and defamatory reports circulating on various media platforms purporting that it is in chaos following the alleged exit of CDC Group Plc, one of its shareholders, and the resignation of Mr. Deepak Malik, a non-executive director representing Arise BV. These alarmist rumours have been perpetrated and coordinated by certain person(s) with the malicious intent of discrediting Dfcu and its successful acquisition of some assets and assumption of some liabilities of Crane bank (in receivership).”

About the resignation of Deepak Malik, the articles were true in that personally Malik on July 5, 2018 wrote to Elly Karuhanga and Jimmy Mugerwe who hold the position of Dfcu Limited chairman and Dfcu bank limited chairman respectively, informing him of his resignation to be effected on September 21, 2018, having been appointed the CEO of Arise BV which is the majority shareholder of Dfcu bank limited with over 58 per cent. This cannot be alleged resignation because the letter confirms Malik’s resignation. Actually Deepak wrote this letter much earlier but Dfcu feared to release it but did so after a month or so.

On resignation of William Sekabembe as CEO of Dfcu bank, it was not malicious news. He did it and is waiting for the agreed upon period to elapse so as he quits. The reason why on July 24, 2018 the Kenya Commercial Bank (KCB) Uganda approached to take over as their Managing Director even as he declined the offer later in a letter dated September 5, 2018.

If the above is what Dfcu Limited/Dfcu bank limited call allegations, the truth will come out in the days ahead especially when parliament embark on digging out what is in the AG’s report on defunct banks.