The Minister of State for Finance Planning and Economic and Development Amos Lugolobi has revealed that the government is set to introduce an excise duty rate of 12 percent on airtime and data bundles to widen the tax base in the country.

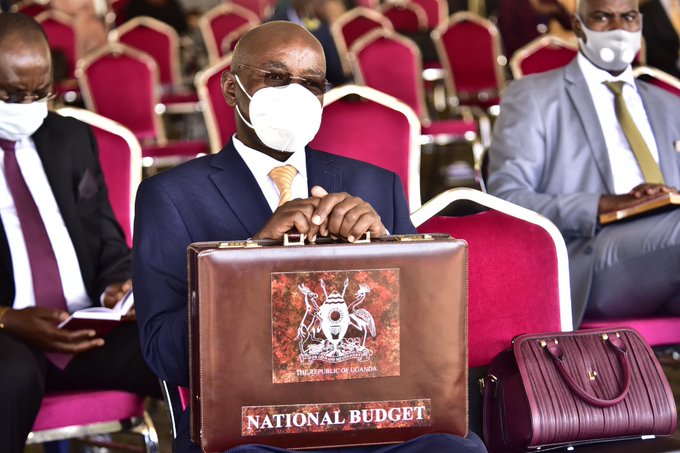

The Minister said during the presentation of the Financial Year 2021/22 budget at Kololo independence grounds.

In May this year, Parliament approved a Shs44.7 trillion budget for the 2021/2022 financial year. The Budget saw Shs714 billion decrease for the first time compared to the approved resource envelope of 2020/2021. The drop this financial year is largely attributed to the projected decrease of Shs2.4 billion in external financing for project support.

“Rationalize the Excise Duty regime on telecommunication services by scrapping the excise duty on Over the Top (OTT) and introduce a harmonized excise duty rate of 12 percent on airtime, value-added services and internet data excluding data for provision of medical services and the provision of education services,” the minister said.

“The domestic revenue for next financial year is projected at Shs22.425 trillion compared to a projected outturn of Shs 19.432 trillion in FY 2020/21. The increase in tax collections will be realized from an improvement in the level of economic activity, increased efficiency in tax collection by URA through strengthening compliance and enforcement, as well as new tax measures and administration reforms,” he said.

The increase in tax collections will be realized from an improvement in the level of economic activity, increased efficiency in tax collection by URA through strengthening compliance and enforcement, as well as new tax measures and administration reforms.

He said the government will reform taxation of rental income to remove the incentive for non-individual rental taxpayers to claim unrestricted deductions which significantly reduce their tax contribution.

“Next financial year, government will introduce an export levy of 7 percent on the value of fish maw exports, impose an export levy of 5 percent and 10 percent on processed and unprocessed gold and other minerals respectively,” he said.

The minister urged URA to enhance data analysis through interfaces with other Government information systems to enhance taxpayer compliance and enforce tax compliance using the Electronic Fiscal Receipting and Invoicing Solution (EFRIS) and Digital Tax Stamps.

“URA should enforce enhanced licensing requirements for clearing and tax agents and bond operators and improve detection of smugglers using non-intrusive inspection equipment and close all bonded houses for imported sugar for re-export to avoid declaration and misclassification,” he said.